NetSpend, one of the nation’s largest providers of prepaid debit cards, has been accused of violating federal law for allegedly misleading users into believing that funds loaded onto these cards will be available immediately, while some users say they had to wait weeks or were never able to access their funds. [More]

swipe out

Cybercriminals Breach Computers For Massive Point-Of-Sale Payment System

The folks at computing giant Oracle have alerted users of its hugely popular point-of-sale payment system that cybercriminals managed to breach the company’s customer support computers and insert malicious code, potentially affecting hundreds of thousands of retail locations around the world. [More]

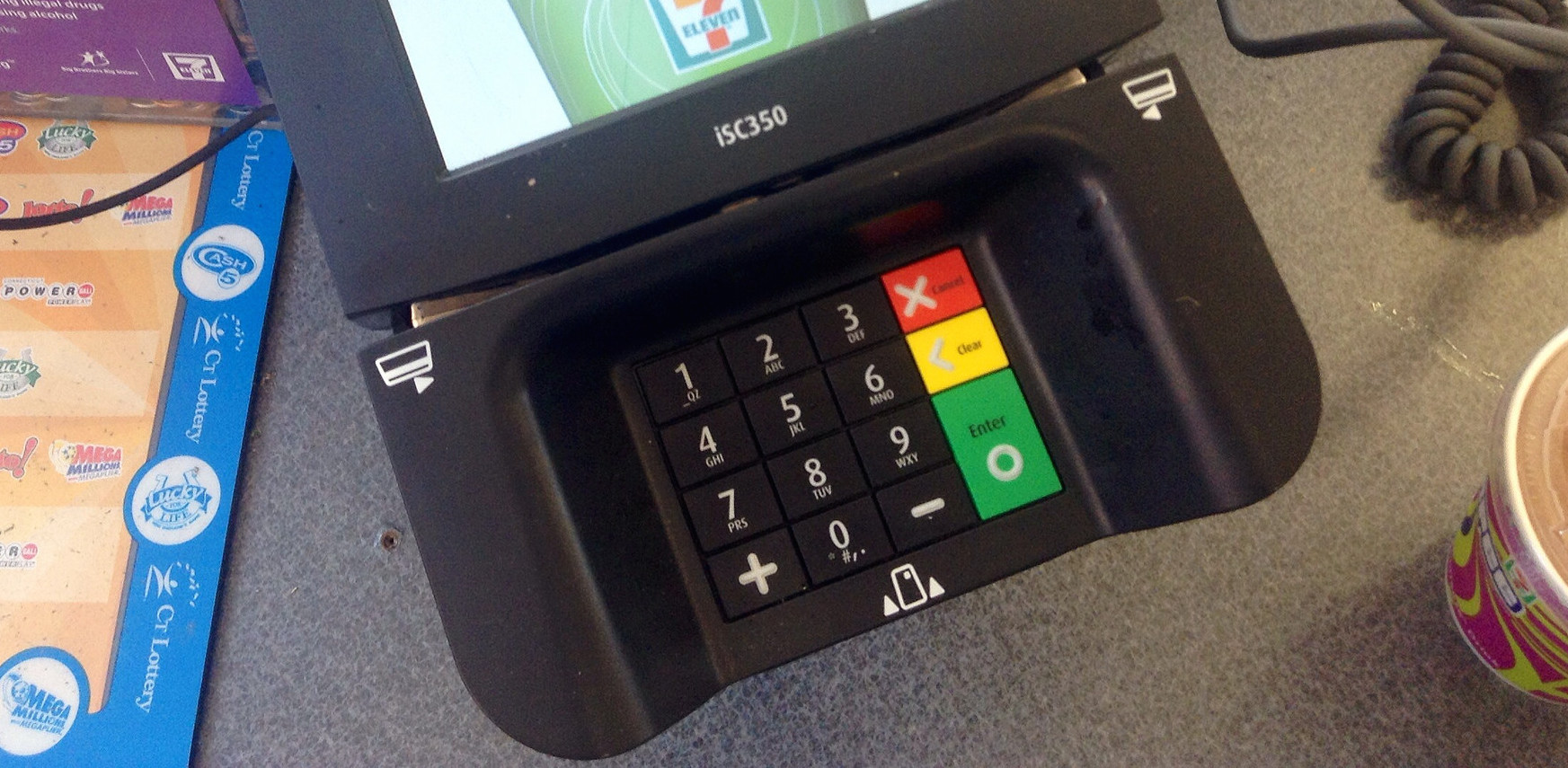

Card Skimmers Found On Walmart Self-Checkout Terminals In Two States

In just the last few weeks, card skimmers — devices that illegally scan customers’ credit cards –have been found at two different Walmart stores. The skimmers in these cases were so convincing that they may have been in place for weeks for being discovered. [More]

Retailers Tell Fed: Debit Card Swipe Fees Are Still Too Dang High

Even though the Dodd-Frank financial reforms effectively halved the fees that retailers must pay to banks for each debit card transaction, the stores say that amount is still too much. And with all of their legal options exhausted, the retail industry is calling on the Federal Reserve to re-think the cap it put in place nearly five years ago. [More]

San Francisco Sues American Express, Alleging Illegal Restraints On Merchants

Earlier this year, a federal court ruled that American Express violated antitrust laws — resulting in higher costs for consumers — by forbidding retailers that accept AmEx from encouraging customers to use competing cards like those from Visa, MasterCard, and Discover. Now, the city of San Francisco is suing the credit card company to get back billions of dollars for merchants in California. [More]

American Express Loses Antitrust Lawsuit Over Merchant Rules

After nearly five years of legal battles, a federal court has ruled that American Express’s merchant agreements violate antitrust laws and has resulted in higher costs for consumers. [More]

Supreme Court Refuses To Hear Retailers’ Complaints About Debit Card Swipe Fees

More than four years after the Dodd-Frank banking reforms directed the Federal Reserve to set a standard for swipe fees — the money charged to retailers by banks for each debit card transaction — the hotly debated issue appears to have hit a dead-end with the U.S. Supreme Court deciding this morning to not hear an appeal from retailers who contend the Fed set the fees too high. [More]

Appeals Court Resurrects Fed’s Debit Card Swipe Fee Limits

In a move that will please banks and annoy retailers, a federal appeals court has overruled a lower court decision on swipe fees — the amount banks charge retailers for each debit card transaction — and revived the previous controversial standards put in place by the Federal Reserve in 2011. [More]

Visa, MasterCard Agree To Let Merchants Add Surcharges To Credit Card Purchases

Earlier this week, we told you that a settlement in a huge lawsuit between merchants and Visa and MasterCard was in the offing and that it could open the door to retailers tacking on surcharges to credit card customers. Well, that proposed settlement has come to pass, meaning you may soon be paying more for the privilege of using your credit card. [More]

Get Ready To Pay Surcharge Every Time You Pay With Credit Card

Visa and MasterCard know there is nothing that American consumers love more than fees and surcharges. That’s why the credit card companies are reportedly looking to do away with longstanding rules that prohibit merchants from adding on extra costs to customers who pay with credit. [More]

Intel Wants To Make It Easy (And Safe) To Pay For Purchases By Swiping Your Card Against Your Ultrabook

The big story, in terms of a technology that is here and that consumers seem to actually want, is super-thin Ultrabook laptops that contain Intel-produced processors. And the folks at Intel tell me they don’t just want to provide users with a faster, lighter-weight computing experience; they also want to make it safer and easier to shop online. [More]

McDonald's Exec: Swipe Fee Reform May End Up Hurting Our Bottom Line

A number of the new or increased banking fees, including Bank of America’s scrapped attempt to charge debit card users $5/month, that have popped up recently have been financial institutions’ reactions to recently enacted regulations that cap swipe fees — the amount banks charge retailers each time a debit card is used to make a purchase. While the goal is to put billions back into retailers’ coffers, some of the nation’s biggest chains say it may end up hurting them. [More]