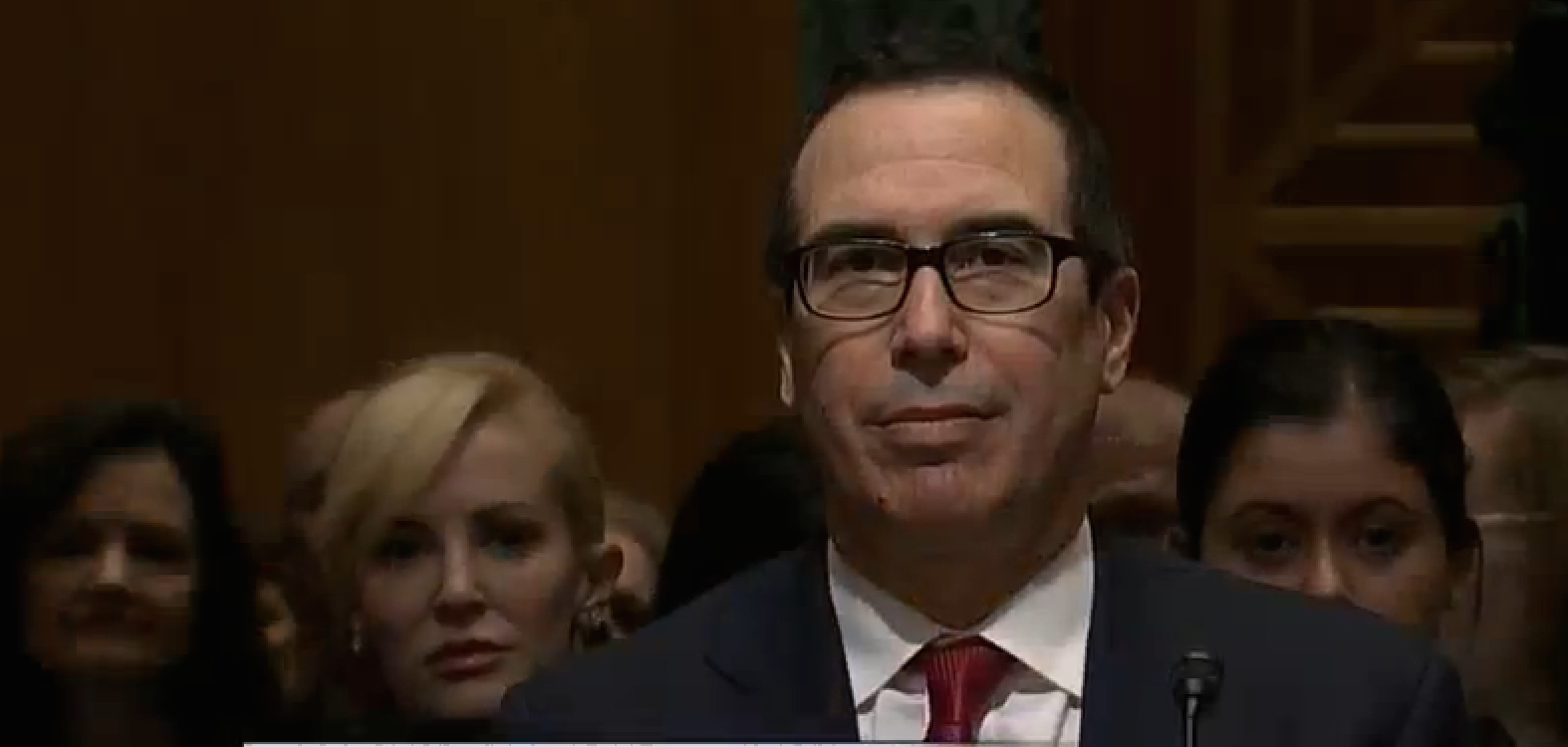

Steve Mnuchin, President Trump’s nominee for Treasury Secretary, recently told members of the Senate Finance Committee that his former bank OneWest did not use the illegal practice of “robo-signing” when foreclosing on homeowners after the collapse of the housing bubble. However, a new report claims that OneWest repeatedly used robo-signed documents on foreclosures. [More]

robosigning

Student Loans Are The New Robo-Signing Crisis

You may remember the term “robo-signing” from the recent financial crisis, where lenders would put homeowners in foreclosure without an actual person reviewing the documents, which is required in many states. The same thing is reportedly happening again with s different debt crisis: student loan lenders are robo-signing those, too. [More]

Chase Hit With $50 Million Settlement Over Robosigned Mortgage Documents

The nation’s biggest banks have already been hit with billions of dollars in settlements over robosigning — the illegal process of signing and filing important mortgage documents without reviewing them for accuracy — so what’s a few million more? Today, the Justice Dept. announced a settlement with JPMorgan Chase that will require the bank to pay more than $50 million in cash, mortgage credits, and loan forgiveness, to over 25,000 currently and recently bankrupt homeowners. [More]

Goldman Sachs, Morgan Stanley Ready To Drop $247 Million In Mail To Victims Of Foreclosure Abuses

Back in January, Goldman Sachs and Morgan Stanley announced a $557 million settlement “for deficient practices in mortgage loan servicing and foreclosure processing.” Later this week, the chunk of that money earmarked for payouts to affected consumers will be going out in the mail. [More]

Goldman Sachs, Morgan Stanley Hit With $557 Million Settlement Over Foreclosure Practices

While most of the headlines about abusive or half-baked foreclosure practices have focused on the huge retail banks — Wells Fargo, Bank of America, Citi, Chase, et al. — the big investment banks haven’t exactly been let off the hook. [More]

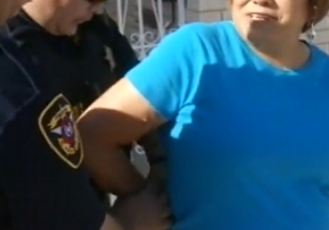

Woman Forcibly Removed From Home, In Spite Of Restraining Order Against Citibank

A woman in El Paso has been fighting foreclosure for several months, saying she was making payments and that Citibank was crediting them to an escrow account without telling her or explaining why. A federal court recently issued a temporary restraining order preventing the bank from foreclosing while the case is litigated, but that didn’t stop county constables from forcibly removing her from her home last week. [More]