The recently enacted sugary drink tax in Philadelphia has not been without controversy, including a soda industry lawsuit, unhappy consumers, and push back from lawmakers. The two biggest names in soda are now making drastic changes to the products they offer — and the people they employ — and blaming it on the tax. [More]

taxes

If You Use A Tax Preparer, Make Sure They Don’t Get Taken In By ‘Last-Minute Email’ Scam

Taxes can be complicated, and you may have last-minute tweaks to make as you pull together paperwork. Scammers are now taking advantage of this fact, posing as taxpayers to siphon away their annual refunds. [More]

Reminder: You Can Still Cut Your 2016 Taxes By Making IRA Contributions

Looking for a way to cut your tax bill or boost your refund before you file? Don’t forget that contributions that you make to your retirement accounts between Jan. 1 and April 16 of this year can count toward either your 2016 or 2017 tax return. [More]

Highlights From The House Debate On Tanning Tax That Turned Into A Sideshow

Among the lesser-discussed points of the Affordable Care Act repeal and replace legislation is a move to get rid of a 10% tax on the use of tanning salons. Why is this suddenly an issue, and how did it cause the House Ways and Means Committee’s discussion of the bill to devolve into a sideshow, complete with debates on the merits of ice cream and Spain’s tax on the sun? [More]

Big Retail Chains Keep Playing Chicken With Their Tax Bills

If a strategy used by a national chain retailer works in one city or state, they’re certain to try it on others. The dark store strategy that has helped retailers in some areas slash their property tax bills by sort-of-but-not-really threatening to close is spreading, and has now reached Wisconsin. [More]

Taxpayers Have A Bill Of Rights Too

It’s tax season, which means you should be preparing your return or getting ready to do so, if only so an identity thief doesn’t get there first and file a fake return to swipe your refund. What you should remember as you file and if you encounter any problems with the IRS is that taxpayers have specific rights that apply to everyone. [More]

Late Tax Refunds Could Mean Fewer People Watching Super Bowl On New TVs

The Internal Revenue Service recently announced that millions of tax refunds may be delayed this year as the agency tries to combat fraud. Some experts say this delay could have an unintended consequence: fewer new TVs tuned in to this Sunday’s Super Bowl. [More]

Auto Industry: Possible Border Tax Would Raise Prices, Even On American-Made Cars

Facing a possible new tax on imported goods, some of the biggest names in auto manufacturing and retail are calling on lawmakers to rethink the tax, claiming it will hurt their businesses and lead to higher prices. [More]

Tax Season Is Now Open: Here’s Why You Should File ASAP

As of today, tax season is officially open! While you might want to file as early as you can if you’re expecting a refund, there’s also a very good reason why you should file as soon as you have your documents in order: to block overseas identity thieves from doing it first. [More]

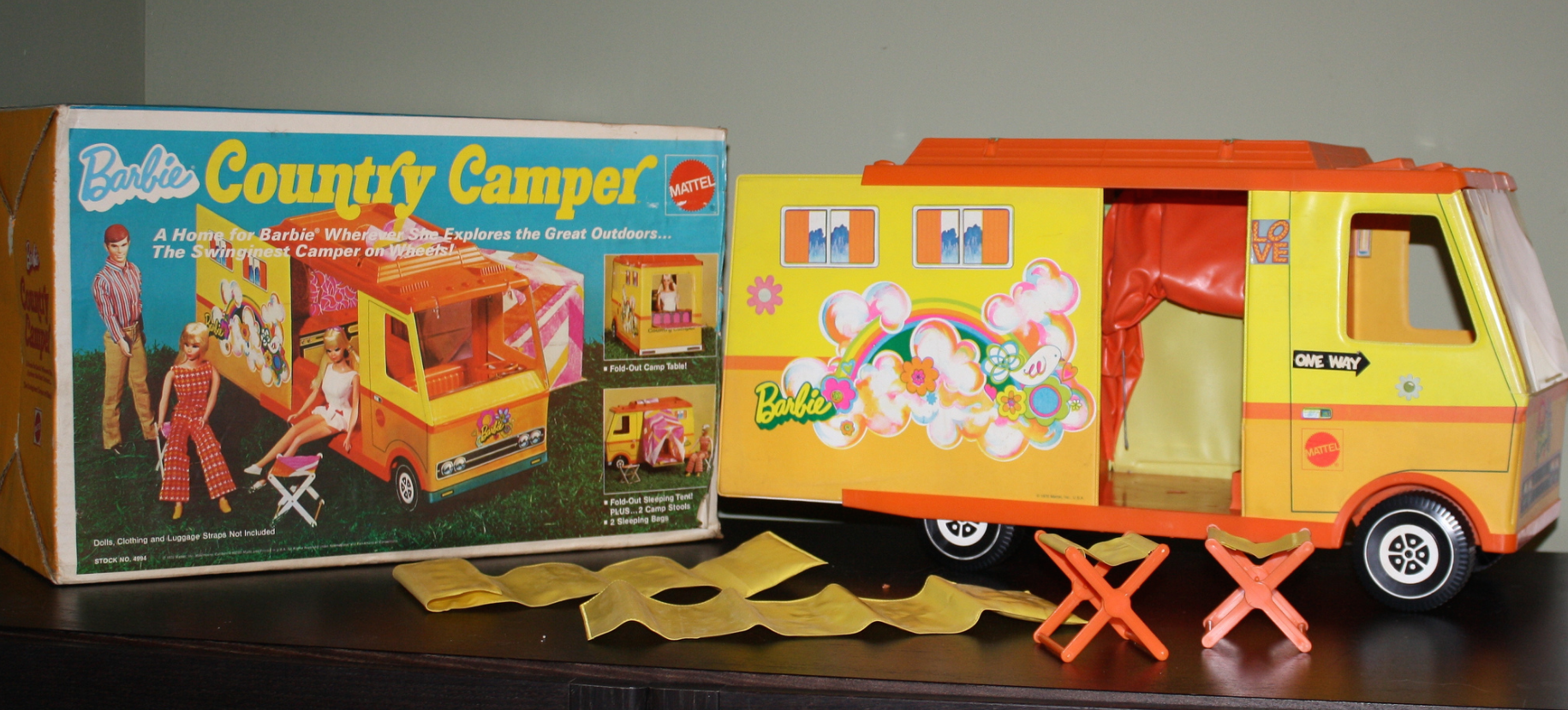

Tax Proposal Could Result In Higher Prices On Toys

Lawmakers are currently mulling over a proposed tax code overhaul intended to reduce the tax burden on U.S. companies that could also have the net result of raising prices on the products those companies manufacture overseas, a change that could hit toy companies particularly hard. [More]

Gas Prices Will Go Up In 7 States Starting Jan. 1

As if waking up on Jan. 1 after a few too many glasses of bubbly the night before isn’t painful enough, drivers in seven states will be starting off the new year with higher gas prices, thanks to new taxes. [More]

Apple Officially Appeals EU’s Decision On Back Taxes

Three months after Apple CEO Tim Cook called the European Union’s ruling that the company owes Ireland about €13 billion in back taxes “political crap,” the tech giant officially filed an appeal against the decision, adding to the already years-long battle between the Commission, Apple, and Ireland. [More]

Controversial Soda Tax Coming To Chicago After County Board Vote

Two days after voters in four different cities approved local taxes on sugary beverages, the county board for Cook County, IL – home to Chicago — has narrowly okayed a $.01/ounce tax, making this the largest single market to try to curb obesity while fattening the municipal coffers. [More]

Chicago Might Be Next To Try Tax On Sodas & Sugary Drinks

Days after the Whole Health Organization announced it supported taxes on sugary drinks in order to curb obesity, the largest county in Illinois is weighing that option — following in the footsteps of Berkeley, CA, and Philadelphia, where a similar tax is now subject to a beverage industry legal battle. [More]

World Health Organization Supports Taxes On Sugar Drinks To Curb Obesity

Berkeley, CA, is currently the only major U.S. city charging a tax on sugary drinks. The Philadelphia tax is coming soon — if it survives a beverage industry legal challenge. In spite of the slow adoption of, and opposition to, these so-called “soda taxes,” the World Health Organization is recommending that more places could fight obesity and other ailments by making sugary drinks more expensive. [More]

NYC Pharmacy Instituting 7% “Man Tax” To Highlight Gender Pricing Discrimination

In an effort to bring awareness to discrimination in gender pricing — for example, charging a so-called “pink tax” on feminine hygiene products — one New York pharmacy has a new rule: male customers have to pay a 7% tax on items for men. [More]

Some Big Chains Like To Pretend Their Stores Are Closed When It Comes To Paying Tax

A big-box store is, by definition, well, big. All that retail, storage, and parking space takes up a fair amount of land. So you’d think that in any state with a property tax, stores would, well, be taxed on their property. And they are… until they’re not. [More]