Hey, remember the TARP program? If banks are now paying back TARP funds, then what happened to those toxic assets? Are they sitting in a canyon in Wyoming for the next 10,000 years? Not exactly.

tarp

Here's Where Your Overdraft Fees Are Going: Banks Are Paying Government Back For Bailouts

Several banks are doing just what they’re always bugging customers to do — paying back money that was lent to them.

Banks Want Taxpayer Aid To Buy Toxic Assets From Themselves

…The Public-Private Investment Program provides subsidies to private investors to encourage them to buy legacy loans from banks. The goal is to encourage buyers to bid more than they are currently willing to pay, and hopefully close the gap with the prices at which the banks are willing to sell.

In Which NPR And Congressional Oversight Panel Chair Elizabeth Warren Hate Each Other

While we were concentrating on other things (Snuggie testing, for example), there has apparently been something of a backlash going on against NPR’s Planet Money podcast for its rude treatment of Congressional Oversight Panel Chair Elizabeth Warren. NPR’s Adam Davidson has since expressed regret that he talked over Ms. Warren in a rude way — but despite the mea culpa, a series of links about the issue has popped up in our inbox more than a week later.

JPMorgan Chase Wants To Repay Bailout Money

JPMorgan Chase, Morgan Stanley and Goldman Sachs are seeking permission to repay government bailout funds, says Reuters.

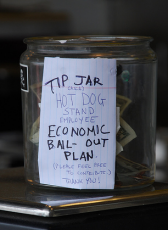

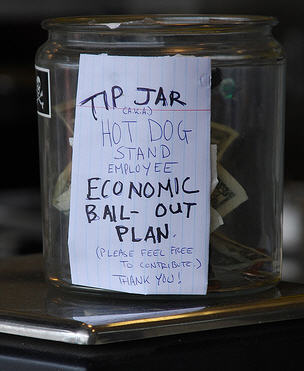

Does Anyone Have $34 Billion For Bank Of America?

Kenneth Lewis is probably having a pretty crappy day. The government just told him that he needs to find $33.9 billion in order to “withstand any worsening of the economic downturn.” Anybody got any spare change?

Bank Of America CEO: The Bush Administration Made Me Do It!

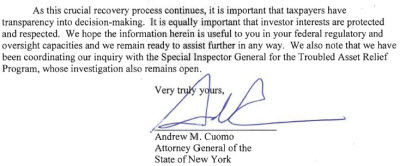

New York Attorney General Andrew Cuomo’s office is at it again. They’ve been investigating the circumstances that led to the merger of Bank of America and Merrill Lynch and the subsequent bonus payments to executives. In a letter to Senator Chris Dodd (D-CT), chairman of the Senate Banking Committee, Cuomo quotes Bank of America CEO Ken Lewis as saying that former Treasury Secretary Hank Paulson threatened him with removal from his position and mass firing of the board and senior management if he didn’t allow the merger to go through.

US Bancorp Blasts TARP As Giant Bait And Switch On America

U.S. Bancorp CEO Richard Davis took shotgun blasts to the TARP program for being a fat big lie. “We were told to take it so that we could help Darwin synthesize the weaker banks and acquire those and put them under different leadership,” Davis said. OMG – truth alert!

What's In This New Obama Foreclosure Plan?

With the economic stimulus (or “e-stim,” as we’ve been calling it) signed into law, President Obama turns his attention to the foreclosure crisis. At an event in Arizona today, he announced the following proposals to help homeowners.

../../../..//2009/02/05/according-to-friend-of-the-blog-and-now/

According to Friend-of-the-Blog and now chairwoman of the Congressional Oversight Panel examining the Troubled Asset Relief Program, Elizabeth Warren, our Treasury Department overpaid banks by as much as 30% for their assets.

Citibank Will Split Into Two Companies, Promises To Lend To Consumers

Vikram Pandit, CEO of Citigroup, announced today that the company would be split after reporting a net loss for 2008 of $18.72 billion. He also promised to put the money from the $700 bailout to work by extending credit to consumers and businesses… responsibly.

Stock Market Pleased By New Phase Of Bailout

Today the Federal Reserve announced the creation of a new special purpose entity that will buy consumer and business debt. Under the new plan, the Treasury will provide $20 billion dollars in of credit protection (from the Troubled Asset Relief Program) — and will absorb most of the losses, should they occur.

American Express Becomes A Bank… And Wants Bailout Money

American Express won U.S. Federal Reserve approval to become a bank holding company — giving it access to the bailout party as credit card defaults climb. Bloomberg News says that the Fed waived the usual 30 day waiting period because (in the words of Fed Chairman Ben Bernanke) we’re experiencing “unusual and exigent circumstances affecting the financial markets.” Today, American Express has requested $3.5 billion in taxpayer-funded capital from the federal government, says the WSJ.