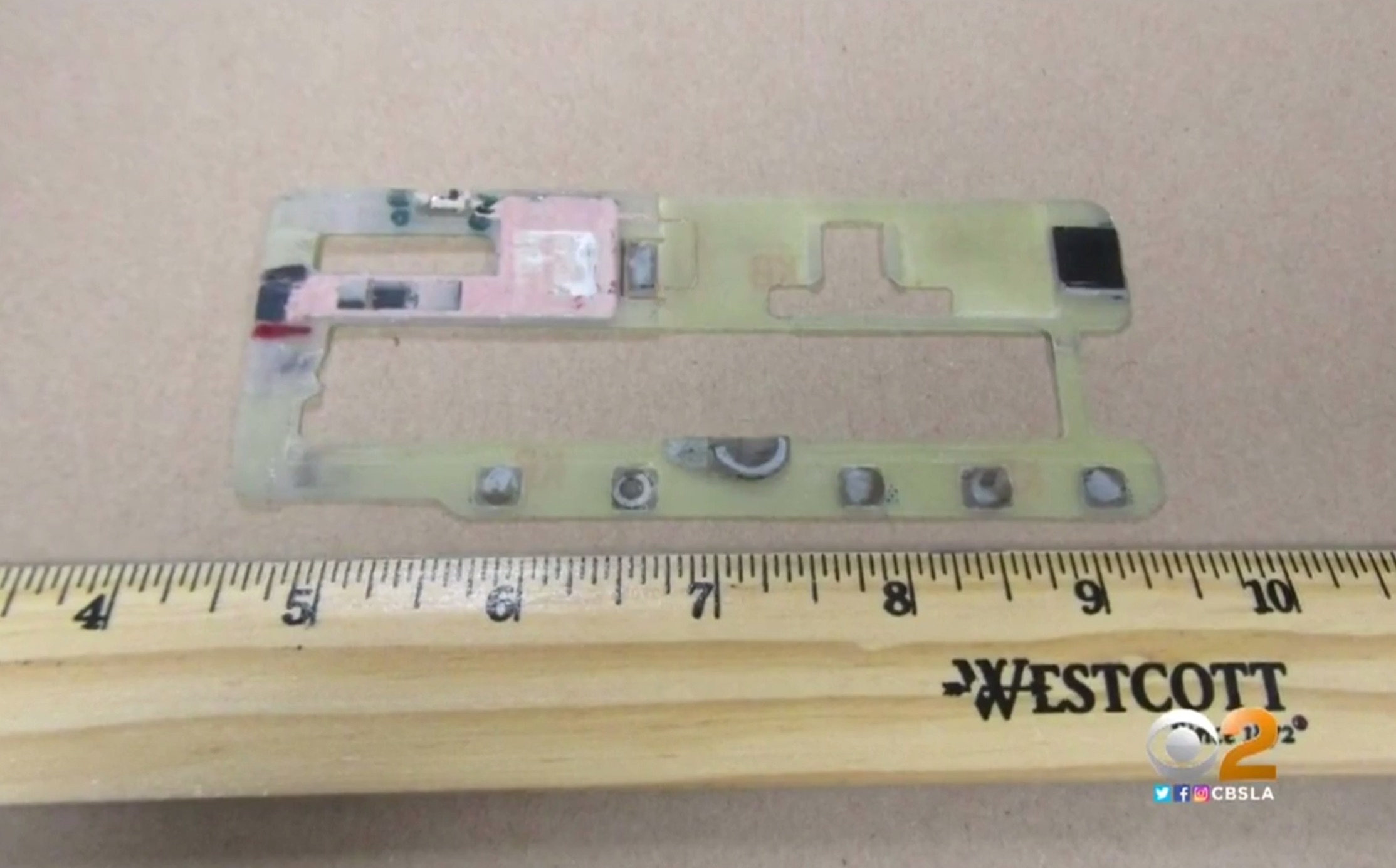

If you’re hitting the road this holiday weekend, you might find yourself visiting some unfamiliar gas stations, ATMs, or kiosks that accept credit cards. The recent arrest in California of two men who are accused of draining $500,000 from US Bank customers’ accounts should remind people across the country and all over the world: be careful where you swipe your debit card, and be protective of your PIN. [More]

us bank

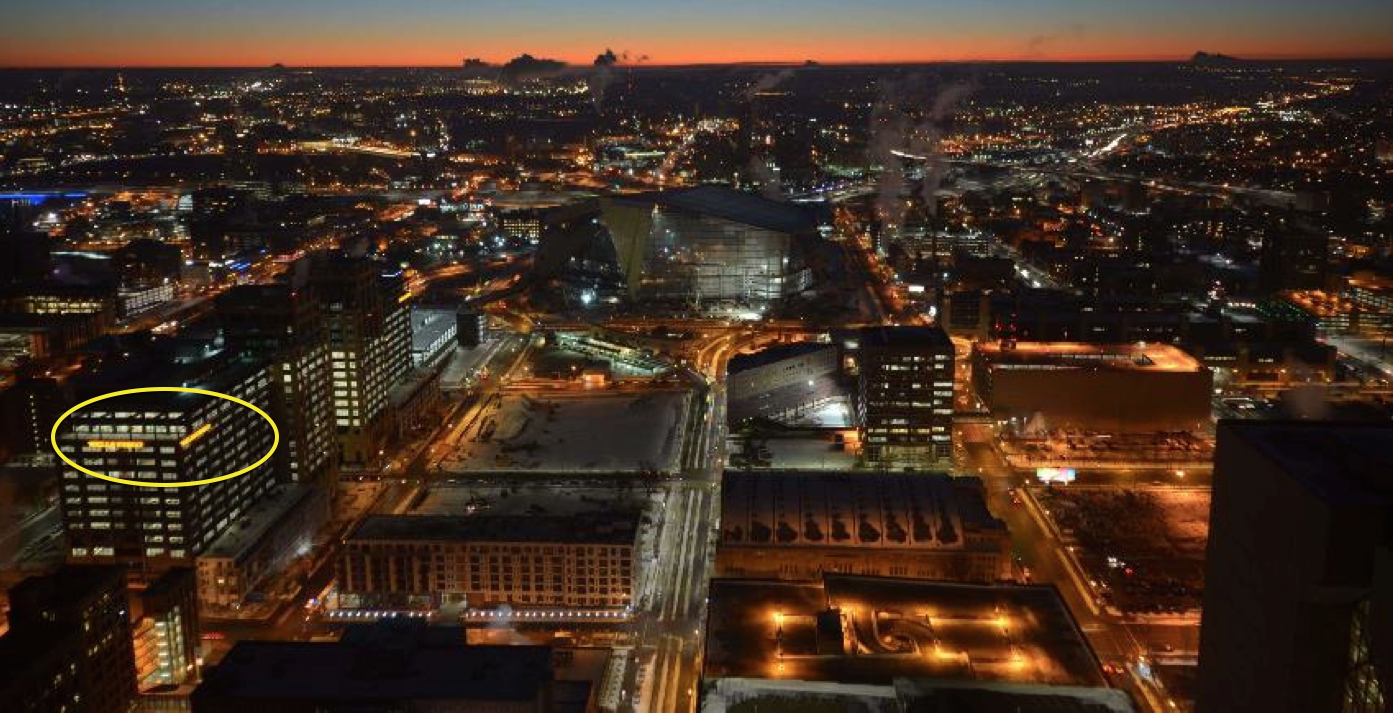

Wells Fargo Must Remove Signs Built To “Photo Bomb” New Minnesota Vikings Stadium

Our brief regional nightmare is over, after a federal court ordered Wells Fargo to take down two rooftop signs erected to cash in on the impending media coverage of the new Minnesota Vikings stadium in Minneapolis. [More]

Judge Tells Minnesota Vikings & Wells Fargo To Settle Stadium “Photo Bombing” Spat

It’s the first week of baseball season, and pro hockey and basketball teams are making their final pushes for the playoffs, so the last thing on many sports fans’ minds is football. Perhaps that’s why the judge in the “photo bombing” spat between the Minnesota Vikings and Wells Fargo is telling the two parties to stop wasting everyone’s time and just work something out. [More]

Wells Fargo Mocks Minnesota Vikings’ “Photo Bomb” Lawsuit

A few weeks back, the Minnesota Vikings sued Wells Fargo, accusing the bank of trying “photo bomb” the team’s new stadium. Wells has since fired back, calling the whole thing “far-fetched.” [More]

Banks Ditched Payday Lending-Like Programs, But What’s Next?

Bank may have exited the payday lending business this month, but that doesn’t mean their next foray into small dollar loans will be any less predatory. That’s why the National Consumer Law Center is urging banks to show leadership in developing affordable credit options for consumers. [More]

US Bank Keeps Pretending To Waive My Checking Account Maintenance Fees

To some people, $7 per month isn’t a lot of money, but it is to Timothy. He was relieved when he learned that US Bank would be waiving the newly-imposed monthly maintenance fee on his checking account. That’s why he was surprised when his local branch called him up to discuss ways to avoid maintenance fees. The letter that said, “you’re a valued customer and we’ll be waiving your fees” apparently said no such thing. [More]

US Bank Scores Twice In Roundup Of Worst Credit Cards

It’s probably not a banner day for some folks at US Bank, after two of the bank’s credit cards landed top (dis)honors in a roundup of worst credit cards of 2012. [More]

L.A. Sues U.S. Bank For Letting Foreclosures Fall Into Disrepair

When a lender forecloses on a home, it becomes responsible for keeping the property safe and reasonably kept-up. But officials in Los Angeles has accused U.S. Bank of ignoring hundreds of foreclosures as they fall into disrepair and/or become taken over by squatters and street gangs. [More]

Judge Rips Into U.S. Bank For Taking Bailout Money But Denying Mortgage Modifications

A judge in Georgia is quickly becoming an internet folk hero after he publicly slammed U.S. Bank for taking billions in government bailout money and all the while refusing mortgage modifications for homeowners in need of help. [More]

Video Of People Closing Down Their Accounts At Big Banks

Tomorrow is Bank Transfer Day. By this date, people all across America are shutting down their accounts at large, costly, name-brand banks and transferring their funds to new bank accounts at their local credit union or community bank. Here is an excellent video made in Portland that follows along with several different people as they close their bank accounts and give their reasons for doing so. One person wants to save money, another disagrees with the bank’s foreclosure practices, a third is mad about the bailouts, and the last is a union withdrawing its funds to show solidarity with holding Wall Street accountable. [More]

Chase Drops Plan For $3 Debit Card Fee

Chase joins U.S. Bancorp, Citigroup, PNC, KeyCorp and other large banks that have recently moved away from the plan to charge consumers a monthly fee when they use their debit cards to make purchases, reports the Wall Street Journal. The bank recently tested the fee in both Washington and Georgia. [More]

Banks Letting Foreclosed NYC Homes Fall Into Dangerous Disrepair

Though New York City real estate remains at a relative premium, a new report says that banks have ignored the upkeep of thousands of seized foreclosure properties, allowing them to fall into horrid levels of disrepair. [More]

US Bank Lets Minnesotans Affected By Govt. Shutdown Skip One Loan Payment

With the gears of state government ground to a halt in Minnesota, there are thousands of people left without income but who still have payments to make on their mortgages and car loans. But at least one bank has decided to give these folks the option of taking a small breather by allowing affected customers to skip one month’s payment without incurring any penalties, fees or dinging your credit score. However, interest will continue to accrue. [More]

US Bank Replaces "Free Checking" With "Easy" Checking (Hint: It's Not Free)

US Bank was one of the last large banks to keep offering free checking but that will be no more after May 15. All customers will migrated over from “Free Checking” to “Easy Checking.” While it’s not certain how it might be any easier, like a US Bank truck drives to your house and picks up your deposits and gives you a free lollipop, it is certain that the checking accounts will have monthly maintenance fees. But you can avoid those fees if you sign up for the right level package and abide by certain behaviors. [More]

My Bank Is Very Strongly Telling Me I Should Definitely Do This, Or Else

When you get a strongly-worded letter from your bank with big deadlines printed on it, and words like “THIS NOTICE IS REQUIRED BY LAW” and other “RECORDS REVIEW” and other ominous phrases, one might think, “Hey, this is something important I have to do.” Or maybe it’s actually just an offer for a free credit report that you can just toss. [More]

Amex Tops JD Power Credit Card 2008 Customer Satisfaction Survey

JD Power and Associates ranked American Express at the top of their 2008 Credit Card Satisfaction Study. Customers gave the company high marks in interaction, billing and payment processes, reward programs, fees and rates, and benefits and services, with the first three factors standing out in particular. Capital One and HSBC, which target revolvers with lower credit scores, received the worst marks. Oddly, Discover got second place. People must really like their two-cycle billing (see “Two-Cycle Billing And Why It’s Evil“). Full rankings inside…