"$10 Minimum For Credit Card Purchase" Signs May Soon Be Totally Legit

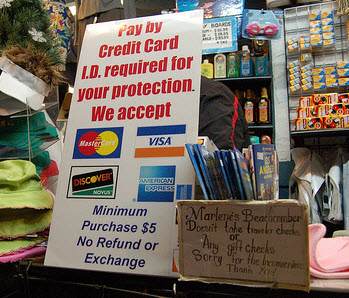

As we all know, merchants are generally not supposed to mandate minimum credit card purchases. It’s a violation of the merchant agreements they sign with the credit card companies. (For more info, check out this article.) The proposed finance bill, however, may legitimize those handwritten signs if it ends up passing.

The NYT says that current Senate version of the bill will allow such minimums as long as there is no discrimination between which type of card the customer is using. A Bank of America card, for example, could not have a $10 minimum while an Amex had none.

On the other had, offering discounts to certain preferred card holders would be allowed. So you could get a $1 discount for having a MasterCard while people with Visa were stuck paying full price.

The provision is part of a larger reworking of the way merchant fees are handled. The credit card companies are against it, because it would require banks to lower fees for merchants who use debit cards. The banks currently use those fees to pay for things like rewards programs and free checking accounts — products that are attractive to consumers and easy to market.

“This is an incredible con job,” MasterCard’s general counsel, Noah J. Hanft, told the NYT. “Under the guise of helping small business, this is just a shrewd and cynical effort that ultimately harms consumers.”

How the Finance Bill Affects Consumers [NYT]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.