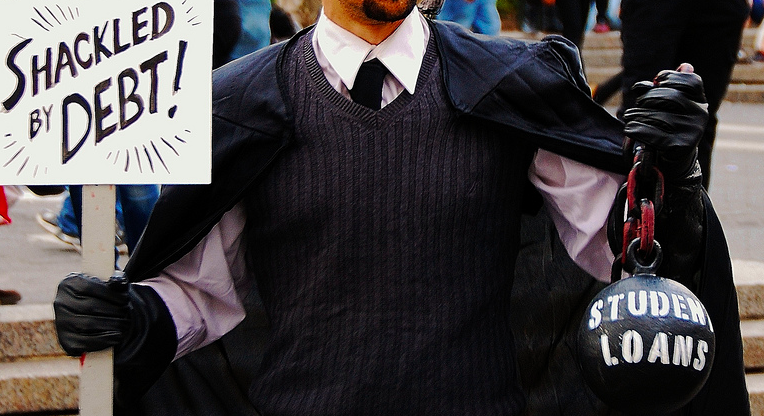

Federal regulations that aim to protect and refund student loan borrowers defrauded by their schools could end before they even go into place, thanks to a lawsuit filed by the for-profit college industry. [More]

the cost of an education

Students Claim For-Profit College Operator Deliberately Let Their School Fail

Former students at one for-profit college allege that the school’s parent company, Laureate Education, committed fraud by deliberately allowing their college to fail and close down. [More]

DeVry Will Pay $2.75M To Settle State’s Allegations Of Misleading Advertising

One month after DeVry Education Group agreed to pay $100 million to settle federal regulatory charges that it used deceptive ads to recruit students, the for-profit educator has come to a multimillion-dollar settlement that should close the book on one state-level investigation. [More]

Former ITT Tech Students Sue To Be Included In Bankruptcy Proceedings

When a retailer goes bankrupt, little thought is given to the store’s customers, but what happens when a for-profit educator goes bust? Do its customers — the former students — have any right to be involved in the bankruptcy proceedings? [More]

Student Loan Repayment Programs Will Eventually Forgive $108B In Debt

While several recent reports have suggested that many student loan borrowers face needless hurdles when trying to reduce their monthly payments through the Department of Education’s income-driven repayment plans, a new study has found the programs are working and will eventually forgive $108 billion in outstanding student debt. [More]

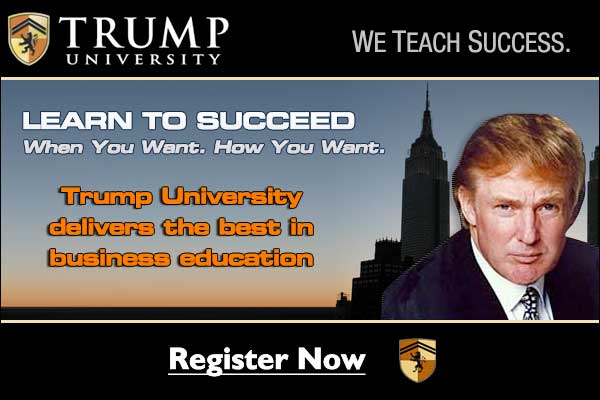

Trump University Fraud Lawsuits Settled For $25 Million

Ten days before President-elect Donald Trump was set to go to trial on one of three fraud lawsuits involving his defunct Trump University, the parties involved in all of these cases have reached a settlement worth $25 million. [More]

Another For-Profit College Chain Has Closed, Leaving Thousands Of Students Stranded

So far in 2016, a handful of for-profit college operators have announced plans to cease operations, closing hundreds of campuses across the country. Joining the likes of the ITT Technical Institute, Wright Career College, and Brown Mackie College brands, Heritage College and Heritage Institute closed its door abruptly this week. [More]

More Than A Year After Corinthian Collapse, Students Still Waiting For Financial Aid Help

Eighteen months after Corinthian Colleges Inc. completed its collapse – closing the remaining Heald College, Wyotech, and Everest University – tens of thousands of former students are still waiting to received some form of relief from the mountains of student loan debt they incurred to attend the defunct college. [More]

Legislation Would Hold For-Profit College Leaders Accountable For Misrepresentations

Lawmakers on Tuesday continued their mission to protect consumers from unscrupulous players in the for-profit college industry by introducing legislation that would impose stiffer penalties and restrictions on the leaders of such institutions. [More]

![Students are spending less on college course materials even though they are still buying the same amount of textbooks and other items. [Source: NACS]](../../consumermediallc.files.wordpress.com/2015/07/couresmaterials.png?w=300&h=225&crop=1)

Increased Competition, New Options Means College Students Are Paying Less For Course Materials

Once upon a time, most college students had very few choices when it came to the textbooks and other course materials they were required to buy each semester: Pricey new books or not-quite-as-pricey used copies, and most of these were gone quickly. But now there are multiple online competitors for buying, renting, and reselling these materials and a new survey shows that students are paying a lot less. [More]

![[Source: Sallie Mae]](../../consumermediallc.files.wordpress.com/2015/07/fig2.png?w=300&h=225&crop=1)

Families Going Deeper Into Their Own Pockets To Pay For College

College spending continues to rise, but not all American families are taking measures to bring down the amount of their own money they have to spend to educate their children. [More]

Attorneys General Coalition Urges Dept. Of Education To Clarify Corinthian Students’ Options

A week after nine senators urged the Department of Education to provide support to the thousands of students affected by the closure of now-bankrupt Corinthian Colleges schools — Everest University, Heald College, and WyoTech — the top prosecutors in 11 states are adding their voices to the chorus encouraging the Dept. to protect students and clarity their options following the company’s final downfall. [More]

Senators Urge Dept. Of Education To Provide Support To Students Affected By Corinthian Colleges Closure

Ever since now-bankrupt Corinthian Colleges Inc. began its downward spiral, consumer advocates, students and legislators have urged the powers that be to provide relief for students of Everest University, Heald College and WyoTech. Today, that plea continued as nine senators called on the Department of Education to provide support to the 16,000 students affected by the company’s final closure. [More]

Corinthian Colleges Inc. Files For Bankruptcy

A week after embattled for-profit college chain Corinthian Colleges Inc. closed its remaining Everest University, Heald College and WyoTech campuses, the company filed for bankruptcy, essentially closing the book on the company’s long downward spiral. [More]

PRO Students Act Aims To Protect Students From For-Profit Colleges’ Bad Behavior

It’s difficult to go a month or even just a few weeks without hearing of another for-profit college being under investigation for unscrupulous practices, such as inflated job placement rates and pushing students into costly student loans. New legislation announced today aims to curtail the number of investigations we hear about by protecting students from predatory, deceptive, and fraudulent practices in the for-profit college sector, before they even enroll. [More]