Anchor store mainstays like Sears, Macy’s, and JCPenney have already been closing stores to cut costs and adapt to shoppers’ changing needs, but one prominent real estate analyst says this culling of department stores is far from over, and that even the most popular malls will likely end up with just one or two traditional anchor retailers. [More]

reports

Amazon Debuts Tool Allowing Parents To Track Kids’ Activities

Many parents monitor their child’s activity when using a computer, phone, or tablet, but the task of checking individual apps and browsing history can be daunting. Amazon thinks it has the answer, at least for kids using its FreeTime program, in a new Parent Dashboard. [More]

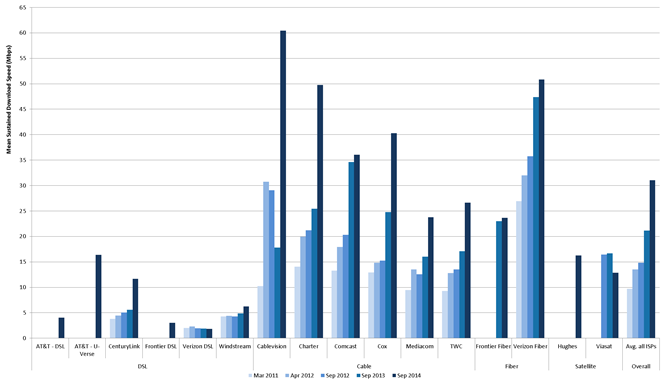

FCC: Cable Internet Really Is Getting Better But It Still Sucks To Have DSL

The FCC has released its latest Measuring Broadband America report, which — among other things — tells consumers if internet providers are indeed living up to the super-fast speeds they advertise. And while the industry is getting better at both delivering and marketing cable broadband, Americans who rely on satellite or DSL internet access are having difficulty catching up.

[More]

Some Student Loan Borrowers Improperly Denied Payment Assistance

Each year, more than five million student loan borrowers are better able to manage their debts thanks in part to government-based loan repayment plans. But yet another report has found that not all students qualified to participate in these income-driven repayment plans are able to, though at no fault of their own. [More]

Student Loan Debt For Recent College Graduates Increases Again, Now At $30K

With college tuition continuing to increase, it probably won’t surprise many people to learn that college graduates are leaving school burdened with more loan debt. According to a new report, the average amount of student loan debt for new graduates has passed $30,000 for the first time. [More]

Airlines Verbally Warning Passengers To Not Use Samsung Note 7 During Flights

Days after the Federal Aviation Administration put out a statement asking passengers not to use or charge their Samsung Galaxy Note 7 smartphones on a plane following reports of exploding and smoking devices, some travelers say airlines are taking additional steps to ensure those devices are turned off. [More]

Banks Making $17B A Year From Fees For Overdrafts & Insufficient Funds

Overdrafting your checking account might only hit you for $35, but when that happens a few hundred million times each year, it really adds up. A new report estimates that banks in the U.S. are now making $17 billion a year from fees for overdrafts and insufficient funds.

[More]

4 Tips From Contractors To Keep Your Home Remodel From Spiraling Out Of Control

When preparing to give your home a little facelift — inside, outside, or otherwise — most of us will probably seek out the assistance of a professional. But finding someone to complete your renovation on time, on budget, and to your liking can be more difficult than it seems, especially when you consider that the construction industry is currently dealing with a labor shortage. [More]

Online Payday Lenders Could Be Worse Than Traditional Payday Lenders

The typical outsider’s view of payday lending involves seedy looking storefront shops in strip malls near pawn shops and bail bonds, so the idea of going to a short-term lender with a cleanly designed, professional website might seem more appealing (not to mention convenient). However, a new report finds that online payday loans may wreak more financial havoc than their bricks-and-mortar counterparts. [More]

Servicemembers Twice As Likely To Submit Complaints About Unsavory Debt Collection Practices

While millions of Americans are no strangers to questionable debt-collection practices, a new report from the Consumer Financial Protection Bureau shows that the men and women in the armed forces are twice as likely than their civilian counterparts to file a complaint when a collector crosses the line.

[More]

Banks Turned Account Overdraft Fees Into $11.16B In Revenue Last Year

Banks with more than $1 billion in assets now need to report on how much revenue they bring in from overdraft fees and other charges. The first report on those numbers shows that banks made $11.6 billion last year from customers who overdrew their accounts.

[More]

FCC: Cable Internet Is Getting Faster, But DSL & Satellite Still Likely To Miss The Mark

The FCC’s job — well, one of the FCC’s jobs — is to make sure that everyone has access to decent broadband connections. You can’t understand what you can’t measure, though, so as part of that, the commission has to measure just how broadband is holding up. They issue a report, called Measuring Broadband America, roughly once a year to share their findings. The new one, the fifth, has just been released and while there’s still a lot of room for improvement, on the whole it seems to be a high note on which to end the year. [More]

Fiat Chrysler To Pay $70M For Allegedly Failing To Disclose Crash Deaths & Injuries

Fiat Chrysler will pay a $70 million fine to federal regulators over allegations it under-reported injuries and deaths related to vehicle crashes. [More]

Report: VW Failed To Disclose One Death, Three Injuries To Federal Regulator Database

Last month it was reported that Volkswagen may have skirted rules that require car manufacturers to report death and injury claims to the National Highway Traffic Safety Administration. A new analysis of the regulator’s database and lawsuits filed against the company show it failed to report at least one death and three injuries involving its vehicles. [More]

Nation’s Biggest Employment Background Screeners Must Pay $13M Over Inaccurate Reports

Before offering a prospective employee a job, many companies will first perform a background check. As with credit reports, any inaccuracies in these transcripts can affect an applicant’s eligibility for employment. To that end, federal regulators have ordered two of the country’s largest employment background screening report providers to pay $13 million in penalties and refunds for providing inaccurate information. [More]

Study Claims 43% Of “Wild” Salmon In Stores & Restaurants Isn’t Wild At All

That wild salmon entrée calling to you from the menu at dinner might not be all it’s advertised. In fact a new study released Wednesday found evidence of mislabeling in nearly half of all salmon sold in restaurants and grocery stores. [More]

Student Loan Debt For Recent College Graduates Increases Again

With college tuition prices continuing to rise, you might assume that college students are entering the real world with more debt on their shoulders. According to a new report, that assumption would be correct.

[More]