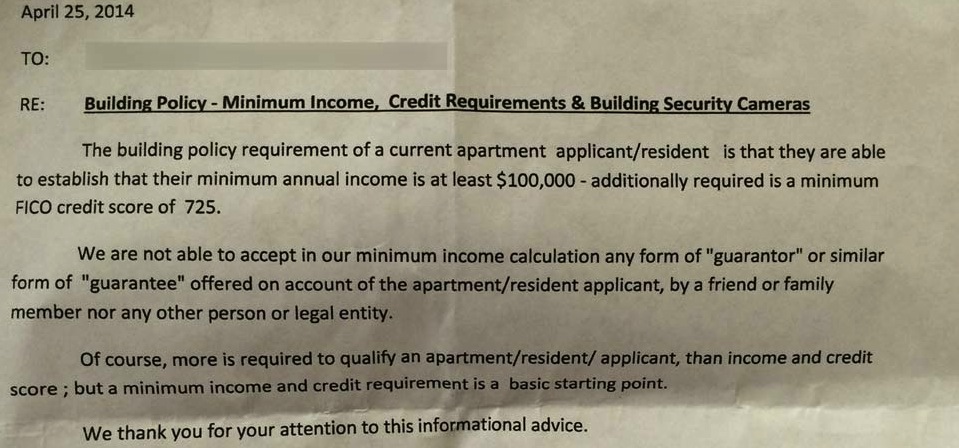

A lot of apartment buildings in pricey cities have strict income and credit requirements for potential tenants, but once you’ve got the apartment all that generally matters is that you pay your rent on time and in full. The landlord of one building in San Francisco recently posted a letter telling current tenants that they will have to be re-screened to make sure they are earning at least $100,000 a year and have sterling credit. [More]

what’s in your wallet

Capital One Is The Most Complained-About Credit Card Company

Since the Consumer Financial Protection Bureau opened its credit card complaint portal in Sept. 2010, more than 25,000 complaints have been filed with the CFPB. And while the 10 largest credit card issuers account for 93% of all those complaints, one company is responsible for more than 1-in-5 of all complaints filed with the Bureau: Capital One. [More]

Consumers Saved $4 Billion In Credit Card Fees Last Year, But Fewer Have Access To Credit

It’s been four years since lawmakers passed the CARD Act, a massive set of reforms for the credit card industry. As a result, consumers have saved billions in fees and other charges, but access to credit has also become more difficult for some people. [More]

Capital One To Refund $140 Million To Customers Misled Into Buying Unwanted Add-Ons

The Consumer Financial Protection Bureau says the barbarians and/or vikings at Capital One went too far in pressuring and misleading the bank’s credit card customers into paying for add-on products like payment protection and credit monitoring. Thus, around two million Cap One customers will be sharing in a refund of $140 million. [More]

Report: Fed Concerned Capital One/ING Direct Merger Could Create Another Too-Big-To-Fail Bank

Back in July, Capital One announced a deal to purchase online bank ING Direct USA for around $9 billion. And even though Cap One tried hard to quell ING customers’ screams of “nooooooo,” the folks at the Federal Reserve are reportedly a bit worried that the deal might create another bank so big that its failure would have a disastrous impact on the economy. [More]

Subprime Credit Cards Are Back, Now With Extra Interest!

After a couple years of hiding in the shadows, credit cards targeted at consumers with less-than-stellar credit ratings are once again making a push to gain new customers. [More]

Lawsuit: Capital One Sent Me Letter Demanding $286 Million

A woman in Pennsylvania has filed a lawsuit against Capital One after a dispute over a few thousand in credit card debt spiraled out of control until, she alleges, it culminated in the credit card company sending her a letter demanding the immediate payment of more than $286 million. [More]

Capital One Made Me Different Loan Offers Depending On Which Browser I Used

Devin says Capital One’s online car loan rates differ depending on which browser you use to go loan-hunting. Apparently the bank’s loan-offering robot doesn’t think much of Firefox users. [More]