The world of finance and economics is pretty complicated as-is, and now there’s “digital money” in the mix making it even worse. Bitcoin is everywhere in the news lately, from hacks to hearings and everything in between. But there are a lot of questions about Bitcoin — starting with, what the heck is all this, anyway? And so, here is everything you wanted to know about Bitcoin, but didn’t actually want to ask your tech-loving, early-adopter friend.

What is Bitcoin?

Bitcoin is the world’s biggest cryptocurrency. It was introduced in 2009, and is the longest-standing, best-known, and most widely-traded cryptocurrency.

Generally, Bitcoin with a capital B means the software and the system; bitcoin with a lowercase b means the actual money.

A what?

A cryptocurrency is digital money. It’s a virtual medium of exchange, not issued by, backed by, or tied to any particular nation or government.

It’s the biggest… but there are others?

Yup. The software that runs Bitcoin is open-source, and there are lots of other folks running with it, too. The Guardian covered nine of the biggest in late November. And of course, the internet being what it is, there are novelty versions, like the actually-popular dogecoin or the defunct Coinye West.

If it’s not issued by a government, where does it come from and who keeps track of it?

The acts of generating new bitcoins and of tracking Bitcoin transactions go hand in hand, and both are accomplished through a process known as “mining.” This is where it starts to get a little complicated.

Basically, mining occurs when a computer or a network of computers runs Bitcoin software. That software creates new entries in Bitcoin’s public record of transactions, called block chains. The math is complicated and hard to forge, so the block chain stays accurate. Because anyone can download and install the Bitcoin software for free, the payment processing and record-keeping for Bitcoin is done in a widely distributed way, rather than on one particular server.

When block chains are created, so are new bitcoins — but there’s a hard limit to how many will ever exist. The system was designed to create more bitcoins at first, then to dwindle exponentially over time. The first set of block chains each created 50 bitcoins. The next set each created 25 bitcoins, and so on. New block chains are created roughly every 10 minutes no matter what; when more computers are actively mining, the program they’re running gets harder (and therefore slower) to compensate. The bitcoin FAQ estimates that the final bitcoin will be mined in the year 2140, bringing the permanent circulation to just under 21 million. (Currently, there are roughly 12.4 million bitcoins in the world.)

How much is it worth?

As of this writing, 1 bitcoin = approximately USD $693. However, the bitcoin exchange rate is intentionally highly flexible.

What can you actually buy with bitcoins?

Swanky cocktails in Manhattan, a Tesla car, tickets and concessions for the Sacramento Kings, and anything you want from Overstock.com.

Also, stolen credit card numbers, drugs, guns, and pretty much anything else of questionable legality bought and sold online. It’s great for money laundering too, according to the FBI.

How do you store and spend your bitcoins? Is there any actual physical money?

Even though there are a handful of bitcoin ATMs in the world, bitcoin is not a physical currency. Spending takes place from one user’s virtual wallet to another user’s virtual wallet, via an exchange of public and private security keys.

Physical bitcoins — which can look like coins or bills, or can be any other item — are storage devices for private keys. In one way, storing private keys in physical media is extremely secure; hackers can’t access the box under your bed via a virtual back door. On the other hand, storing private keys in physical media is as insecure as keeping cash on hand; thieves can access the box under your bed via a literal back door. Or you could end up losing the external hard drive with your $5 million on it.

Is this risky? It sounds kind of risky.

There certainly is a lot of volatility in the bitcoin market. The exchange rate has shifted by over $90 this week alone.

The government backing a standard currency — like, say, the US dollar — works hard to keep its money stable. We have the Federal Reserve issuing monetary policy and acting as a central bank to keep the value of a dollar from flying up and down like the stock market does.

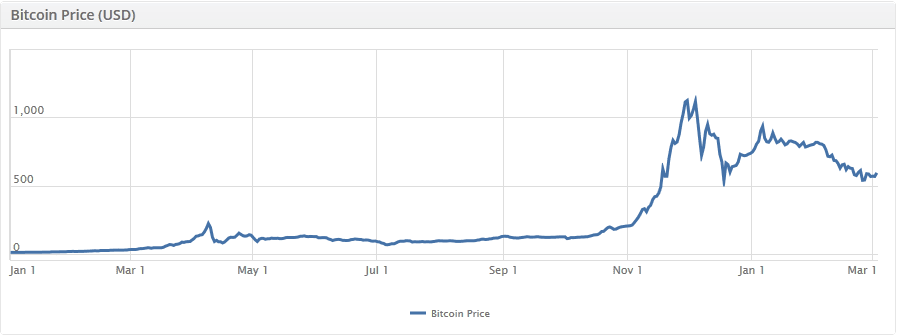

For the first three to four years of its life, bitcoin was actually fairly stable, as historical charts show. The price increased very gradually from roughly $0.05 per bitcoin to more like $5 per bitcoin, which is indeed a good rate of return for early investors. And that concept of “investors” is key. Bitcoin is a market full of speculators, and because it’s not tied to anyone’s monetary policy or oversight, it’s prone to boom and bust. Since the beginning of 2013, the value of bitcoin has jumped as high as $1116 and dropped to $539.

Bitcoin values from Jan. 1 2013 through Mar. 3 2014, via Coinbase.

Investment losses or devaluation are only one of the two big ways bitcoin users can be left high and dry. The other is good old-fashioned theft. While the US money you keep at a standard bank is insured against disaster by the FDIC, there is no such backstop for bitcoin wallets. If the virtual place your virtual money is stored loses it all, you’re screwed.

Speaking of losing money, what’s all this about Mt. Gox?

Mt. Gox is — or rather, was — one of the largest bitcoin exchanges, a site where people bought and sold their virtual money to each other. As Wired reports in detail, it was apparently a poorly-run, mismanaged venture, and hackers were able to gain access and siphon off bitcoins. Lots of them. About $460 million worth, on top of a 2011 hack that cost $8.75 million, and another $27 million “missing from its bank accounts.” All told, in three years Mt. Gox has somehow lost or had stolen nearly a half-billion actual dollars’ worth of alternative money.

And if you’re curious why it’s called Mt. Gox, it’s because it originally stood for “Magic: the Gathering Online Exchange” before becoming a bitcoin trading site in 2010.

So is all this “alternative money” legal? Do the feds care?

Yes, and sort of. It’s not illegal, at any rate.

The Senate Banking Committee and Senate Homeland Security Committee held hearings on Bitcoin back in November. The outcomes were largely positive for Bitcoin, with the Obama administration and Senate willing to leave Bitcoin alone for the moment.

However, the complete collapse of Mt. Gox has returned federal attention to the world of cryptocurrency. Senator Joe Manchin (D-WV) has called for a ban on bitcoins, and the Senate Banking Committee brought in Federal Reserve chair Janet Yellen to testify about the potential for regulating Bitcoin. The thing is, there is no such potential, Yellen said, at least not now. She testified that Bitcoin is “a payment innovation that’s taking place outside the banking industry,” and added:

To the best of my knowledge there’s no intersection at all, in any way, between Bitcoin and banks that the Federal Reserve has the ability to supervise and regulate. So the Fed doesn’t have authority to supervise or regulate Bitcoin in any way.”

Yellen also added, “It’s not so easy to regulate Bitcoin because there’s no central issuer or network operator,” calling Bitcoin a decentralized, global entity.

To Bitcoin developers and users, that global reach and lack of central authority is a core feature, not a bug. Meanwhile, federal prosecutors have sent subpoenas to Mt. Gox, which on Friday declared bankruptcy.

At today’s exchange rate, there’s an equivalent to $8.5 billion out there in the world in bitcoins. It seems likely that regulators and governments will want to keep an eye on where it goes in the future.

Editor's Note: This article originally appeared on Consumerist.