Earlier this week, the news broke that Americans are, as a whole spending more on dining out than on groceries. In a related piece of news, a study from bank SunTrust says that a surprisingly large portion of American households that earn $75,000 per year live paycheck to paycheck because they’re spending too much money on “lifestyle expenses” to put any money away. [More]

suntrust

Woman Finds $1,000 At Bank Drive-Thru, Doesn’t Give Into Temptation

You pull up to the bank drive-thru to make a deposit, only to find a stack of cash sitting on the ground next to the drop slot. Some may be tempted to blow that money on… well, honestly $1,000 doesn’t go very far, but it’s still free cash, right? Not so, says one good samaritan from Georgia. [More]

SunTrust Denies Taking Automatic HELOC Payments, Then Stops Taking Them

Steven opened a free checking account with SunTrust, the bank that holds his mortgage, because it was free and convenient. But something strange started to happen: payments to his home equity line of credit began to magically disappear. His local bank staff denied that this was happening or that it was even possible, but it kept happening. It was convenient, so he didn’t look too far into it. Until the auto-payments that never existed stopped. [More]

Suntrust Checking Account Wasn’t Really Closed, Goes Zombie

Stephen had an account at Suntrust, and decided to leave that bank behind and start a shiny new credit union account with his wife. He left the Suntrust account open instead of withdrawing all of his money and transferring it to the new account, spending it until it was empty, then going in to close it. This plan would have worked beautifully if Suntrust had actually closed the account when he asked them to. [More]

Banks To Offer Foreclosure Reviews To More Than 4 Million People

Millions of Americans have lost their homes in the last few years and — as any reader of Consumerist knows — the banks who foreclosed on those properties have also made more than their fair share of errors. Thus, starting today, 14 of the country’s largest mortgage servicers are contacting millions of foreclosed-upon former homeowners to offer them the opportunity to have their cases independently reviewed. [More]

SunTrust Drops Monthly Debit Card Fee

With banks taking more and more heat from the banking public — and oodles of people reportedly switching accounts to more consumer-friendly credit unions — SunTrust announced today that it is eliminating the monthly debit card fee for Everyday Checking and will be refunding that fee to customers who have already paid. [More]

Survey: 30% Of Consumers Would Leave Bank Over Debit Card Fees

With financial institutions like SunTrust and Bank of America implementing fees for using debit cards to make purchases — and a number of other banks doing regional tests on similar fees — a new survey says that nearly one out of three American consumers would leave their bank if it introduced such a fee. [More]

Consumers Union Urges Bank Of America CEO To Drop Debit Card Fee

Two weeks after asking regulators to investigate Bank of America’s plan to charge some customers a $5 fee to make purchases with their debit cards, our cousins at Consumers Union have taken their case directly to the bank’s CEO. [More]

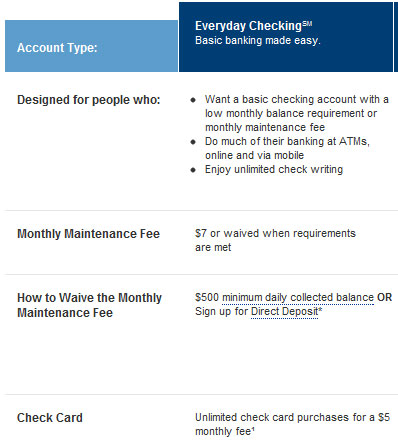

SunTrust Sunsets Free Checking

The next bank to do away with free checking is SunTrust, and they’ve got their own unique twist on it. [More]

Wells Fargo & SunTrust Cancel Debit Rewards Programs

Last week, we wrote about JPMorgan Chase’s decision to get rid of rewards programs for debit card users in response to a new law that will slash the amount of money banks receive per debit card transaction. Now comes news that at least two other banks — Wells Fargo and SunTrust — have followed suit. [More]

Scrounged Up Bank's Fee Schedules

After more digging, we ferreted out some of those notoriously hard to find bank’s fee schedules. These list all the fees a bank can levy against a consumer’s personal checking or savings account. Most are buried to some extent, limiting consumer’s abilities to shop around.

Top 5 Online Banks For Customer Satisfaction

You can’t please all of the people all of the time, but you can try. Here’s a list of the online banks that are trying the hardest.

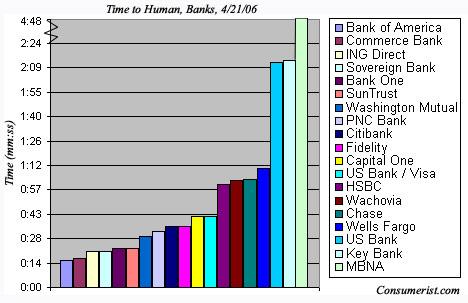

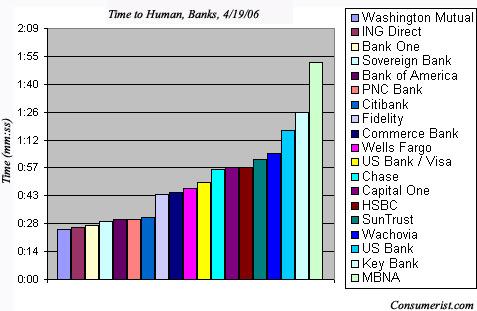

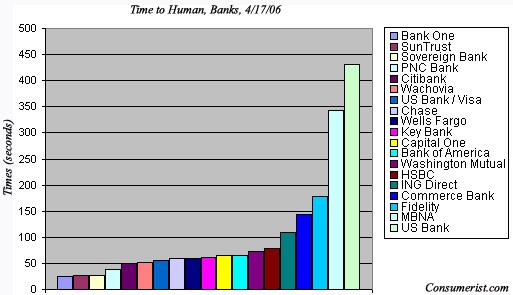

Time to Human, Banks, Day 5

Ring ring, Mr. Banker, pick up the phone, we hit the stopwatch and hang up. Here are the results.

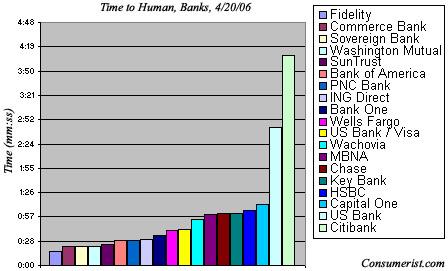

Time to Human, Banks, Day 4

Today’s results in our week-long test of how long it takes banks humanoids to pick up the ring ring ring.

Time to Human, Banks, Day 3

The results of today’s benchmark test to see how long it takes banks’ live humans to pick up the phone.

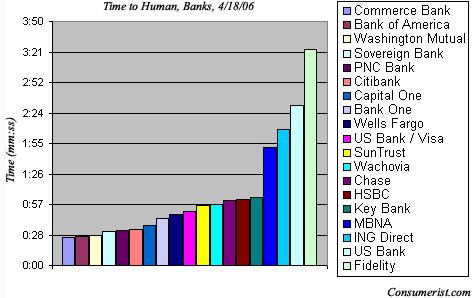

Time to Human, Banks, Day 1

We’ll be calling up the banks this week to see who’s the quickest at having a human pick up the phone.