KidsSave is a kid-centric application (Windows XP only, with an OS X version coming out next year) that lets your child track allowances and other types of “income” and teaches the benefits of saving.

saving

Top 9 Good Habits For A Deep Recession

For many of us, this is the first recession where we are responsible for our own financial well-being. How should we react? What habits are important during a long, deep recession?

America's "Cheapest Family" Wants To Teach You To Live "Debt-Free"

Meet Steve and Annette Economides. They are raising a family of 7 in Arizona on an annual income of about $44,000.

I Lowered My Time Warner Bill In 4 Minutes, Just By Asking

Yet another success story for our “Just Ask To Pay Less Money” technique. Commenter tinyrobot was paying too much for Time Warner Cable, so he called them up and told them so. Now he pays less. It’s not a Thanksgiving miracle, you can do it, too.

Economy: "Consumers Have Thrown In The Towel"

Consumer spending is down and credit card defaults are up!

../../../..//2008/10/15/wired-offers-money-saving-tips/

Wired offers money saving tips for “geeks.” Most of them involve buying and renting fewer dvds and/or canceling cable. [Wired]

6 Ways Not To F— Up Your Finances Before You're 30

1. Stop with the credit cards already! MSNMoney says that the average credit card debt among 25- to 34-year-olds was $5,200 in 2004. You should be saving in your 20s, not spending.

Reader Saves $425 By Saving Save Every $5 Bill

Brandon Savage writes that he’s having success with saving by taking the advice in our “Get Rich By Saving Every $5 Bill” post. Since starting in August, he’s got $425 in additional savings this way. Here’s how he does it:

Give The Gift Of College For Your Next Birthday Party

Thanks to state-sponsored 529 plans, friends and family can finally contribute to college savings funds without drowning under long forms and boring paperwork.

Whiney Pilots Complain That Stingy Airlines Are Forcing Them To Fly "Uncomfortably Low On Fuel"

Ugh, those selfish pilots can’t be bothered to help their airlines return to profitability. No, instead they’re whining to NASA that they’re being forced to fly “uncomfortably low on fuel” and that “safety for passengers and crews could be compromised.”

Get Rich By Saving Every $5 Bill

There’s a woman who saves every $5 bill she gets, blogs Get Rich Slowly. She’s been doing so for three years and has saved $12,000.

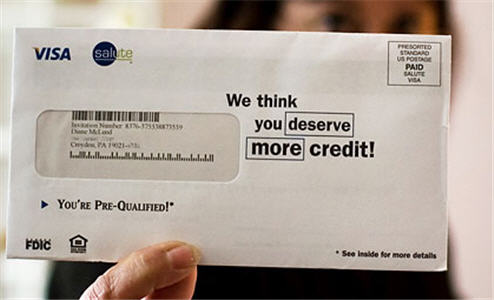

Debt Slavery: Why Are Americans So Willing To Dig Themselves Deep Into Debt?

The New York Times has an article that tells the unfortunate tale of Diane McLeod and her love affair with debt. She started out “debt free” when she got married, but after a divorce she’d managed to accrue $25,000 in credit card debt. Despite not having a down payment or any assets, Diane was given a $135,000 mortgage. Over the next few years, illness, underemployment, and shockingly irresponsible spending combined disastrously with the bank’s willingness to refinance her loan as her home appreciated (for a fee, of course). 5 years later, Diane owes $237,000 on her mortgage. She’s in foreclosure now, and a recent sheriff’s auction of the home did not draw a single bidder. A similar house down the street recently sold for $84,000 less than she owes on her home.

Why You're Going To Need A Million Bucks To Retire

Over at ABC News columnist David McPherson is responding to some reader backlash stemming from an article in which he used an example of somebody retiring with $500,000 in an IRA. The readers accused him of being out of touch with reality. Well, rather than apologize, he’s upped the ante. Now he says you’ll need $1 million to retire.

7 Ways Your Public Library Can Help You During A Bad Economy

Reader MG is a fan of the site and a public librarian and has written a list of 7 ways that your library can help you during a bad economy. Libraries are an excellent resource and they’re pretty easy to use. Don’t worry if you’re not a big reader, there’s lots more stuff to do at the library besides just checking out books.

AOL Repackages Personal Finance Content, Names It WalletPop

Apart from the quite adequate assortment of calculators, it’s all a big heap of plain-Jane articles slotted into categories by simple tags.

Shame Yourself Into Spending Less With A Hello Kitty Debit Card

Reader MervinGleasner has Hello Kitty to thank for his unique method of curbing personal spending. In a comment on our “Succeed Through Self-Undermining!” post, he writes: