Is This The Worst Piece Of Mortgage Advice Ever Given?

For many first-time home buyers, especially people looking to buy in an area where home prices are higher than average, the biggest roadblock can be saving up to make that down-payment. While there are some tried-and-true methods for amassing that cash — a “gift” from your parents is the classic example — here’s one from a mortgage broker we would never, under any circumstances, suggest you try.

In a Vancouver Sun article, someone claiming to be a mortgage broker actually says:

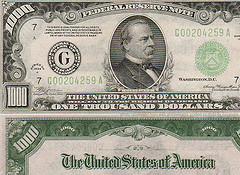

buyers can borrow the down payment through a line of credit, personal loan or possibly cash advances against a credit card.

Even with the caveat that the buyer would have to be able to afford to service the mortgage debt, pay property taxes and heating costs plus an additional payment on the borrowed funds,” this has to be among the most ludicrous suggestions we’ve ever heard.

Now, we’re not Canadian, but unless our neighbors to the north are somehow paying single-digit interest rates on cash advances — and a peek at sites like Creditcards.ca shows they are not — this person is actually suggesting you take out what is effectively a high-interest loan so that you can qualify for a low-interest home loan?

Writes Consumerist reader Kara, who tipped us to the badvice:

A cash advance against a credit card? at 21-29%? Interest kicking off as soon as you take it out? I honestly don’t know if there’s any sort of professional accreditation/ethical organization for mortgage brokers or not, but if there is, they need to have a chat with this gal. If there’s not, clearly there ought to be.

Speaking from my own experience as someone who recently bought his first home — and who had to answer for every penny deposited in the accounts used to make the down payment — I find it hard to believe that most underwriters would give the green light to a mortgage applicant who needed a credit card cash advance to make up a sizable chunk of their down-payment.

And even if you could manage to get the mortgage, you shouldn’t be saddling yourself with more debt before you’ve even gone to closing.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.