Rent-to-own stores offer cash-strapped consumers the ability to take home a new refrigerator, living room furniture set and hundred of other items by allowing them to pay a little each month. But, as we’ve reported in the past, what seems like a convenient years-long payment plan often adds hundreds – even thousands – of dollars to the price tag of a product. To ensure potential customers of rent-to-own stores know what they’re getting into, our colleagues at Consumer Reports put together a helpful video spelling out the potential dangers of such retail models. [More]

payment plans

Executive Order Would Expand Student Loan Debt Forgiveness Program To 5 Million Additional Consumers

College students and graduates weighed down by crushing student loan debt can expect a little help in repaying those loans with the forthcoming expansion of the Pay As You Earn initiative. [More]

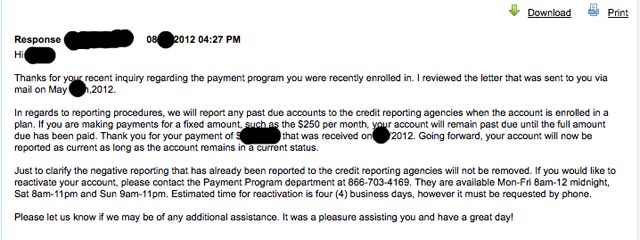

American Express Payment Plans Won't Do Your Credit Any Favors

Ryan was in a tight spot, and late with the payment on his American Express account. The problem didn’t seem as scary as it could have been, though. The company’s Web interface offered him the opportunity to sign up for a payment plan, so he could pay down the outstanding balance over a period of as long as twelve months. Neat! But the plan didn’t quite have the credit-saving effects that he expected. He was reported to credit bureaus as delinquent during the entire repayment period. That’s how the plan works. [More]

Consumerists, How Do I Deal With Credit Card Companies Now That I've Lost My Job?

Newly unemployed, credit card debt-carrying Lilgaladriel wants some advice on how to deal with the credit card companies. He writes: [More]

FTC Files Contempt Charge Against BlueHippo For Continuing To Rip Off Customers

Today the FTC lodged a contempt charge against scammy no-credit-needed electronics seller BlueHippo, saying that the company hasn’t honored its prior agreement to stop scamming customers. BlueHippo agreed to pay back $3.5 million nearly two years ago to reimburse customers who never received the computers they pre-paid for, but the FTC says since then the company has sucked another $15 million out of customers.