Beat The "Four Square" Dealership Ripoff

Former used car salesman Alan Slone grew a little Jimminy Cricket in his ear and decided to spill his guts on a classic dealership technique used to addle your mind and empty your wallet. It’s called “The Four Square” and the object of the game is to make you lose. Here’s how it works, and how to beat it.

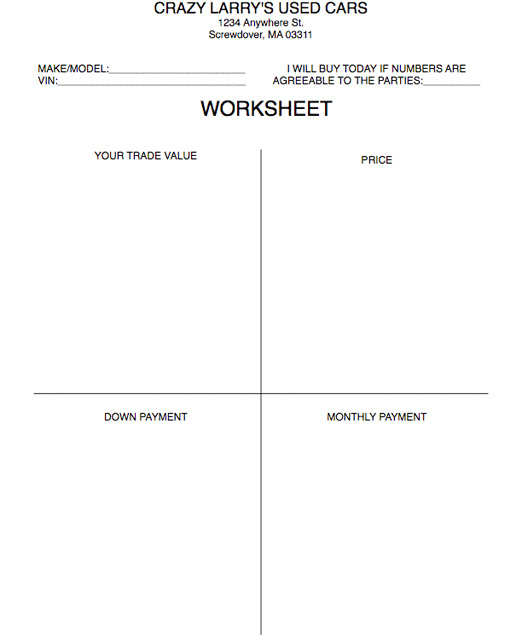

At the heart of it all is the “4-square,” a sheet of paper (sample above) divided into four boxes: your trade value, the purchase price, down payment, and monthly payment. This is supposed to help you and the dealership come to an agreement, but as you’ll see, it’s really more akin to three-card monte dealer’s deck of cards. Many, but not all, dealerships use this tool.

Here’s 5 tips to get you started, and then a very detailed breakdown of how the dealership manipulates buyers with the four-square.

1) GET YOUR FINANCING THROUGH THE CREDIT UNION BEFORE YOU EVEN STEP ON THE LOT.

Once a car salesman knows you don’t need financing, they’re more willing to be forward with you and knows they don’t have to work on the payments with you, because it won’t help. We’ll still try to beat whatever APR you’re getting at the bank and offer you payment deals, but forget them. You’ve got it worked out, and only need to know the price – bringing us to the next point.

2) DON’T HAGGLE OVER ANYTHING BUT THE PRICE.

This seems obvious to most of the readers of The Consumerist, but most people miss this – especially if they’re getting dealer financing.

3) DO YOUR HOMEWORK.

Know what the MSRP of the car is, know what your trade is worth. (Here’s a hint: take the NADA and subtract about $2K – used cars are appraised by books that aren’t published to the public, so it’s not blue book or NADA value. It’s called “black book” value; “black books” are published weekly by companies such as Manhiem Auto Auctions (http://www.manheim.com/), and these show the going price at the auction, that week, for your car. Basically, wholesale cost.)

4) LET THEM KNOW THAT YOU KNOW WHAT THEY ARE DOING.

If you read this article, you are already ahead of 99.9% of the people walking in. They’ll cut most of the bullshit with you if they know that you’re not going to fall for it.

5) UNDERSTAND THAT YOU ARE NOT GOING TO PAY COST FOR THE CAR, AND THE AMOUNT YOU PAY OVER COST WILL BE MORE THAN YOU THINK.

6) HERE’S HOW THE FOUR-SQUARE WORKS:

The “worksheet” (or four-square, as it’s called) is the first thing a person will see when they sit down to negotiate a car’s price. This sheet is used both in used and new car sales. When the interested party sits down, they’ve already driven the car, and have talked to the salesman about what they’re looking for. The salesman has had the trade evaluated, if there is one, and has gotten the customers something to drink to take the edge off.

After sitting everyone down, the salesperson starts filing out the four-square. A blank one looks something like this:

The salesman will only put down the make, model, VIN and customers information (not pictured). Then, the salesman will have the customer initial the part that says “I will buy today if numbers are agreeable to both parties.” If there’s any resistance (which normally there isn’t), the salesman simply says that its to make sure that the customer really is ready to drive the car off the lot today – IF they can get the numbers right. I never had anyone not sign the form who was actually willing to buy the car today. By doing this, you have shown your commitment to the manager in the tower (tower: back room, usually behind glass, where the salesman goes to confer with his manager.)

(A note about the tower: This is where the deal actually takes place. The salesman you are dealing with is NOT who you are negotiating with – the sales manager, who sits behind a desk (and is usually one of the scummiest people you’ll ever meet) is who’s actually going to be haggling with you. This will not happen in front of you, nor will you see what is actually happening. It’s a bit of theatre, this part.)

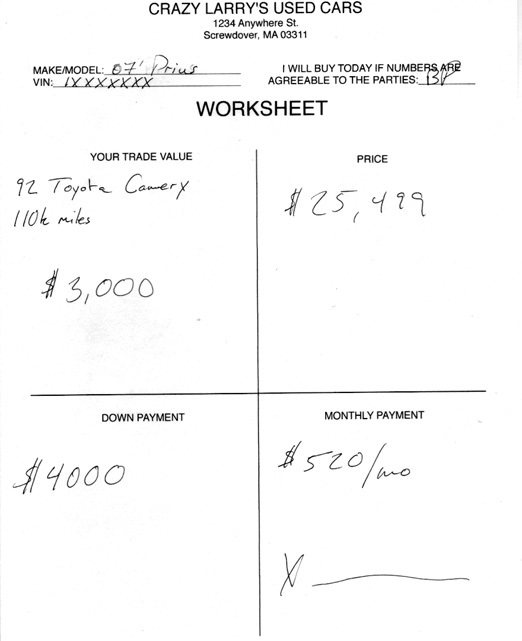

The salesman will then take the paper up to the tower, and when he returns, you’ll see something like this:

The salesman will start, very matter-of-fact, going over the numbers with you. First, he’ll start with the value of your trade.

The value of your trade, as listed, is $3000. You, expecting at least 5k for your beater, are unhappy with the number. That’s fine, the salesman says. We’ll get to that in a moment. He then goes on, very quickly, to just state the price of the car. Salespeople are instructed to move over these parts of the sheet VERY QUICKLY, as you’ll see in a moment.

Next, he arrives at the down payment square, which is easily double what you’d hoped to put down today on the nice new Prius you now want very badly. Lastly, he arrives at the monthly payment. “That payment is outrageous! I can’t afford that!” is what you’re probably thinking. All in all, these are pretty crap numbers from what you see.

THESE NUMBERS ARE MEANT TO INSULT YOU AND PUT YOU ON THE DEFENSIVE, ESPECIALLY THE LAST TWO. The idea here is that, unless you’re really observant, to get you less concerned about the overall price of the car and what your trade is worth (we’ll go into trade manipulation in a moment), and get you to the payment plans offered at the bottom. The salesman, who knows you are steamed, will keep on acting like nothing is wrong, and hand you a pen to sign by the X. This is done for two reasons – 1)You might be the biggest, dumbest sucker we’ve had today and actually agree to these terms (happened twice the three months I did this), or 2) You look like the aggressor when you say you won’t sign.

When you decide state that those numbers don’t work for you, the salesman will ask which numbers you have a problem with. Most people will go straight to the down payment, as that’s usually the part that most people gag on, followed closely by the trade in value. The salesman will then either talk about your trade (and proceed to downplay the car as much as they can – that’s usually pretty easy), or will go directly to the down payment. Very discreetly, the salesman will fold the four square so that the only figures you see when you’re talking are the down payment and monthly payment.

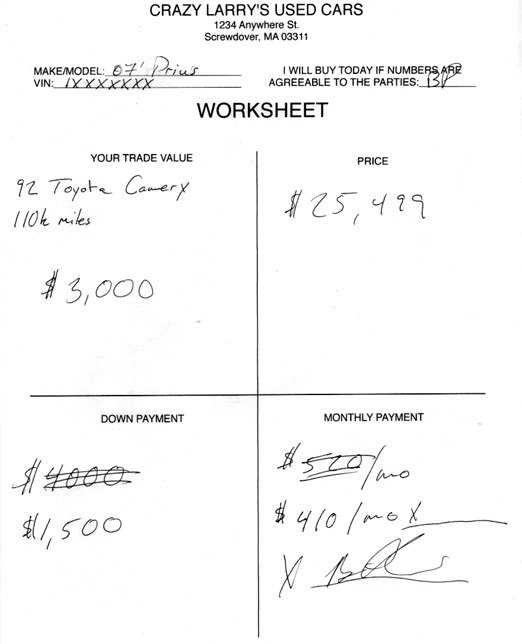

The salesman will then say “Well, what were you thinking about putting down today on the car?” You’ll respond something like 1500, 1000 or even less if you’re in a bind and NEED the car but are broke. The salesman will nod, and act as if he’s empathetic with your plight – those bastards up in the tower *are* asking too much from you! He’ll then cross out the down payment number and write in the number you’re looking for.

At this point, the salesman will say something to the effect of, “Well, we may be able to get that down payment done for you. But, as I’m sure you know, the less you put down today, the more you’ll have to pay off on the car – so this payment is likely to go up. What were you looking to pay on the car for payments?” You respond, “I didn’t plan on paying that much, must less more!” The salesman will pause, hoping that his last line will sink in a bit and you’ll either acquiesce to the current number or offer something higher.

If you don’t, and insist that you were only planning on paying $300 a month for the car, the salesman will say, “I don’t think I can do this, I really don’t. But, I tell you what; my manager is crazy today and hasn’t sold that many cars – he’s really under the gun from upper management to get some cars out today, and he might just do this. Tell you what – if I can get these numbers, would you buy the car right now?” You say, “Well, sure, I guess.” The salesman will say, “Okay, can you write me a check for the down payment so I can take it up there? They’re not usually willing to turn down someone if I show up with cash in hand!” (Real reason? People are really unwilling, for some reason, to ask for a check back later if negotiations start to break down.)

Most people, at this point, will write the check – if the salesman is good enough with the snow job, people will honestly think that they’re getting a good deal and that they need to do everything they can to get the manager to cave and sell them the car for next to nothing. The salesman will also get you to sign the form, by the X, saying that you’re agreeing to the new numbers, not the old. He’ll then put on his “wish me luck” face, and trudge up to the tower to haggle with his boss, the mean ol’ manager.

(A note about the X: There’s nothing legally binding here, BTW. You could sign your SSN, your blood type, and your name all on that line – but there’s nothing binding on either party to make that happen. It’s a precursor to the real deal with all the lovely paperwork in finance…but not the actual deal. However, the dealerships make you do this so you’ll think its official and leverage yourself into thinking you may have just bought a car.)

The salesman will return, with a huge grin on his face, and something like this:

He’ll say, “Wow! He really is in a tough spot! He was willing to let this go for the down payment you wanted! But, like I was saying, he couldn’t really hit the payment you were looking for because he went down so far on the down payment, and he can let it go for this. (Motions towards new payment offer.) Would this work for you?” You will sit and look at the number, and wish you weren’t buying a car today but instead on vacation. You will either agree, and we’ll enter the final turn, or you’ll go another couple of rounds with them until they either meet you somewhere in the middle, or you start to walk out.

(Note about “walking out.” This doesn’t work if your offer is, truly, unrealistic. You need to do your homework before going in – this includes finding out how long the car has been on the lot [just driving by and seeing it for a couple of weeks is good ammo], what the going rate is for those cars, and above all else, securing your financing before you get there, so you’re more worried about the ACTUAL PRICE OF THE CAR instead of these bullshit terms.)

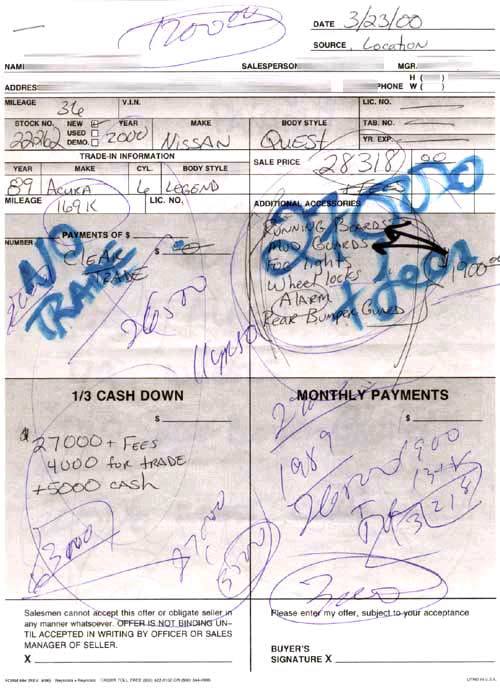

Now, lets say you’ve got a problem with the trade price, as well as the other figures (other than price.) The salesman (and manager) will probably agree to whatever price you want for your trade, within reason. So, assume the sticking point is that you want $5,000 for your trade – that’s fine, we’ll just say it’s going to be bought for $5000. We simply move around the price of the car to $2,000 more, and you’re in the clear. You don’t notice, we don’t say anything, and you feel happy. This is the way that dealerships do the whole “push pull or drag” sales where they’ll give you $5,000 for an engine block.

So, at this point, we’ll assume that you’ve gotten everything square and you’re ready to close the deal. Sometimes, if the manager feels especially nasty (or has gone a few rounds with you via the worksheet), they’ll come out of the tower and say “Folks, I’m (Douchey McDouchebag), the sales manager here. Congratulations! You’ve just bought a car! We were able to get the payments to $310 – I know you wanted $300, but that was the best we could do. That’s close enough, right?” They’ll nod their head (another psychological trick to get you to agree), and almost every time the person says “Yea, that’s fine!” The problem is, they didn’t realize that a $10 payment bump over a 5-year loan nets an extra $1k in profit for the dealership. It’s called “the $10 (or $15, or $20) close”, and I only saw it fail when a person was really, really exasperated with us. The deal ends, and you wake up in a year realizing that, somehow, you’re $6,000 upside down on your car, while the dealership is laughing all the way to the bank.

So, those are the major pitfalls associated with the four-square; it looks really unassuming on its face, but its designed to make you pay more, and not realize what’s going on. The manager, during negotiations, will write in BIG BIG letters, will turn over the sheet if he needs room, and will write over other things in order to make it as confusing and hard to deal with as possible in attempts to wear you down and make you sign.

The saying we used to have around the lot was “It’s like the Dallas Cowboys playing a Pee-wee Football team.” The average car salesman does this dance 4 times a day – you do it once every 3-5 years. They are better, and they will get you on some level. However, by doing stuff like this, you can control how much it happens.

Here’s what a finished four-square might look like:

Have you ever been put through the four square ringer? Did you beat the box or did the box beat you? Leave your thoughts in the comments.

RELATED: Four-Square Basics: How the Dealer Works the Numbers [Edmunds]

This post originally appeared March 30, 2007.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.