You’ve heard of “flipping” houses, well now there’s “flopping.” While the first was speculative, this one is outright fraud. [More]

subprime meltdown

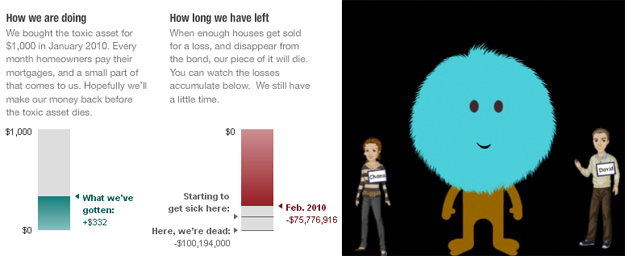

Reporters Buy Up Toxic Assets

To dig right into the meat of the story they’ve been tracking for over a year, NPR Planet Money reporters David Kestenbaum, Chana Joffe-Walt plunked $1000 down and bought up a securitized pack of Countrywide mortgages. At one point it was worth $75,000. Will the homeowners pay their mortgages and the reporters make their money back or will too many houses get sold at a loss and the asset implode? Follow along and find out. [More]

80% Of Today's Delinquent Homeowners Will Lose Their Homes

If you know 5 people behind on their mortgage payments, 4 of them are going to end up losing their homes, according to a new study released by John Burns Real Estate Consulting. [More]

Get $1000 In Ameriquest Mortgage Settlement

If your home mortgage was serviced by the defunct Ameriquest or its affiliates, you could stand to receive payouts starting at $1,000. Just enter your loan number on the settlement website and it will tell you if you’re eligible. The $325 million settlement came after a multi-state investigation which found shady lending practices that failing to disclose that loans had adjustable rates, failing to disclose the terms of the loan, refinancing homeowners into inappropriate loans, inflating home appraisals, and charging excessive fees. [ameriquestmdlsettlement.com] [More]

Bernanke Says The Recession Is "Likely Over"

Good news? Federal Reserve Chairman Ben Bernanke says that the recession is over, but that it won’t really stop the rise of unemployment — currently at a 26-year high of 9.7%.

Affidavits On How Wells Fargo Gave "Ghetto Loans" To "Mud People"

Here’s the official court filing (PDF) so you can get the full details on how Wells Fargo pushed or even fraudulently placed black borrowers into sub-prime loans, even when those borrowers could afford prime loans, along with an office environment where employees threw around racist slurs, calling black borrowers “mud people” and their mortgages “ghetto loans.” The official statements referenced in the NYT article are in this document in full. The affidavits begin on page 48. Two screenshots inside…

Loan Officers Detail Wells Fargo's Blatantly Racist Subprime Loans

UPDATE: Read the affidavits here.

1 In 8 US Households Either Late Or In Foreclosure

Here’s your daily depressing mortgage news — as employers shed jobs mortgage delinquencies are rising — intensifying and spreading the mortgage crisis.

Make The Bank Prove It Really Owns Your Mortgage Before You Let Them Toss You Out

We’ve written about this before, but as more and more people face foreclosure (last year’s foreclosures totaled 2.3 million, according to the AP) its a good time to remind people of this strategy.

Bank Of American Puts Congresswoman On Hold For Two Hours

Don’t take it personally if you can’t reach Bank of America to renegotiate your mortgage payments. Congresswoman Maxine Waters (D-CA) tried calling the bank on behalf of two constituents, only to be “repeatedly put on hold for long stretches, disconnected, transferred to extensions that did not work, and ultimately switched to a recording which directed her to the bank’s website.”

Bank Of America Fires Former Merrill Lynch CEO

It seems that Bank of America didn’t really appreciate that unexpected $15.4 billion dollar 4th quarter loss by Merrill Lynch — because its former CEO, John Thain has been shown the door.

Was George Bailey Just A Subprime Lender?

It’s A Wonderful Life is a heartwarming classic film — but it now seems to have wrecked our economy. Whoops!

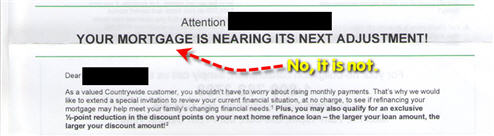

Countrywide To Fixed Rate Customer: Your Mortgage Is About To Adjust!

Countrywide either doesn’t know, or doesn’t care that reader Graham has a fixed rate mortgage, because they keep sending him “notices” that his mortgage is about to “adjust.”

Understand The Financial Crisis In 3 Minutes

If you or someone you know still scratches their head when trying to understand how the financial crisis began and played out, the Washington Post has a 3-minute slideshow with voiceover by business reporter Frank Ahrens that clearly and succinctly explains how it all happened. The pictures are pretty, too.

Greenspan Says That His Free-Market Ideology Was Flawed

Here’s something that probably doesn’t happen too often. Former Federal Reserve chairman Alan Greenspan had a crappier day than you did. He had to admit before our federal government that his free-market, anti-regulation ideology was “flawed.” Ouch.

Consumer Spending Will Shrink For The First Time In Nearly Twenty Years

Consumer spending, the engine that powers our economy, is probably going to shrink for the first time in nearly two decades, says the NYT — a move that will “all but guarantee” that the current economic crisis will deepen.

Citibank, Wells Fargo May Carve Up Wachovia, Feast On Its Bones

Bloomberg is reporting that Wells Fargo and Citibank may split Wachovia. Neither bank would get assistance from the government and taxpayers under the deal being discussed now.