Banks Pull Credit Card Tricks To Lure Consumers Back Into Spending More Money

Now that recession-weary consumers have been shedding debt, banks are doing their best to convince you to get that spending back up. Somewhat tricky moves from various credit card companies could result in a high balance if you’re not careful.

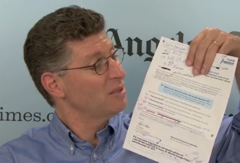

The L.A. Times‘ David Lazarus highlights a recent example involving Chase Freedom MasterCard.

Holders of these cards were informed that they no longer have credit limits, but instead something called “credit access lines.” All accounts have been automatically switched over, and customers must opt out if they don’t want to banish credit limits.

Chase provides a confusing definition of a credit access line: “A credit limit sets a specific amount an account can borrow. With a credit access line, you have the ability to charge over your credit access line and not be charged an over-limit fee. You can revolve, or carry from month-to-month, transactions adding up to your total credit access line.”

Don’t feel bad if you don’t understand that, Lazarus didn’t get it, and neither did we. He asked a Chase spokesman if they expect the average person to get enough information about credit access lines from that explanation. The spokesman acknowledged that it could’ve been written in a “clearer manner.”

“A credit access line means that you may be able to go over your credit limit without any over-limit fee,” he said. “It gives you the ability to spend.”

With no knowledge of your credit limit, no immediate penalties and no awkward moment when a charge is denied, consumers might be tempted to spend more, at a time when most are trying to tighten their belts and manage their money more responsibly.

Chase makes it easier for consumers to overspend [L.A. Times]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.