One of the many innovations that ride-hailing service Uber has given the world is that it popularized the phrase “surge pricing,” which means raising the price for something as demand for it goes up. Lots of industries do this, but filing taxes is something that everyone has to do. [More]

taxes

No, The IRS Will Not Call You To Verify Your Tax Return Information

Because trying to steal money from others will never get old for criminals, scammers are constantly changing tacks to come up with new ways to rake in their ill-gotten gains. This tax season, there’s a new trick bedeviling taxpayers over the phone. [More]

Lawsuit: New York Shouldn’t Charge Sales Tax On Tampons

Should tampon sales be taxed by the state? Five Manhattan women don’t think so, and have filed a lawsuit against New York’s Department of Taxation and Finance saying it should be tax-free. [More]

President Signs Bill Making Internet Service Tax Ban Permanent

While federal law has long blocked most states from collecting taxes on Internet service, that prohibition has to be renewed every few years. But today President Obama signed into law a new piece of legislation that makes existing bans permanent, and puts an end date on Internet taxes for the few states that still collect them. [More]

IRS: Email, Text Scams Targeting Taxpayers Up 400% This Year

It’s tax season, which means it’s the prime time for scammers to crawl out from underneath their scammy rocks and try to nab taxpayers’ personal info. So far, this year’s electronic tax scams are even more prevalent than before, the Internal Revenue Service says, surging 400%. [More]

Senate Passes Bill Making Internet Tax Ban Permanent

Nearly two decades ago, Congress passed the first Internet Tax Freedom Act, establishing that — with a handful of grandfathered exceptions — local, state, and federal governments couldn’t impose taxes on Internet access. Problem is, that law has had to be renewed over and over, each time with an expiration date. But today, the U.S. Senate finally passed a piece of legislation that would make the tax ban permanent. [More]

Papa John’s Accused Of Taxing Delivery Fees In Illinois

Sometimes it’s just easier to have a piping hot pie delivered to your door, even if it means you have to pay a small fee for the convenience. But an Illinois man claims in a recently filed class-action seeking lawsuit that Papa John’s added a little extra to his bill in the form of an illegal delivery tax. [More]

IRS: You’ll Have Until April 18 To File Your Taxes This Year

Already stressing over doing your income taxes? You’ll have a few more days of breathing room before they’re due this year: the Internal Revenue Service has set a filing deadline of April 18. [More]

Taxpayer Advocate Concerned About IRS Plans To Move More Support Online

It was just last week that we wrote about how this year will probably be better than last year for U.S. taxpayers with questions or problems. Yet looking forward to the next decade or so, changes in how the IRS provides support will mean leaving some Americans behind. [More]

Advocate: Additional IRS Funding Should Be “Extremely Helpful” In Actually Helping Taxpayers

As we approach 2016, taxpayers might be wary of dealing with the Internal Revenue Service after last year’s identity theft problems. But according to the IRS’ national taxpayer advocate, the agency is going to be much better at dealing with taxpayers than it was last year. [More]

Congress Pulls Together Proposal To Ban Internet Access Taxes Permanently, Likely To Become Law

There never has been a tax on email or bandwidth use, for most of us, because Congress made it illegal to charge one more than 15 years ago. That law, though, was temporary and for the better part of two decades, has constantly needed to be extended or renewed. This year, Congress appears finally to be sick of doing that and has real plans to make it permanent, once and for all. [More]

Wells Fargo Reportedly Under Federal Investigation Related To Student Loan Servicing

According to a new report, Wells Fargo is the latest big-name bank to be scrutinized as part of the Consumer Financial Protection Bureau’s ongoing investigation into student loan servicing practices.

[More]

Sorry, You Can’t Pay The IRS With A Check For $100 Million Anymore

You there! The one ready to write a big, fat check to the Internal Revenue Service — drop that pen. The agency has announced that it will no longer accept checks for $100 million, so you’ll just have to write more than one check. So yeah, you can go ahead and pick that pen up again now. [More]

Coloradoans Will Be Able To Buy Pot Tax-Free For One Day, And One Day Only

Colorado residents might have circled Sept. 16 with a bright green marker on their calendars: that’s the day the state has decided to drop the 10% marijuana tax in order to comply with a tax provision in its constitution. [More]

Citigroup Facing Federal Investigation Into Student Loan-Servicing Practices

Just last month federal regulators announced that an ongoing probe into potentially unscrupulous student loan-servicing practices resulted in nearly $18.5 million in refunds and fines from Discover Bank. Now, regulators appear to have Citigroup in their crosshairs, as the financial company announced it was party to an investigation. [More]

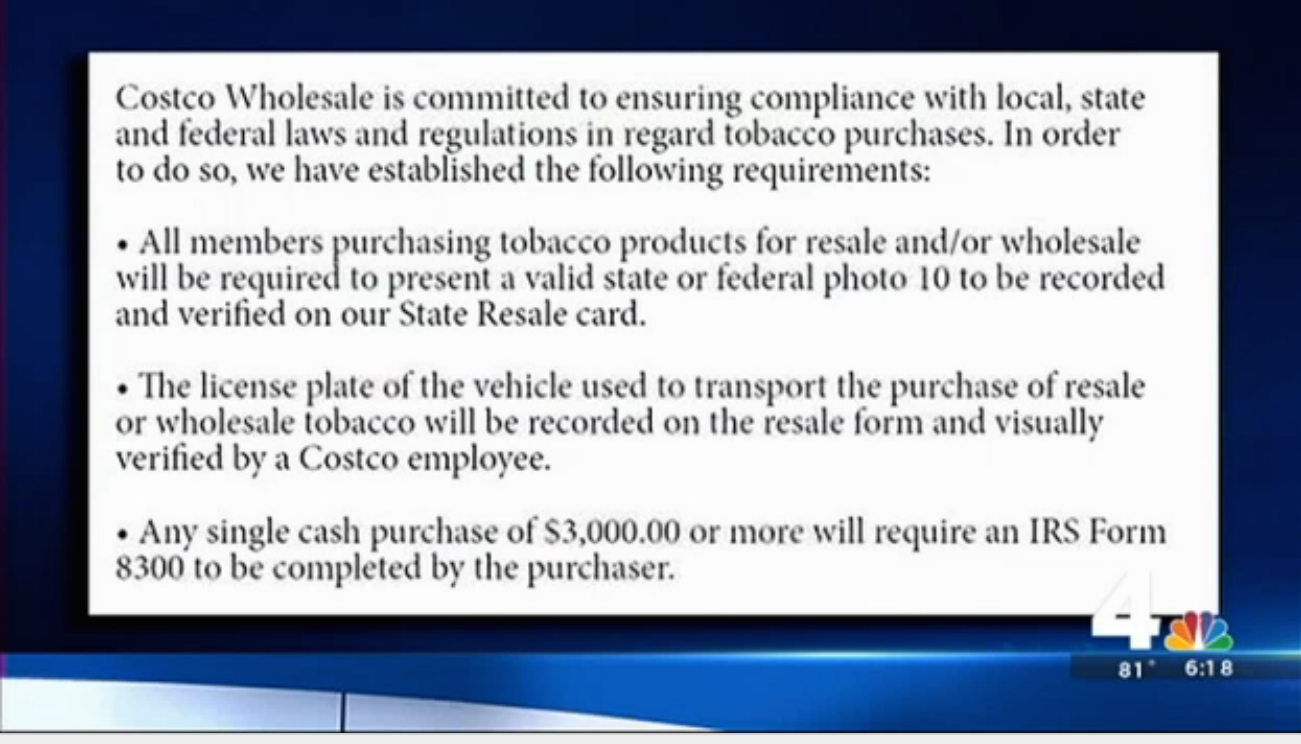

Costco Joins In Virginia Crackdown On Bulk Cigarette Buyers

Following reports of Costco shoppers loading up entire trucks full of large boxes of cigarettes, presumably with the purpose of reselling them on the black market in other states, the wholesale club is now posting signs indicating that these customers will face much more scrutiny going forward. [More]

Discover Bank Must Pay $18.5 Million Over Illegal Student Loan Servicing Practices

As federal regulators continue to probe potentially unscrupulous student loan servicing practices, the Consumer Financial Protection Bureau has ordered Discover Bank and its affiliates to pay nearly $18.5 million in refunds and fines for, among other things, overstating amounts due on student loans and failing to notify borrowers of their rights. [More]

House Passes Permanent Ban On Tax For Internet Service

In 1998, Congress passed a temporary moratorium on state taxes collected for Internet access (though a number of states were still allowed to collect them). The ban has been extended numerous times in the 17 years since, but is set to expire again this fall. Rather than merely kick the can down the road with another extension, the House of Representatives has voted (again) to make the moratorium permanent. [More]