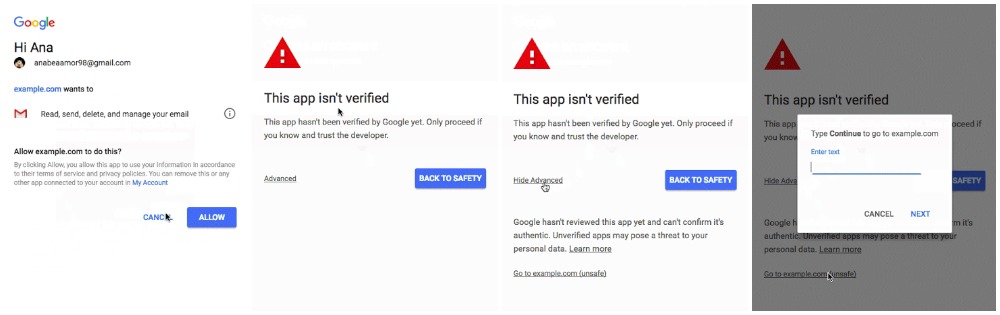

Two months after Google added phishing protections to the Android Gmail app, the company is taking its no-phishing attack approach further by introducing new warnings and a more complex verification system for new apps. [More]

verification

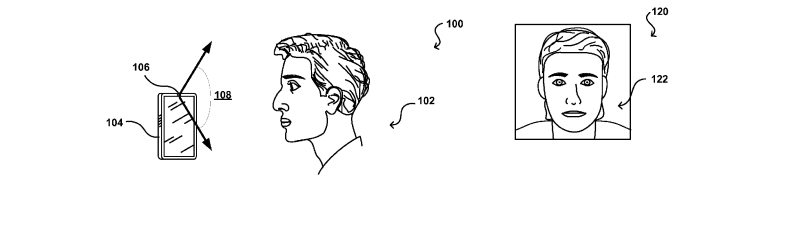

Amazon Files Patent For Pay-By-Selfie System

MasterCard may have rolled out its new “selfie” verification system last month, but it’s not the only company to take consumers’ love of self portraits and turn it into a way to make money. To that end, Amazon recently filed a patent for a so-called selfie pay system. [More]

Diesel Website Wants Color Scan Of Your Credit Card Via Email

I know credit card fraud is rampant, but I’m not sure sending full scans of your card through email is the proper way to fix things. [More]

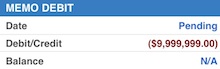

Chase Freezes Long-Time Customer's Accounts With $9.9 Million Overdraft Fee

Chase froze Micah’s checking accounts with a $9.9 million overdraft fee after he took the ultra-suspicious step of opening a joint checking account with his girlfriend. Rather than merely freeze the joint checking account, Chase decided to freeze all of Micah’s assets until they could verify that their customer of thirteen years was really whom he said he was. Not even a letter from the Social Security Administration, handed to the local Chase branch and sent to Chase’s fraud unit could stop Micah’s debit card from being canceled. Now Micah has no access to his cash, a $9.9 million charge to his name, and still no joint checking account with his girlfriend. [More]

Bank Of America: "That's Why You Don't Open New Accounts Online"

After reading about how Jesse was banned for life from Bank of America for no clear reason, other readers wrote in with similarly bizarre BoA stories. Wayne was locked out of his new account after he opened it and charged a $75 overdraft fee. Chris was sent checks linked to a duplicate account and then charged penalties when the checks bounced. Edward’s new account was closed but the CSR refused to tell him why, and he was charged a $60 “research fee” for the closing. When Edward went to a BoA branch to clear things up, he says the employee there told him, “That’s why you don’t open up accounts online.”

Qchex Shut Down, Scammers Everywhere Weep

ArsTechnica reports that a judge has ordered Neovi, the company behind Qchex, to immediately stop offering their service, which allowed people to create and send checks drawn on any bank so long as they provided the account info. As you can imagine, this led to abuse by scammers who would use Qchex to create fraudulent checks.

Capital One Hates Deaf People

What’s in your wallet? I said, what’s in your wallet? Oh, forget it. From a reader:

UPDATE: Sprint Loves To Give Out Your Billing Address

After getting blogo-lambasted for a gaping security hole that allowed anyone to call up and snag your name and home address by punching in your Sprint cellphone number into an automated system, Sprint has closed that selfsame privacy aperture.

Sprint Loves To Give Out Your Billing Address

Sprint is taking the lead for crappy customer verification after Boing Boing spilled that their new international call identity verification service will spill the name and address of the owner of a particular phone number just by typing that number into a robot-manned 1-800 number.