John Oliver made a huge splash this week when, to prove a point on his show, he purchased $15 million worth of medical debt for $60,000… and then promptly forgave it all. A lot of that debt was “zombie debt,” which, like its namesake, keeps coming back from the dead to bother people who would much rather be left alone and unbitten. [More]

zombie debt

Is It Time For Regulators To Stab Zombie Debt Through The Brain?

What a lot of people don’t know — and what debt collectors rarely mention — is that most unpaid debt has an expiration date after which you can’t be sued for repayment. And even fewer consumers are aware that this dead debt can be sparked back to life by making a payment after it’s already passed on to the debt afterlife. A new report calls on federal regulators to make sure that debt doesn’t rise from the dead in zombie form. [More]

Debt Collectors Keep Calling About Bogus Debt, Even After Being Threatened With Suit

From calling at all hours of the day and night to contacting you at work, we’ve told you before about the large number of banned practices for debt collectors. But one man says he’s the victim of a tenacious debt collector trying to collect a debt he doesn’t even owe. [More]

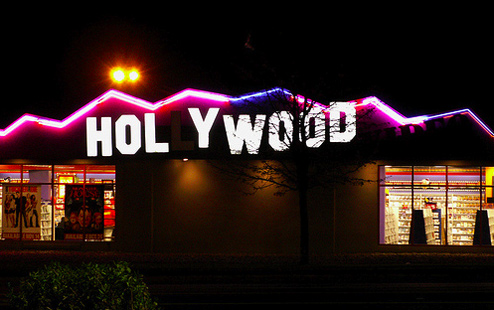

Why Hollywood Video Zombie Debts Just Won't Go Away

Movie Gallery/Hollywood Video went bankrupt with only one real asset: enough outstanding overdue notices to make a librarian weep. Americans owed the chains something like $125,000,000, which is not a typo. These debts were sold, and the new owners zombified them and really, really want to get their paws on that money. A year and a half after we first reported that customers and even employees were receiving invoices from collection agencies for zombie debts, they’re still at it. [More]

Debt Collectors Now Going After Former Hollywood Video Employees

Zeke once worked for now bankrupt and defunct Hollywood Video. Employees had special accounts allowing them to rent older movies (more than a few weeks old) for free and not have to pay late fees when they didn’t bring them back. Zeke is sure that he wouldn’t hallucinate free movie rentals, but the collection agency that sent him the letter insists that this policy never existed, and that it’s up to him to prove that he didn’t owe the company $28.95 in late fees at the time he quit. [More]

Kaplan University Demands $3,310.56 After Graduation, Can't Explain What For

Melinda has an MBA from Kaplan University, and has enough business sense to know that she shouldn’t have to pay debts that aren’t hers in the first place. The for-profit college, part of the Washington Post Company, has decided that she owes them more than $3,000 even though her tuition was long ago paid with federal financial aid. No one can show her a detailed breakdown of the bill, or explain why no one noticed that she owed the money until months after graduation. Update: Kaplan has since resolved Melinda’s problem. [More]

Zombie Debt Collector Tries To Collect 11-Year-Old PayPal Balance

Christopher is currently being haunted my a small debt from his past. At least, it might be from his past: he’s not sure. A collection agency is after him trying to collect a $315 PayPal balance from the dot-com bubble era. He doesn’t remember owing PayPal any money, but who knows? That was a crazy time. He wonders what his next steps should be. [More]

Please Make Dead Friend's Creditors Stop Calling My Mom

Kevin’s mom is the executor of a family friend’s estate. Chase, the company that holds this family friend’s mortgage somehow got hold of her phone number, and is now calling her incessantly, looking for…. the dead person? Chase reps claim that they’re not allowed to speak with the executor of the estate, yet they keep calling back despite pleas to leave her alone. [More]

Wave Of Fake Debt Collectors Hints At Possible Data Breach

The Better Business Bureau has released a warning to be aware of scammers calling to threaten people with arrest “within the hour” for defaulting on payday loans. What makes them stand out from normal debt collecting scammers is these callers have huge amounts of personal info on their victims, including Social Security and drivers license numbers; old bank account numbers; names of employers, relatives, and friends; and home addresses.

Judge Orders Credit Reporting Bureaus To Strike Forgiven Debts From Records

The three big credit reporting agencies—Experian, TransUnion, and Equifax—have been inaccurately reporting debts on millions of consumers’ credit reports even after the debts have been forgiven during bankruptcy filings. Once forgiven, the debts are supposed to be removed from credit reports, but the agencies are continuing to report them as active. They have until October 1st to comply with Judge David O. Carter’s order to “revamp their systems,” writes Jane J. Kim on the Wall Street Journal’s finance blog. Now if you’re in debt trouble, you can look forward (?) to having either unpaid debts on your credit report, or a bankruptcy filing, but hopefully no longer both at the same time.

Third-Party Debt Collectors Misusing Courts To Increase Profits

The Chicago Tribune writes that “More than 119,000 civil lawsuits against alleged debtors are clogging [Chicago] courtrooms,” but since collection agencies make money off of volume business, the suits filed are based on too little information. The result: cases based on mistaken identities, or for debts already settled, or against debtors who have made good-faith efforts to work out repayment plans. “The system is out of control,” one attorney tells the paper.

Collection Agencies Sending Out 1099-C Forms For Zombie Debts?

It seems that some bottom-feeding debt collection companies—the ones who buy old debts that are frequently beyond the point where you can be sued for collection (what the FTC calls “time-barred debts”)—purchase old debts, mark them up with incredibly high penalties and fees, then “forgive” them and write them off as tax losses and send the debtors 1099-C forms—which means you have to pay taxes on the forgiven amount. If this happens to you, here are a few things you should consider first.