It’s like the Olympics for corporations: Cities all over the country have put themselves into the running to be the home to Amazon’s planned second headquarters, and many of them are offering huge tax breaks and other incentives. But just like the Olympics, cities may regret making such a deal, and several places vying for Amazon’s attention have apparently not learned important lessons from themselves and others that were overly eager to court a new corporate HQ. [More]

pew charitable trusts

Which States Have Tax-Free Holidays, And When Do They Happen?

As families prepare to send their little ones back to school, they’re heading to malls, big box stores, and other retailers to fill their backpacks and closets. While many companies offer deals and programs targeting back-to-school season — we’re looking at you Target — many states are also offering their own deals in the way of sales tax-free weekends. [More]

Most Americans Favor Payday Loan Reforms

Despite claims from the payday loan industry that Americans don’t want reforms intended to prevent borrowers of these short-term loans from falling into a revolving debt trap, two new reports show that most people do think it’s time to rein in payday lending and provide more affordable loan options for borrowers in need. [More]

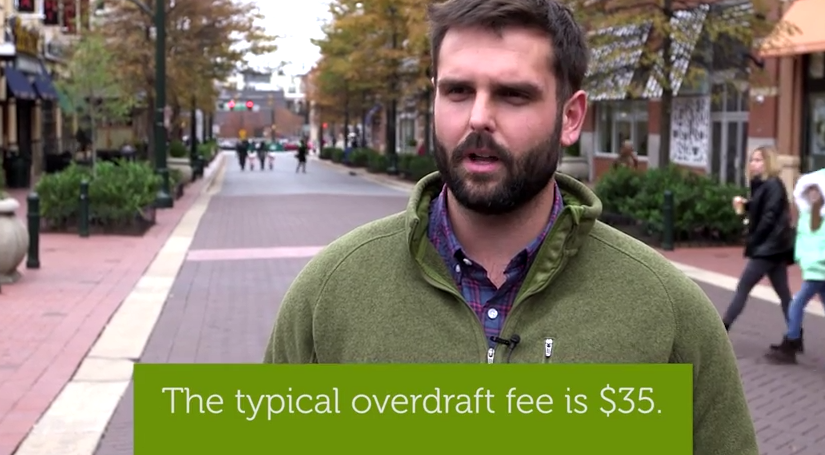

Bank Overdraft Policies Have Improved, But Not Enough To Protect Most Consumers

Over the years, banks across the country have modified their policies regarding overdraft fees to comply with federal regulations — including requiring consumers to opt-in to the costly protection. Despite this, account holders spend nearly $32 billion each year on the fees. And according to a new report, that likely won’t end anytime soon, as most large U.S. banks continue to charge high, sometimes exorbitant overdraft fees. [More]

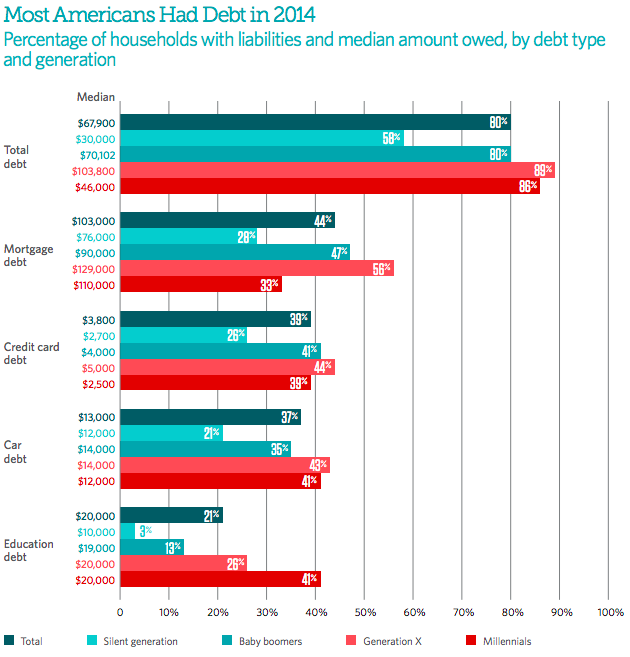

Nearly 80% Of Americans Hold Some Form Of Debt, But It Isn’t Always Bad

When most people think of debt, they probably conjure up a vision of consumers struggling to make ends meet after making unwise financial decisions. But that actually isn’t the case for most Americans. In fact, like other things, debt in moderation is actually a good thing. [More]

Pew: With Nearly 23 Million Consumers Using Prepaid Cards, More Protections Are Needed

To the naked eye, general purpose reloadable prepaid cards function much like long-established credit and debit cards and have quickly gained traction with consumers, especially those who have been shut out from traditional banking options. In fact, about 23 million consumers use prepaid cards regularly. [More]

Pew Charitable Trusts Illustrates The Devastating Effects Of Payday Lending, How It Can Be Fixed

Back in March, the Consumer Financial Protection Bureau took its first long-awaited step in reining in the payday loan industry by releasing an outline for potential regulations over the small-dollar lines of credit known to thrust consumers into a devastating cycle of debt. While consumer groups were quick to applaud the steps, they also expressed concern that more could be done to protect people from the devastating consequences of such loans. This week, Pew Charitable Trusts released a video detailing the predicament nearly 12 million Americans face every year when taking out payday loans and how regulators might be able to find an answer. [More]

Banks Continue To Improve Consumer Safeguards, But Progress Isn’t Coming Fast Enough

Opening a checking account with a bank is a rite of passage of sorts for many consumers, but the plethora of small-print disclosures, fees and other services are enough to confuse even the most seasoned account holder. While banks attempted to simplify their practices over the years, a new Pew Charitable Trusts report shows that some banks – and regulators – have a long way to go before they’re truly doing everything they can to protect consumers. [More]

Many Americans Still In The Dark About Overdraft Fees & Other Bank Practices

While millions of consumers contribute to the $32 billion in overdraft fees collected each year, a new video shows that many checking account holders don’t fully understand the way overdrafts work or how much they spend on the fees each year. [More]

Outline For Payday Lending Rules A Good Start, But Not Enough To Fully Protect Consumers

Today, the Consumer Financial Protection Bureau released the first details of long-awaited regulations governing payday loans and other small-dollar lines of credit known to thrust consumers into a devastating cycle of debt. While consumer advocates were quick to applaud the Bureau’s work, and those in the financial industry to voice displeasure with aspects of the potential rules, both groups agreed that the coming months will involve more time and effort to craft meaningful protections for both sides of the issue. [More]

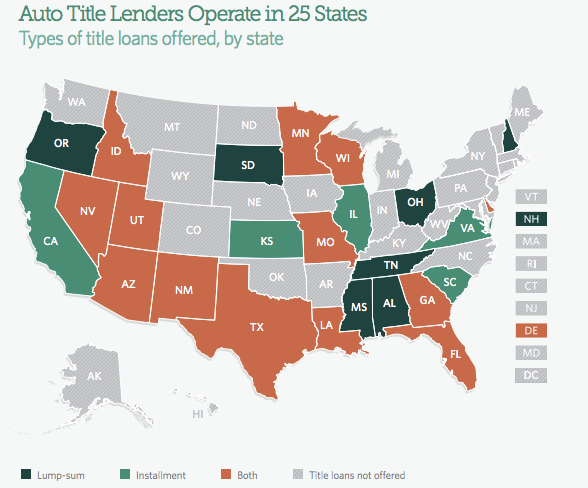

Report: Auto Title Loans Just As Bad, If Not Worse Than Payday Loans; Should Face Same Rules

Each year millions of consumers turn to high-interest, short-term loans to make ends meet. While you may be more familiar with payday lenders who charge triple-digit interest rates with the goal of trapping borrowers into taking out new loans to pay off the old ones, a new report finds that payday’s lesser-known relative, auto title loans, have equally destructive repercussions. [More]

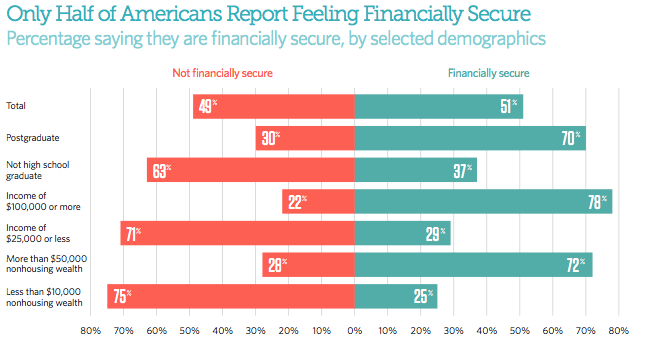

Report: Americans Are Optimistic About Their Finances But Few Actually Feel Secure

Americans’ positive feelings about the economy have officially returned to the level they were at on the eve of the Great Recession, according to a new study from Pew Charitable Trusts. While that might sound comforting, it doesn’t mean consumers are actually feeling secure in their own financial stability. [More]

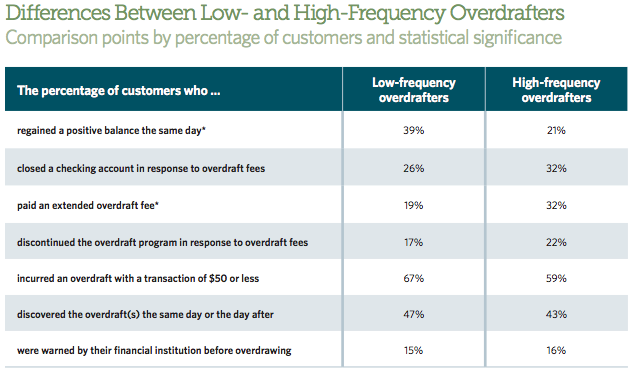

Report: Overdrafting Just A Little Or A Lot Has The Same Negative Consequences For Consumers’ Accounts

For most consumers, overdrawing their checking account results in a hefty fee. While it’s safe to argue that consumer who have more overdrafts will pay more in fees, a new report from The Pew Charitable Trusts finds that both high-frequency and low-frequency overdrafters often face the same devastating financial ramifications from banks’ overdraft penalties. [More]

Service Members Deserve More Transparency From On-Base Banks, Credit Unions

The Military Lending Act attempts to shield military personnel and their families from some predatory lending practices, but a new report from the Pew Charitable Trusts claims that some traditional banks on military bases are nickel-and-diming members of the armed forces with excess overdraft fees, and a general lack of transparency.

Online Payday Loans Cost More, Result In More Complaints Than Loans From Sketchy Storefronts

We understand why someone might opt for getting a payday loan online instead of doing it in person. It’s easier, faster, doesn’t require going to a shady-looking storefront operation where some trained fast-talking huckster might try to upsell you unnecessary add-ons or tack on illegal insurance policies. But the truth is that people who get their payday loans online often end up in a worse situation than they would have if they’d applied in person. [More]

Video Shows You Don’t Need All That Fine Print In Prepaid Card Fee Disclosures

Prepaid debit cards may offer a convenient alternative for unbanked consumers, but there are often unexpected costs buried in all the fine print of the cards’ disclosure documents that most people never read. It doesn’t need to be that way. [More]

Report: Most Consumers Don’t Care If The Post Office Offers Financial Services

At first glance it wouldn’t appear that the United States Postal Service and banks have much in common. But that might soon come to an end if an idea to expand banking services to local post office branches in an attempt to meet the needs of the underbanked. [More]

Despite Regulations Most Consumers Don’t Understand Overdraft Penalty Plans; More Rules Needed

Since 2010, financial institutions have been required to obtain an opt-in confirmation from consumers before enrolling them in overdraft penalty plans, yet a new report found more than 50% of consumers who incurred such penalty fees in the past year don’t believe they opted into any such plans. This revelation, coupled with consumers’ concerns over fees and bank practices, has led to a call for federal regulators to improve rules governing financial institutions’ overdraft policies. [More]