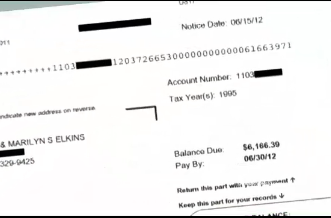

State Goes After Man For Tax Bill From 1995 Image courtesy of (CBS Sacramento)

“I’m doing good to remember what happened two weeks ago,” the 66-year-old tells CBS Sacramento’s Kurtis Ming about the recent invoice he got from the state’s Franchise Tax Board.

The bill, which is mostly comprised of interest and penalties, now totals $6,166.39.

The man has bank records but they don’t go back 17 years. And he says that the accountant who prepared his tax return oh so many years ago has no longer with us on this plane of existence.

The state of California actually has 20 years to collect delinquent taxes — twice as long as the IRS — but only if it notifies the taxpayer of the delinquency within four years.

When reached by CBS, the Franchise Tax Board claims it first notified the man back in 1996 and that its policy is to notify delinquent taxpayers once every year. The man insists that he not only paid the taxes back when he was supposed to, but that he never received delinquency notices from the state until now.

“If they attach my bank accounts or where my social security check is, I’m dead in the water,” he explains, concerned that attempts to garnish his earnings would bankrupt him.

Once CBS got involved, it offered to allow the man to pay off his bill in installments, but he maintains that he paid the taxes 17 years ago and has lawyered up.

A rep for the FTB tells Ming that delinquencies older than 17 years represent about 2% of the Board’s total delinquencies.

The Board has a 60-day period for taxpayers to open an appeal regarding a delinquency notice, but that doesn’t matter in that case since those 60 days vanished some time in 1996.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.