While many consumers are likely just getting used to their more secure, but far from perfect, chip-and-signature payment system and others are beginning to use a chip-and-PIN system, MasterCard is testing yet another secure transaction option: chip-and-fingerprint. [More]

Payment Systems

Verifone, Largest Maker Of Card Payment Terminals, Targeted By Hack

Verifone, the company behind many of the payment systems you see at retailers across the country, is reportedly the latest hack attack victim. [More]

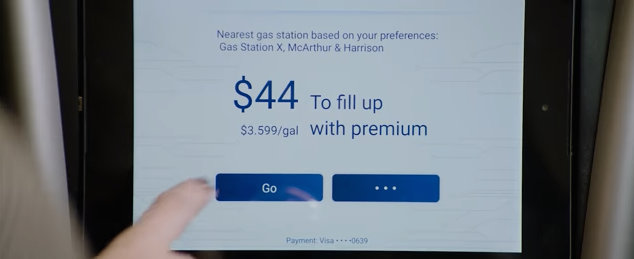

IBM & Visa Team Up To Turn Everything Into A Mobile Payment System

Consumers make millions of purchases each year through their phones with systems like Apple Pay, PayPal, Samsung Pay, and other programs. But soon, people might be able to use any number of other connected devices to buy products or pay for services, as IBM and Visa announced a partnership to bring payment systems to a number of “smart” products. [More]

Report: Target Is Considering Its Own Mobile Wallet App

It seems everywhere you turn these days, another company is offering a new way to pay with a smartphone: there’s Apple Pay, Android Pay, Samsung Pay, as well as Walmart’s newly announced mobile payment system, and now Target might be hopping on the bandwagon with its own mobile wallet. Any bets on whether it’ll be called “Target Pay”? [More]

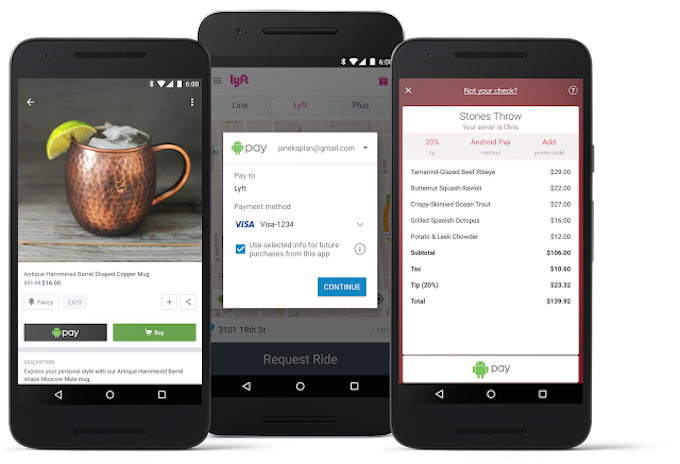

Android Pay Opening The Doors To In-App Purchases Starting Today

A few months after Google launched Android Pay into the wild, the company says the payment system will make the hop from tap-and-pay transactions at stores to include in-app purchases as well. [More]

Regulator Issues “Guiding Principles” For Making Real-Time Payments Safe, Secure

If you buy something with a debit/credit card or an online check, there can be a delay of hours or days before the other party gets those funds. Advances in technology are allowing payment platforms to cut that down to mere seconds, which could help consumers by preventing banks from re-ordering multiple transactions to maximize overdrafts. But as non-cash payments inch closer to real-time transactions, federal regulators want to ensure that companies are following certain best practices to make things safe and consumer-friendly as possible. [More]

Target Wants To Perfect Chip-and-PIN Before Venturing Into Digital Payment Methods

Consumers and businesses alike are always seeking out ways to streamline the checkout experience, most recently with mobile payment systems like Apple Pay and Android Pay. But there’s one major retailer that won’t be jumping into new payment options just yet. [More]

AmEx, Jawbone Partnership Allows Customers To Buy Things Using Fitness Trackers

Using your phone to pay for things at the register is so 2014. With the soon-to-be released Apple Watch allowing payments to be made with a flick of the wrist, other wearable companies are jumping on the bandwagon. Case in point: a new joint venture from Jawbone and American Express. [More]

Corporate Infighting To Keep Americans From Paying With Their Cellphones For The Next Few Years

Don’t expect your cellphone to replace your credit card anytime soon. The New York Times reports that banks and telecoms still can’t agree on the basics needed to develop such a payment system, even though similar systems have been available in Japan for the past five years.