Some neighborhood groups would look at squatters — people who live rent-free in vacant buildings — as a negative to be shooed away in favor of paying tenants. But the folks in one part of Detroit would rather have squatters occupying the empty homes in their area than see these buildings stripped or burned to the ground. [More]

recession watch

People Who Bought Pontiac Silverdome For $583K Now Asking $30M For Run-Down Arena

The Pontiac Silverdome hasn’t played home to the Detroit Lions since 2002; the Pistons fled 27 years ago. Aside from a handful of one-off events, it’s basically gone unused for most of the last decade, with much of its few remaining assets recently auctioned off. And yet the company that paid only $583,000 for the arena at a 2009 auction are now asking for a whopping $30 million. [More]

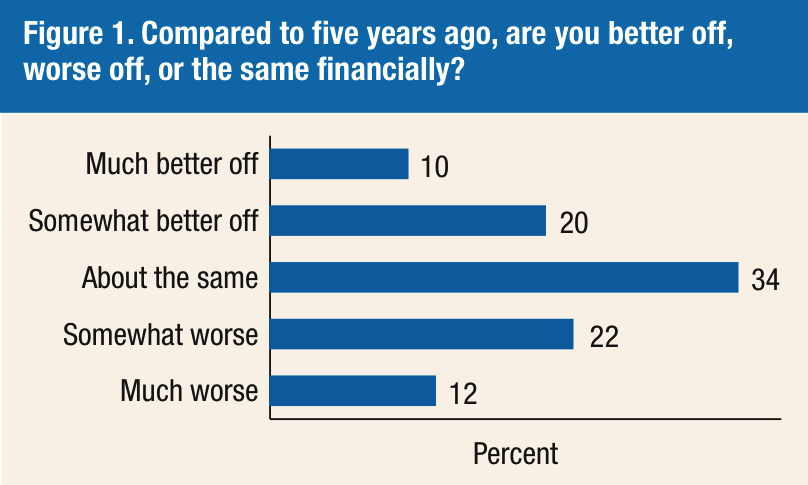

1-In-3 Americans Still Feeling The Sting Of Recession

While many Americans are now doing better than they were during the Great Recession, those dark days took such a toll on many consumers’ savings that some people who are currently doing well enough to pay the bills and enjoy a decent living aren’t able to make necessary longterm investments, like buying a new home or saving for retirement. [More]

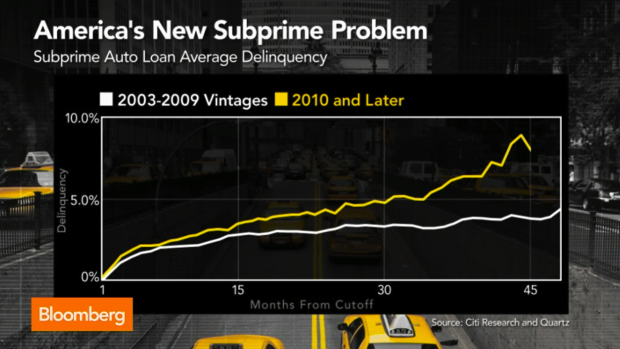

Why Are Some People Having A Harder Time Paying Off Car Loans Post-Recession?

For many of us, things have improved since 2010, when the country finally began clawing its way out of the crater that resulted from the collapse of the housing market. So why are some consumers doing a worse job of making car loan payments than they were during the recession? [More]

Fewer Teens Are Driving Because They’re Broke

In 2012, 73% of graduating high school seniors nationwide had driver’s licenses according to the Centers for Disease Control. That’s down from 86% in 1996. What’s the reason for the drop? Better public transportation? Helicopter parenting? Stricter testing requirements? No, not that. A new study from the insurance industry-funded Highway Loss Data Institute indicates that it’s because teens don’t have jobs. [More]

What Does It Mean That No One’s Buying $3 Nail Polish?

Earlier in the Great Recession, cosmetics company Coty was doing pretty well. The company makes the least expensive cosmetics that you’ll find in a local drug or discount store, brands like Sally Hansen and Rimmel. Even as the global economy fell apart around us, people could still spare a few bucks for nail polish, and the company did relatively well. Now sales are down and retailers aren’t ordering as much. Why is that? [More]

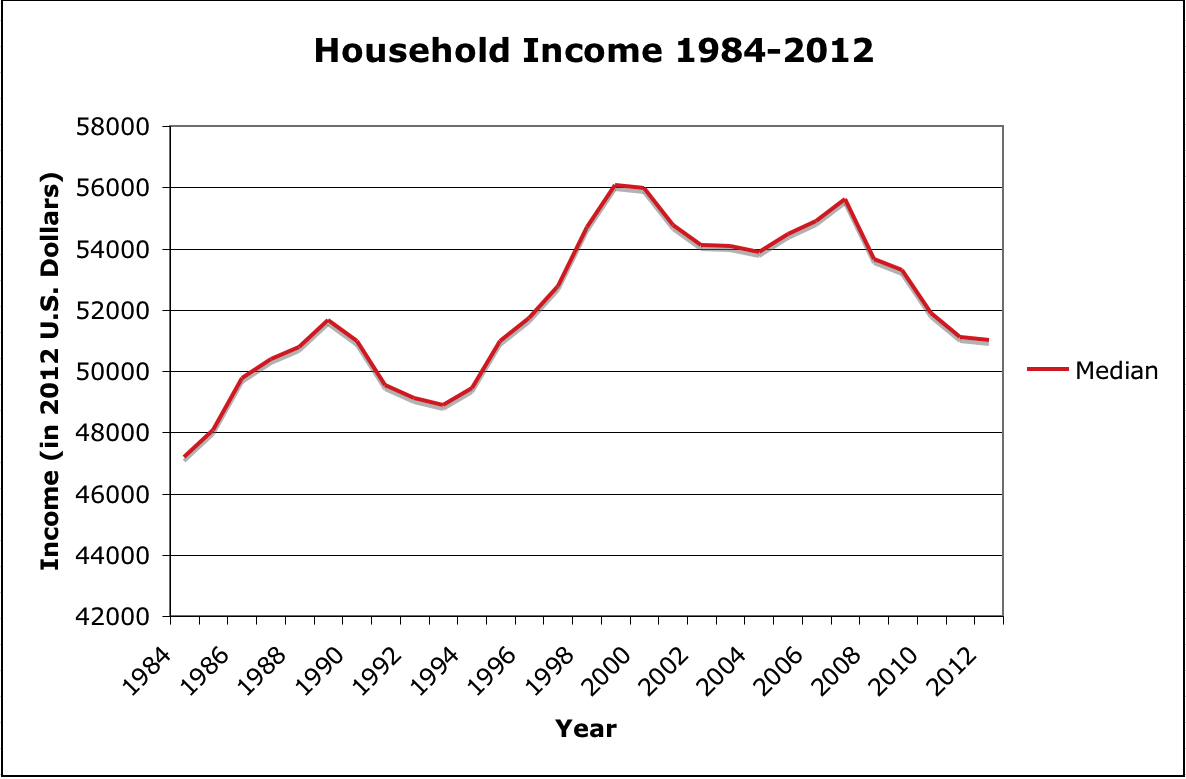

Here Are Two Charts To End Your Day With A Frown (Even If You’re Exceedingly Wealthy)

Like many people in their late 30s, I sigh whenever I see some superstar athlete, billionaire, or Oscar winner who was born way back in 1989, when I was but a pimply adolescent with dreams of being chauffeured around in a stretch Porsche limousine. Know what else is depressing about 1989? The median household income in the U.S. was higher than it was in 2012. [More]

On 5-Year Anniversary Of Mortgage Meltdown, Those Responsible Are Doing Just Fine

On Sept. 15, 2008, Lehman Brothers became the largest bankruptcy filing in the history of this country. It was the first domino of many to fall, followed by the likes of Bear Stearns, Merrill Lynch, Countrywide, Wachovia, Washington Mutual, and many other banks and investment firms that had bet too much money on the subprime mortgage market, only to have it collapse when people realized many of those bad loans would never be repaid. These events ripped apart the American economy and left people out of work for extended periods of time. But not most of the bankers responsible for the mess. [More]

$1 Homes For Sale In Indiana, But Don’t Go Counting Quarters Just Yet

When you hear that Gary, IN, has a dozen homes for sale for $1 each, you might be inclined to dig into your wallet and ask, “Will you take a 10-spot for the whole lot of them?” But these home aren’t available to just anyone with four quarters to rub together, so nearly 94% of interested buyers have been turned away. [More]

Needy Oenophiles Pawning Prize Bottles Of Wine For Cash

Eight years ago, it seemed like everyone in New York City was operating a hedge fund, and many of those suddenly rich folks splurged on necessities like rare bottles of wine. Then things went sour and these briefly wealthy types had to relocate the contents of their wine cellars to a storage unit. Realizing that cash-in-hand may be more helpful than bottles of wine they may never drink, some are using their prize wine collections as collateral on short-term loans. [More]

DOJ Sues Bank of America For Lying About Sketchy Mortgage-Backed Securities

Even though Bank of America execs appear to have avoided criminal prosecution for their part in the recent economic collapse, BofA continues to be slapped upside its head with civil suits for its bad behavior. The latest comes from the U.S. Dept. of Justice, which sued BofA and a number of its affiliates, alleging the defendants misled investors by telling them that mortgage-backed securities were A-OK, when in fact they were more toxic than a house full of lead paint and asbestos. [More]

Drop In Number Of First-Time Home Buyers Is Cause For Concern

The notion of buying your first home, building equity, and eventually moving up the property ladder is still something many young Americans aspire to, but between more stringent underwriting procedures, lingering student loan debt, competition from real estate speculators and higher interest rates, first-time buyers are being squeezed out of the market. [More]

Fannie Mae Fires Head Of Office At Center Of Kickback Scandal

A few weeks back, we told you about the Fannie Mae office in Irvine, CA, where some employees have been accused of taking kickbacks from real estate brokers in exchange for priority access to the bailed-out mortgage-backer’s lists of repossessed properties. Now comes news that the head of that office has been given the boot “for performance issues.” [More]

AIG CEO To College Grads: Take Whatever Job You Can Get

If the students graduating from Alfred University on May 18 are expecting a world-is-your-oyster type speech from speaker, AIG CEO and Alfred alumnus Robert Benmosche, then they may want to put on headphones during his portion of the ceremony. Or they may want to listen to the tough love speech he’s got planned. [More]

Mortgages Slightly Easier To Get For Prime Borrowers, Still Tough For Subprime Applicants

Ten years ago, a potential home buyer could walk into a Countrywide office and get pre-approved for a half-million dollar home loan based on a bank statement written in crayon on a restaurant place mat and a pinky swear that the loan could be paid back. We all know too well the results of those lax standards, which is why regulators and banks ramped up restrictions on lending to the point where applying for a home loan is like auditioning for American Idol, without the washed-up celebrity appearances. But a new survey says that lenders are easing up… a bit. [More]

Dow Cracks 15,000 Threshold For First Time In History

Earlier this year, it was big news when the Dow Jones Industrial Average cracked 14,000 for the first time since 2007. But earlier this morning, promising employment numbers sent the DJIA soaring, up more than 160 points until it surpassed the 15,000 mark, a new high. [More]

Are Wall Street Investors Pumping Up The Next Housing Bubble?

Areas like Las Vegas, Phoenix, and Miami — all hit pretty hard by the collapse of the last housing bubble — are now seeing home prices rise at rates above the national average. But rather than this being an indicator that these areas are finally recovering, some worry that it’s just a lot of hot air being pumped into another bubble by Wall Street investors. [More]

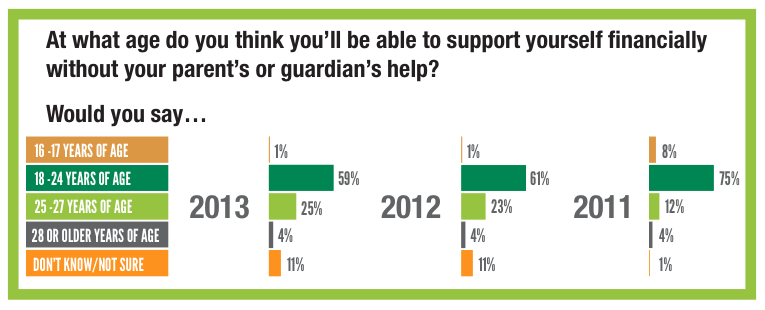

Number Of Teens Expecting To Depend On Parents Into Adulthood Has Doubled Since 2011

In what could be an indicator of either a massive drop in teens’ financial prospects or the fact that teens today are getting more realistic about their financial futures, a new survey shows that the percentage of teenagers who expect to remain dependent on mom and/or dad until at least age 27 has doubled in just the last two years. [More]