Back in November, the Consumer Financial Protection Bureau filed a lawsuit against one of the nation’s largest providers of seller-financed homes after it failed to comply with a subpoena to turn over documents related to home foreclosures. This week, a judge upheld the Bureau’s authority to request the documents from Harbour Portfolio Advisors. [More]

rent-to-own

Retailer That Overcharged, Then Sued Military Personnel Is Going Out Of Business

A year ago, Virginia-based USA Discounters was in the spotlight after the supposedly discount retailer — which had several locations adjoining military bases and directly marketed its financing to servicemembers — was criticized for charging ridiculously high prices on its products and then suing soldiers in such a way that they could rarely defend themselves in court. The retailer then changed its name to USA Living and promised to not be so evil, even though the lawsuits continued. Now comes news that the retailer is going to close up shop for good. [More]

What You Should Know About Rent-To-Own Retail Models: Extra Costs, High Interest Rates

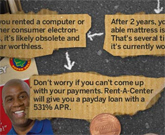

Rent-to-own stores offer cash-strapped consumers the ability to take home a new refrigerator, living room furniture set and hundred of other items by allowing them to pay a little each month. But, as we’ve reported in the past, what seems like a convenient years-long payment plan often adds hundreds – even thousands – of dollars to the price tag of a product. To ensure potential customers of rent-to-own stores know what they’re getting into, our colleagues at Consumer Reports put together a helpful video spelling out the potential dangers of such retail models. [More]

Fingerhut.com Uses Over-Inflated Retail Prices To Make Rent-To-Own Look Affordable

On its TV ads, Fingerhut.com shows people making peace with their “budget” alter-egos by doing their shopping on the website that allows you to make “low” monthly payments. But what the site doesn’t say is that not only do those payments add up to a lot more than the original price of what you’re buying, but that Fingerhut’s sticker prices are grossly inflated over the actual retail prices. [More]

Senator Calls On Regulators To Take Closer Look At Rent-To-Own Stores

To people strapped for cash but looking to make a big-dollar purchase, the idea of financing that item through a rent-to-own store can be tempting. After all, most of us can afford $30/month, but not everyone has $900 on hand. But those monthly payments may go on for years, meaning you’ll pay double or triple the face-value of that purchase by the time you’re done. In the last decade, this rent-to-own model has become increasingly popular, especially among lower-income Americans. Now one U.S. Senator is asking federal regulators to keep a close eye on this retail industry. [More]

Rent-To-Own Stores Are Like Blockbusters For Couches

It’s not a good sign for the prospects of the American working class when the president of a rapidly-expanding rent-to-own household goods company observes that items are coming back to his stores so quickly that it’s “like a Blockbuster.” Yes, it could be that a family just wanted to rent a big-screen TV for a special event, but items are more likely to come back because a customer couldn’t make their payments. [More]

Aaron’s Agrees To Stop Snooping On Customers Via Rented Computers

In Sept. 2012, Aaron’s was one of several rent-to-own retailers caught using software to illegally snoop on customers who rented computers. Yesterday, the Federal Trade Commission announced that Aaron’s has agreed to settle these charges and make sure franchisees cease the spying. [More]

Rent-To-Own Car Tires Become Popular, Are A Terrible Idea

Having to get new tires is annoying. They’re not cheap and you usually have to buy four of ’em at once. If you don’t have a few hundred dollars at hand or available on your credit card, what do you do? A growing number of Americans in that predicament are turning to rent-to-own tire stores, where they pay overinflated prices on consumer-unfriendly terms. [More]

Sears Heard That Rent-To-Own Is Ridiculously Profitable, Decides To Try It Out

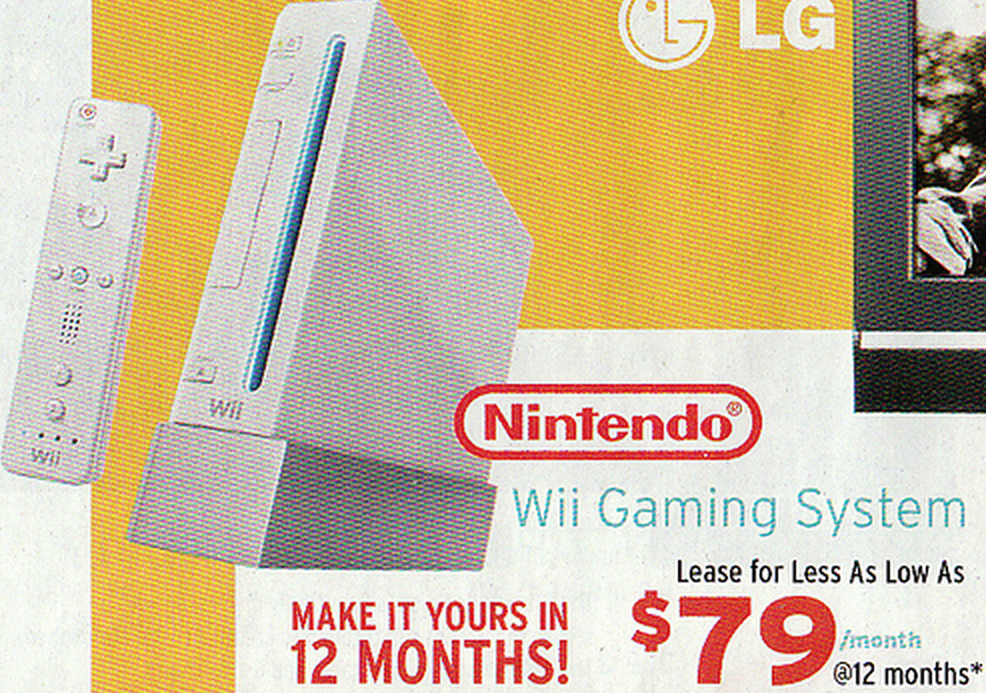

The rent-to-own business is an extremely profitable one: who wouldn’t want to collect more than three times the list price of, say, a computer? So it’s interesting but not surprising that troubled retailer Sears is now entering the lease-to-own market in a partnership with the existing rent-to-own company WhyNotLeaseIt. [More]

Rent-To-Own Companies Busted Using Tracking Software To Spy On Customers

For years, we’ve been warning consumers about rent-to-own electronics businesses because they usually end up costing customers a heck of a lot more money in the long term. Now there is another reason to avoid them: The Federal Trade Commission has caught seven rent-to-own companies installing tracking software on computers to do everything from tracking their locations to capturing screenshots of confidential info to secretly snapping photos of customers. [More]

Rent-To-Own Electronics Could End Up Costing You Three Times The Retail Price

For decades, rent-to-own services like Rent-A-Center have advertised themselves as an affordable way to purchase pricey electronics and appliances by making monthly payments. But while it might seem tempting to make a small monthly payment on a huge TV, an investigation by our smarter siblings at Consumer Reports says you could end up paying upward of three times the retail price if you go the rent-to-own route. [More]

Your Rented Computer Could Be Spying On You

According to a recently filed lawsuit, a big rental chain installs physical hardware and software into its rented computers, capturing the keystrokes, screenshots, and even webcam images of unsuspecting customers. The only way to disable it is by waving an electronic “wand” over the device. The spyware was revealed when a store manager for the chain showed up at renter’s house to try to repossess the laptop and showed the renter a picture of him taken by the webcam, unbeknownst to him, by the leased laptop. [More]

Rent-A-Center Responds To Predatory Lending Infographic

Sonia, Rent-a-Center’s Public & Community Affairs person, saw our popular post, “How Predatory Lending Works, From Payday Loans To Rent-To-Own” and has a rebuttal that shows how they do math. I showed it to Jess, the creator of the infographic, and he has a rebuttal to the rebuttal. Let the chips fall where they may: [More]

How Predatory Lending Works, From Payday Loans To Rent-To-Own

You’re a savvy, savvy consumer. You pay your credit card bills in full every month, auto-deduct a generous portion of your paycheck into savings, invest in index funds, and always make sure you’re getting the best deal from your cable and wireless providers. Unfortunately, some of your brethren do not read Consumerist and can get caught up in the jaws of predatory lenders, wasting limited cash on things like payday loans, bad credit cards, and using rent-to-own stores. So let’s take a walk down the wild side and see how each of these bad choices work, in a giant infographic, courtesy of Mint and WallStats, after the jump. [More]

BlueHippo Files Chapter 11 After Bank Accounts Frozen

It appears that when the FTC filed a contempt charge against scamtastic consumer electronics purveyor Bluehippo, the company’s bank took notice and froze their accounts. Now Bluehippo has filed for Chapter 11 bankruptcy protection, claiming that they can’t repay their creditors, what with the frozen bank accounts and all. This will not end well. [More]

Rent A Center Accused Of Illegal Collection Tactics In Washington

There are many, many good reasons why you shouldn’t purchase your home furnishings from rent-to-own outfits, but the state of Washington has discovered an exciting new one: collection tactics from Rent A Center that are so aggressive, they’re illegal.

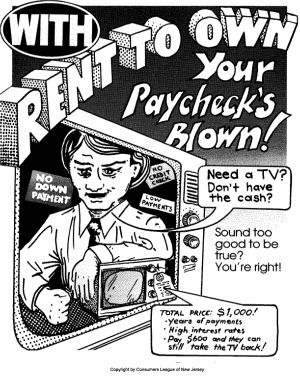

Do Not — We Repeat — Do Not Rent Your Home Furnishings

One unfortunate side-effect of the downturn is the resurgence of rent-to-own businesses. These stores, which include large chains like Rent-a-Center and Aarons, lease everything from furniture to TVs to consumers who have trouble getting traditional loans or credit cards, and don’t have enough cash to pay for the item upfront. While paying, say, $100 a month for a big LCD TV might seem like a good deal to some cash-strapped consumers, you inevitably end up paying interest rates that can run over 100%, and if you miss a payment or two, you can say goodbye to the TV — and any cash you’ve already paid out.

../..//2008/08/26/just-in-case-you-werent/

Just in case you weren’t already sure that “Rent To Own” was a terrible, horrible, no good, very bad deal… Read this. [ABC News]