Will Banks Of The Future Lack Tellers?

How many times have you walked into a bank branch and done business with a teller recently? Between using ATMs to make deposits and withdraw cash and getting direct deposit from your workplace, the answer is probably “not all that many.” The bank PNC looks at customers like you and sees the future. A future without traditional teller windows.

Instead of getting in a teller line, PNC customers of the future will walk up to concierge desks. Instead of tellers, they’ll meet with “financial consultants” who can perform transactions like a teller would, but also sell customers new services, advise them, and show them how to use mobile banking so they don’t need to walk into a branch so much in the first place.

Tellers will be able to train for the consultant positions, which could pay better if employees meet sales goals and receive incentives. Will they want to? Advising customers on their banking choices is a different job from handling routine transactions, and not all tellers might want that job. PNC will find out in the near future.“This is being driven by customer choices,” a company spokesman told journalists. The question is, will customers show up in a branch even less with the new format, or seek out a bank where they don’t have to deal with a salesperson every time they want to deposit some rolled coins?

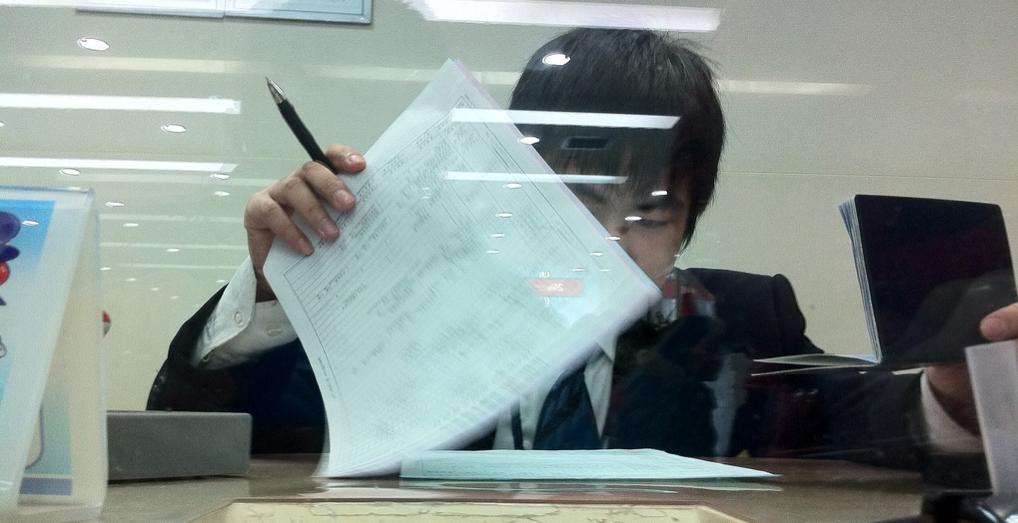

PNC Bank plans to eliminate tellers at many of its branches

Read more:

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.