In June, Costco will officially change its store-branded credit card from American Express to a Visa card issued by Citi. The wholesale club is promising a seamless transition, but some longtime Costco customers have concerns: Will my credit score or history be dinged? Can I opt-out? [More]

visa

Citi Will Send Members’ New Costco Visa Cards In May

This June, things will change at Costco: the warehouse retailer will change its official, store-endorsed credit card from a Costco-branded American Express card to a Costco-branded Visa card from Citi. We now know that the new cards will start being mailed out in May, and what kinds of rewards users will be able to expect. [More]

Costco Credit Cards Will Officially Switch To Citi, Visa In June

For more than a year now, Costco has been preparing to take its store-branded credit card business in a new direction. Specifically, it’s transferring its credit card network from long-time partner American Express to Citigroup and Visa. After hitting a few snags in the road, the shopping club now plans to make things official in June. [More]

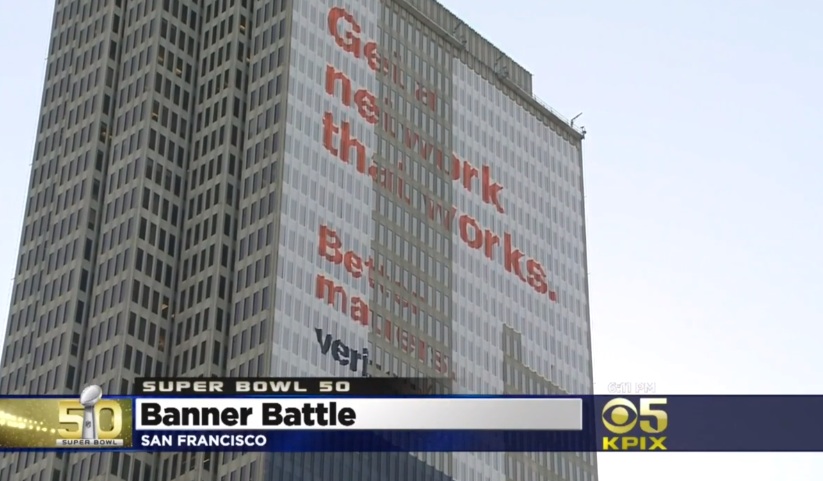

San Francisco Wants High-Rise Verizon And Visa Ads To Come Down Before Super Bowl

With visitors coming to town for a high-profile sporting event next week, two high-rise buildings in San Francisco sold exterior ad space to Verizon and to Visa. There’s a problem, though: the ads, which are 15 and seven stories high respectively, are illegal, and the city wants them to come down before the Super Bowl. [More]

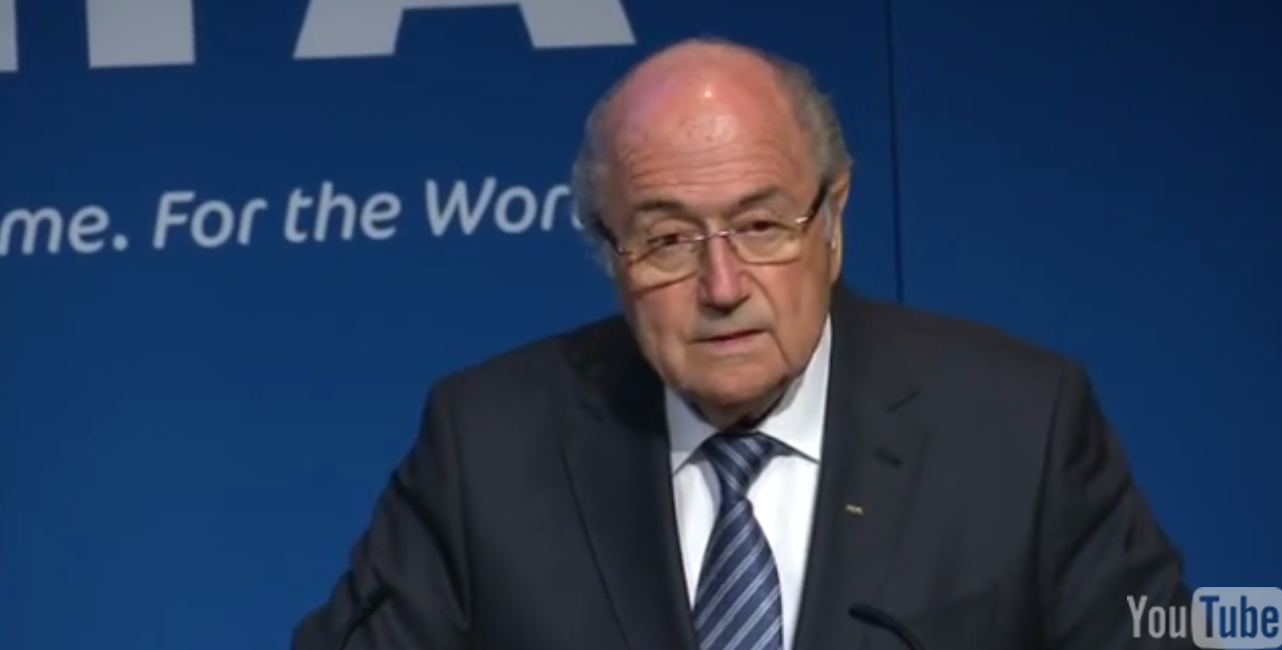

FIFA Chief Sepp Blatter Banned Over $2M Payment To Fellow Soccer Exec

More than six months after he announced he would eventually be ending his nearly two-decade reign atop the world’s largest soccer organization, FIFA president Sepp Blatter has been banned from the sport for eight years. [More]

Chevron And Visa Try Out Mobile Payments At The Gas Pump

Mobile payment at the gas pump using NFC technology like Apple Pay, Samsung Pay, or Android Pay? What is this technological wizardry? Yes, Chevron is starting to experiment with making the hottest technology of 2014 available at the pumps in its gas stations, starting with 20 stations in California. [More]

The Chip-And-PIN Credit Card Era Starts Today. What You Need To Know

Over the past few months, you may have noticed more retailers adorning their checkout stands with shiny new credit card readers. While those systems still have an area along the side where you swipe your card’s magnetic strip, they also have a smaller slot (typically) on the front where you simply jam gently insert your card. This is all part of the country’s shift toward more secure, but far from perfect, chip-enabled cards that kicks into high-gear today. [More]

I’ve Been Forced To Sign A Bogus Credit Card Bill While Traveling Abroad. What Can I Do?

International travel is great! There are millions of great places to see, people to meet, and foods to try waiting out there in the world. Unfortunately, there are also crooks and fraudsters everywhere. Most of us know how to handle a sticky situation when we’re on our home turf, but what do you do when someone in a place where you don’t speak the language is taking advantage of your wallet in a way you didn’t agree to? [More]

Target Agrees To Pay Visa $67M Over 2013 Data Breach

It’s hard to believe that it’s been nearly two years since cybercriminals breached Target’s in-store payment network and stole credit card data for millions of customers during the year’s busiest shopping season. Credit card issuers went after the retailer because they had to pay for the huge number of replacement cards that were issued to affected customers. Now it looks like Target and Visa have reached an accord that will put $67 million back in those card issuers’ hands. [More]

Most Small Business Owners Aren’t Ready For Chip-And-PIN Credit Cards

Following a string of high-profile data breaches last year, Visa and MasterCard handed down a requirement that all merchants transition to the more secure chip-enabled credit card payment system by October of this year. While several major retailers have already made or are in the process of making the switch, a new report finds that many small business owners don’t even know about the deadline – or the potentially costly consequence of not meeting it. [More]

Appeals Court Breathes New Life Into ATM Fee Price-Fixing Suit

More than two years after a federal court dismissed price-fixing lawsuits against Visa, MasterCard, Bank of America, JPMorgan Chase, and Wells Fargo, a federal appeals court has revived the cases that involve allegations that these banks and payment networks illegally and anticompetitively established fee levels for out-of-network ATM use. [More]

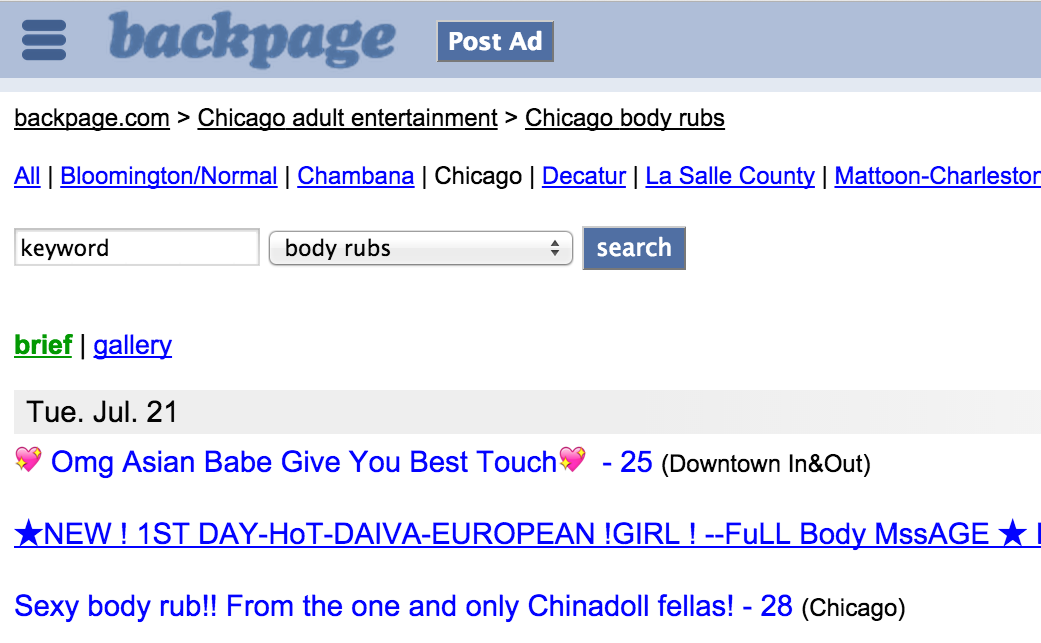

Court Says Sheriff Crossed Line By Convincing Visa, MasterCard To Sever Ties With Backpage.com

First, an Illinois sheriff convinced Visa and MasterCard to stop doing business with online classifieds site Backpage.com, claiming the site was a storefront for sex traffickers. Then Backpage sued the sheriff, alleging his actions were tantamount to government censorship. Now a judge in the case has told the sheriff to back off of Backpage. [More]

Backpage.com Sues Sheriff For Persuading Visa, MasterCard To Stop Serving Site

Earlier this month, the sheriff of Cook County, IL, persuaded both Visa and MasterCard to end their relationships with online classifieds site Backpage.com, alleging the site is known to “promote prostitution and facilitate online sex trafficking.” Today, the website fired back with a lawsuit against the sheriff. [More]

Visa, MasterCard Cut Ties With Backpage.com After Pressure From Law Enforcement

After pressure from law enforcement, both Visa and MasterCard have announced they will no longer process payments for classified ads on Backpage.com. The site has often been criticized for its “Adult” section, which some say makes it easy for pimps and sex traffickers to solicit customers for sex. [More]

John Oliver Pledges To Eat McDonald’s, Drink Budweiser If They Use Sponsorship Power To Change FIFA

Last week, the soccer world was rocked when numerous current and former FIFA officials were arrested and charged with accepting illegal kickbacks and bribes. Only days later, FIFA President Sepp Blatter, under whose oversight these alleged crimes have occurred for nearly two decades, was reelected. That’s why John Oliver has called on FIFA’s high-profile sponsors to use their financial leverage to effect some change in the most powerful soccer organization in the world. [More]

Visa Sends A Warning That It Could Pull Its FIFA Sponsorship

What a difference a week makes: Although last week it seemed Visa, Coca-Cola and other big name sponsors would stick with their sponsorships of the 2022 soccer World Cup amidst rumors of human rights abuses in host country Qatar, after multiple officials of the Fédération Internationale de Football Association (FIFA) and several allied businesses were arrested yesterday, it seems some companies are getting cold feet. [More]

Visa, Coca-Cola Respond To Human Rights Concerns About Qatar World Cup; Not Pulling Out As Sponsors

Since the mysterious cabal that is FIFA announced that the 2022 soccer World Cup would be played in Qatar, there have been rumors of graft, concerns about the exceedingly high temperatures, and most importantly multiple reports of human rights abuses at worksites for the new stadiums and other facilities being erected around the country. As more people call on the event’s largest sponsors to pull their support, some are responding, though none are giving any indication that they won’t slap their name on the wildly popular tournament. [More]