I suspect some readers will say that Assefa Senbet is to blame for screwing up one of his final payments to Citibank on a deferred interest loan agreement. They’ll be right–it was his responsibility. But he didn’t skip a payment, and he wasn’t late. In fact, he frequently overpaid in order to pay it off early. Near the end of the loan, however, he sent in a check for $70 instead of $81. As a consequence, he’s now paying off $887 in deferred interest fees at a 30% interest rate. [More]

penalties

Wachovia's "Way2Save" Account Triggers Over $5,000 In Penalty Fees

Wachovia has a new financial product called Way2Save that automatically moves $1 from your checking account into a high interest personal savings account every time you make an electronic bill payment. Susan tried to maximize her contributions by making a lot of little bill payments, but Wachovia cut off access to her funds without notice and triggered an avalanche of penalty fees. Now she owes over $5,000 to her credit card companies, far more than she would likely have ever earned through Wachovia’s complicated savings program, and of course Wachovia is denying any responsibility.

Target Must Pay $600,000 To Settle Lead Paint Charges

Looks like the CPSC can afford donuts tomorrow for their office: Target has agreed to pay $600,000 for selling toys with too much lead on them from May 2006 to August 2007, reports Reuters. The fine “resolves allegations” over the issue, so now Target can focus on what it does best, which is act crazy.

Bank Piles On Overdraft Fees Due To Merchant Error, Doesn't Seem Too Keen On Refunding Them

Here’s a story from a reader about a bad bank practice that we hear about too frequently—a bank cascades hundreds of dollars worth of overdraft fees on an error that’s beyond the customer’s control, but then is unresponsive or uncooperative on refunding those fees.

Banks Cling To Overdraft Fees Because They Need Them To Survive

Banks now make more on debit card overdraft fees than credit card penalties—they’ll rake in about $27 billion in 2009 alone, according to the New York Times. They obviously have zero incentive to curb the practice. In fact, one economist told the paper that “45 percent of the nation’s banks and credit unions collect more from overdraft services than they make in profits.”

Robocalls Banned!

Today the FTC banned pretty much all telemarketing-based robocalls starting Tuesday, September 1st, 2009. At that point, “violators will face penalties up to $16,000 per call,” notes the Los Angeles Times.

Got Solar Panels? Utility Wants To Charge You For Not Using Their Energy

Midwest utility Xcel Energy wants to charge anyone using solar panels a monthly fee for sustainably generating their own energy. According to company spokesman Tom Henley, “We just don’t think it’s fair that customers that don’t have solar panels on their homes should subsidize these solar panel customers any further.” Huh?

Plastic Surgery Company Agrees To Pay $300,000 For Fake Customer Reviews

Over a year ago, we wrote about Lifestyle Lift and its attempts to astroturf a customer review website (while simultaneously suing that website for trademark infringement, naturally). But then they caught the attention of New York Attorney General Andrew Cuomo’s office, and now they’ve agreed to pay $300,000 and will stop publishing fake reviews online.

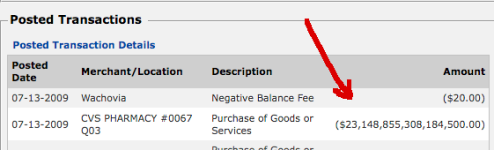

Unruly Teen Charges $23 Quadrillion At Drugstore

Kids these days! Hawkins writes, “My lectures about financial responsibility appear to have failed: yesterday [my teenaged daughter] charged $23,148,855,308,184,500.00 at the drug store.” You would think Visa would have caught the error and addressed it, if you were high. What Visa actually did was slap a $20 “negative balance” fee on it, of course. Update: Here’s what happened!

Bank Of America: "That's Why You Don't Open New Accounts Online"

After reading about how Jesse was banned for life from Bank of America for no clear reason, other readers wrote in with similarly bizarre BoA stories. Wayne was locked out of his new account after he opened it and charged a $75 overdraft fee. Chris was sent checks linked to a duplicate account and then charged penalties when the checks bounced. Edward’s new account was closed but the CSR refused to tell him why, and he was charged a $60 “research fee” for the closing. When Edward went to a BoA branch to clear things up, he says the employee there told him, “That’s why you don’t open up accounts online.”

Mattel Will Pay $2.3 Million Penalty For All Those Lead Toys

Remember back when lead toys were all the rage? Oh, those dangerous days, when you couldn’t lick a Dora the Explorer doll without fear of memory loss! Well, Mattel and the Consumer Prouct Safety Commission (CPSC) have reached an agreement on how much Mattel should pay for importing toys that exceeded U.S. lead safety guidelines, and the amount is $2.3 million. Maybe now the CPSC can use some of that money to grease the DC wheels and get their new chair nominee confirmed.

Capital One Charges Woman $29 Late Fee For Paying Too Early

Jason writes, “My wife just sent me an email saying that she paid ‘too early’ (before the new statement was generated) and got charged a ‘Late Fee’ of $29!” He says she called Capital One and got the fee waived, but it’s a good reminder that if you make a payment before the new statement period begins, your card provider will likely apply the payment to the previous statement period, and will still expect a fresh payment from you by the new due date. Just make sure your payments aren’t scheduled so early that they’re applied to the past and you’ll be fine.

Report: Loan Modifications To Date Haven't Been That Effective

Fewer than half of loan modifications made at the end of last year actually reduced borrowers’ payments by more than 10 percent… [while] nearly one in four loan modifications in the fourth quarter actually resulted in increased monthly payments.

Your Credit Card Limit Can Be Reduced Below Your Current Balance

We’ve seen how available balances can disappear when lenders cut credit card limits, but SmartMoney points out that lenders can cut your limit below your current balance, causing all sorts of problems. They’ll send you a notice, of course, but you may not receive it for several weeks. Your best bet is to set up your own alert system. A web-based financial service (like Mint) will send you an email or SMS alert if your available balance drops below a specified threshold.

Private School Tells 300 Students To Pay Up Or Get Out

A new quarter just started this week at Marian Catholic High School in Chicago, and on the first day back, 300 students were pulled out of class and lined up outside the school, then told to contact their parents and pay their outstanding tuition or they’d have to leave. The Chicago Tribune writes that “by lunchtime, about 100 students were sent home-some confused, some embarrassed and a few angry.” The school says parents owe around $450,000 in outstanding tuition payments, far higher than usual, and that they’re trying to avoid layoffs and other budget cutbacks. Will the poor economy lead to higher attendance at public schools? “If you want a good education, you have to dish it out,” one parent told the paper.

../../../..//2009/03/11/missouris-attorney-general-has-won/

Missouri’s Attorney General has won a $300,000 judgment against a telemarketer that violated the state’s do-not-call list. It is the third-largest award so far.

Chase Wants You To Pay Your Taxes By Credit Card. Don't.

Chase has emailed its customers a friendly reminder that if you can’t pay your taxes this year, you can charge them on your Chase credit card! Even the IRS site suggests you consider using a credit card if you can’t pay your debt. However, before you do something as debt crazy as charge up a high credit card balance, consider the following points and make sure you’re doing the most financially responsible thing.

Big Box Retailers Fight Back Against FCC's Recent Fines

Best Buy, Circuit City, and Sears are all contesting the FCC’s recent fines against them for not properly following analog transition rules in their stores, reports Ars Technica. Last week, Best Buy submitted a 41-page response (PDF) that claimed among other things that the FCC has no authority to fine them.