More Readers Crunch The Numbers, Figure Out Pet Health Insurance Doesn’t Work Out So Well Image courtesy of (Jeffrey Beall)

Last week, we shared an account by reader Howard about his dog’s illness and the results of his decision to get a VPI pet health insurance policy. While health insurance is just that–insurance, not an investment vehicle–Howard and other readers have crunched the numbers and found that the policies are a worse deal than just sticking the money in the bank.

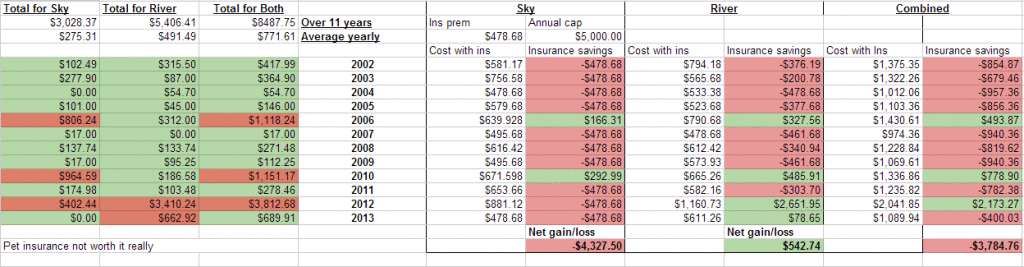

Reader Bob did the below fancy color-coded Excel calculations based on vet care expenses for his actual pets. He worked on the assumption that insurance reimburses 100%, which generally isn’t the case, and found that insurance for both animals combined led to a net loss.

Other readers noted that Trupanion provides better coverage than VPI, but we haven’t seen a cost breakdown of that statement and can’t vouch for it.

Of course, there are exceptions: the people who pay in more premiums than benefits subsidize those exceptions. If your pet becomes seriously ill early in its life before you’ve had the chance to stick the aforementioned money in the bank, insurance can be very helpful. If you aren’t good about saving money (which isn’t a value judgement: it’s good to know your own strengths and weaknesses) then having insurance to mitigate risk may work out well. If your pet belongs to a breed predisposed toward certain genetic diseases, it can be a good choice as well–even if the company sets different premiums for your pet and its relatives.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.