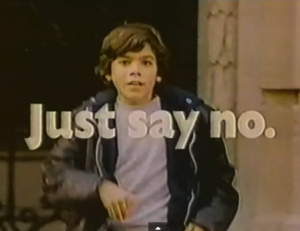

Just Say No… To Marijuana Stock Scams

Look, we know that all the cool kids in the neighborhood have tried it, and some swear that it’s just the bee’s knees, but before you get lured into a mistake that will leave you penniless and regretful, you should learn to just say no to investing in scammy marijuana stocks.

Look, we know that all the cool kids in the neighborhood have tried it, and some swear that it’s just the bee’s knees, but before you get lured into a mistake that will leave you penniless and regretful, you should learn to just say no to investing in scammy marijuana stocks.

Legally produced and sold marijuana is a growing business in the U.S., especially now that Washington and Colorado have legalized the drug. This means that there is a lot of money to be made in a completely legitimate fashion. It also means there are a growing number of people out there trying to sell you the stock equivalent of a bag full of oregano.

FINRA, the private regulatory body overseeing investment firms, has issued a warning to consumers, not about the risks associated with marijuana, but on how to sniff out and avoid being taken in a pot-related stock scam.

The warning explains that even though the scams might be taking advantage of investors’ interest in a new market, the scammers are often using the classic pump-and-dump ploy:

“Specifically, fraudsters lure investors with aggressive, optimistic—and potentially false and misleading—statements or information designed to create unwarranted demand for shares of a small, thinly traded company with little or no history of financial success (the pump). Once share prices and volumes reach a peak, the cons behind the scam sell off their shares at a profit, leaving investors with worthless stock (the dump).”

FINRA gives the example of a company that went so far as to put out 30 press releases in just the first half of 2013, each touting how much money could and will be made by investors. One release claimed that the stock “could double its price SOON.” Meanwhile, the company has only posted losses and has yet to even formulate a business plan.

Like any investment scam, there are some tried-and-true ways to avoid being taken in:

Ask “Why me?” Most legitimate companies don’t just go seeking investors via cold calls, e-mails, and faxes. “Why would a total stranger tell you about a really great investment opportunity?” asks FINRA. “The answer is there likely is no true opportunity.”

Consider the source. If a corporate officer for a company is the one telling you about how great the company is going to be, take that info with a grain of salt the size of Montana. He or she benefits directly from your investment, whereas you just stand to possibly lose your money.

“Be skeptical about companies that issue a barrage of press releases and promotions in a short period of time,” adds FINRA. “The objective may be to pump up the stock price. Likewise, be wary of information that only focuses on a stock’s upside with no mention of risk.”

Do your research. Scammers are often repeat offenders, so exercise your Google muscle and research the names of key corporate officials and major stakeholders, as well as the company itself.

According to FINRA, one CEO of a possible pump-and-dump marijuana business spent nine years in prison for operating one of the largest drug smuggling operations in U.S. history. Another former CEO of a similar company was indicted for his role in a multi-million dollar Ponzi scheme. These are generally not people with whom you should entrust your money.

Be wary of frequent changes to a company’s name or business focus. Changing brand names is one thing, but repeatedly and/or frequently changing the actual name of a company can be an indicator that there is something to hide. FINRA says one suspicious marijuana company has changed its name four times in 10 years.

Check out the person selling the stock or investment. Anyone can hand you a sheet of paper saying you own shares in something, but a legitimate investment salesperson must be properly licensed and work for a firm registered with FINRA, the SEC and a state securities regulator.

If you’re unsure about that guy who cold-called you to sell you a stock, FINRA’s BrokerCheck allows you to search for free. You can also check with your state securities regulator, click here for a list of contact numbers for each state.

If the company still passes muster after those basic checks, then it’s time to start doing even more research, like finding out which market the stock trades on, and looking through the company’s filings with the Securities and Exchange Commission (assuming there are any). Even then, just because a company trades on the NYSE or has filed reports with the SEC doesn’t mean it’s not simply out to grab your money and run.

Feel like you’ve been taken in by a pump-and-dump scammer, whether related to the marijuana business or not? You should file a complaint via FINRA’s online portal. And if you have a lead on a possible investment scam, there is the FINRA tip line.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.