A longstanding complaint against auto insurance is that it sometimes lumps in drivers based on things — like location, type of car, and age — that may have little-to-nothing to do with a particular driver’s behavior or history. In recent years, some insurers have begun offering drivers a way to get more personalized rates by allowing the insurance company to track their vehicular movements, but many American consumers simply aren’t willing to share that information. [More]

progressive

3 Things We’ve Learned About How Demographics, Credit Scores & Marital Status Affect Your Car Insurance Rates

When you get a quote for car insurance, you might think that only a few things matter — your driving record, the cost and use of your vehicle, the type of coverage you need, and other factors directly related to operating an automobile. But the fact is that many insurers are basing your insurance quotes on data points that have nothing to do with driving, like your credit score, marital status, and ZIP code. New research shows that determining price using these types of demographic and financial factors (rather than driving record alone) can have a serious impact on the affordability of car insurance. [More]

27 Major Companies That Are Worth Less Than WhatsApp

Just how big of a deal is the $19 billion WhatsApp is getting from Facebook in the acquisition announced yesterday? It’s a pretty freaking big deal — especially when you consider that there are a whole lot of major companies –including many that produce physical goods you can reach out and touch — that have been around longer than WhatsApp and are worth a lot less. [More]

Consumer Group: The Rich May Pay Less For Car Insurance Even If They’re Not Safe Drivers

Driving safely and avoiding accidents isn’t just common sense — injuries hurt, car wrecks are bad — but also a way to make sure drivers keep their auto insurance premiums down. But according to figures released by a consumer group recently, insurance companies are in the habit of charging higher premium to safe, low- or moderate-income drivers than to richer people who were at fault for an accident. [More]

I Hate Progressive Insurance For Waking Me Up Over And Over

Tegan is mad at Flo from Progressive. Arguably, it’s her own fault: she leaves the TV on overnight as a sort of background noise. This leaves her and her fiancé at the mercy of whatever commercials run while they’re dozing. A new spot for Progressive insurance that advertises their mobile app features the loud, prominent sound of a vibrating phone. Most TV watchers might glance at their own phones in confusion, but Tegan was asleep, and was on call for work, so when she heard the vibrating sound, she woke up to check her phone. [More]

Progressive Provides More Details On Controversial Lawsuit

Earlier this week, the brother of a woman killed in a car crash made headlines around the world by claiming that his sister’s insurance company, Progressive, had actually come to the legal defense of the driver accused of causing the fatal accident. Since then, the insurance company has stated that it was not defending the other driver, but only defending itself in the lawsuit — a distinction the brother found wanting. Today, the insurer says it has reached a settlement with the family and is attempting to clarify matters further by explaining why its lawyers ended up on the other side of courtroom. [More]

Progressive Denies Defending Driver Who Killed Policyholder In Crash

UPDATE: The victim’s brother has issued a rebuttal to Progressive’s statement. It has been added to the bottom of the post.

—

Yesterday, the brother of a woman who died in a car crash made headlines when he wrote that lawyers for his late sister’s insurance company, Progressive, had acted as the defense counsel for the driver accused of causing the accident. At the time, we had asked the insurer to clarify its actual involvement in the case, but it only offered a vague “our hearts go out”-type statement. But now Progressive is flat-out denying it came to the defense of the at-fault driver. [More]

Why Would The Victim's Insurance Company Defend The Other Driver In A Fatal Car Accident?

After Woman Dies In Car Crash, Brother Says Her Insurance Company Defended Other Driver In Court

Progressive Roadside Assistance Won’t Tow My Car After It Caught Fire

Matthew and his family were having a great day in the country until their car caught fire. First they noticed an odd smell…and then the smoke and flames. Eventually the fire department showed up, but their insurance company, Progressive, wouldn’t tow the car because the damage was caused by a fire. Sure, a fire caused by an electrical problem with the car. [More]

Bank Of America Tops List Of Companies With Craptastic Customer Service

Bank of America may have lost this year’s Worst Company In America tournament by the narrowest of margins, but the results of a new customer service satisfaction survey put BofA at the head of the class when it comes to irking consumers. [More]

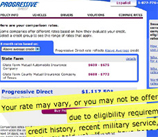

Progressive Direct "Glitch" Hikes Premium From $800 to $2,000

Kevin received a surprise when he checked the renewal notice for his car insurance recently. A 260 percent surprise, in fact, even though he’s not a bad driver and hadn’t been in any accidents. [More]

Which TV Ad Spokesperson Needs To Be Retired Next?

With the recent announcement that Apple has taken mercy on all TV watchers and finally put a bullet in the head of the “I’m a Mac” ad campaign, along with with McDonald’s’ decision to keep longtime front man Ronald McDonald, in spite of a push to have him put out to pasture, we want to know from you which TV ad character/spokesthing you think should be next in line for retirement. [More]

Progressive Has No Notion of Christmas Spirit, Announces Yule-tide Rate Increase

According to an Email received by reader Jessica, Progressive Auto Insurance is increasing rates for New York Customers by nearly 20%. And the best time to announce this? Christmas day, of course!

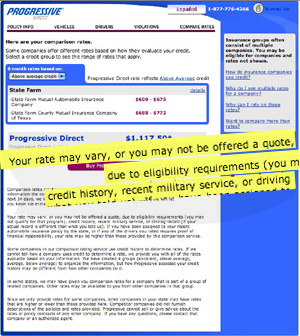

Progressive Responds To Question About Using Recent Military Service To Determine Rates And Eligibility

The Progressive auto insurance company saw our post “Why Is Progressive Using “Recent Military Service” To Determine Rates And Eligibility?” and responded to let us know that it’s just to make sure that service members aren’t penalized for having a lapse in their coverage due to the fact that they’ve been deployed overseas. They’ve apologized for the confusing wording on the website and have pledged to rewrite it for clarity. Full official statement, inside…

Why Is Progressive Using "Recent Military Service" To Determine Rates And Eligibility?

[Update: Progressive responded and clarified that the fine print does NOT mean they will use military service to give you a higher rate.] We got this email tonight from Ceaser, who wants to know why his military service would negatively affect his car insurance:

While searching for new car insurance on progressive and sadly other insurance carriers, figuring what the rate check would be I answered a few questions. Some questions asked were if I was currently in the military and in college, I am both. As an Iraq war Army vet I am currently going to school with the GI bill, and tuition assistance from the Air national guard, so I put that I am both a student and national guard.

Progressive Says Lying Its Way Into Church Support Group To Dig Up Lawsuit Dirt Was "Reasonable"

Remember how Progressive got caught infiltrating a church support group and secretly recording it in hopes of discrediting two of its members involved in an insurance claim? And then their CEO posted a public apology, calling the incident “apalling?” Well, now, in defending itself against the lawsuit filed by the people whose privacy was breached, Progressive is calling its actions “reasonable.” Progressive must be some kind of special alchemist to brew a concoction both “appalling” and “reasonable” at the same time.