More than 6,300 Missouri residents will receive refunds or have their debts voided after the state’s attorney general reached an agreement with an online payday lender based on a Sioux reservation in South Dakota. [More]

payday lending

Missouri AG Shuts Down Eight Online Payday Lenders Operating From South Dakota Reservation

Online Payday Lending Companies To Pay $21 Million To Settle Deception Charges, Must Waive $285M In Loans

It’s no secret that payday lending companies charge high interest rates and a butt-load of fees for their small dollar, short-term loans. Payday lending companies break federal laws by not being upfront about the often highly inflated fees they charge. The FTC today jumped in to block two online payday lending companies from preying on consumers with the highest fine ever levied against a payday lender. [More]

Protecting Military Servicemembers From Predatory Loans Is A National Security Issue

In recent years, we’ve written a number of stories about laws aimed at protecting active-duty servicemembers and their families from predatory loans and the businesses that try to take advantage of loopholes in these rules. Some readers have asked why members of our armed forces merit protections not available to civilians. But this isn’t about just doing something nice for our soldiers; it’s about removing a threat to national security. [More]

1-In-4 Americans Turn To Payday Loans & Other High-Cost Financial Products

When discussing the topic of payday loans — or other high-cost, short-term financial products like auto-title loans and check-cashing — there can be a tendency to treat them like something that only a small percentage of Americans use. But a new report from the FDIC confirms that 25% of us have turned to one of these potentially predatory services in the past year, and that this rate has not been going down. [More]

The Best Lines From John Oliver’s Takedown Of The Payday Loan Industry

As regular readers of Consumerist know, we’re not exactly fans of the payday loan industry. If we were snotty teens and lived in the same neighborhood as Mr. Payday, we’d leave a flaming bag of dog poo on his doorstep. That’s why it was so nice to see our disgust for payday loans shared by John Oliver on HBO’s Last Week Tonight. [More]

CFPB: ACE Cash Express Must Pay $10M For Pushing Borrowers Into Payday Loan Cycle Of Debt

Another payday lender faces a hefty fine — to the tune of $10 million — for allegedly pushing borrowers into a cycle of debt. [More]

Bank Of America Agrees To Scan For Illegal Payday Lenders In NY

Payday lending is illegal in more than a dozen states, including New York, but some lenders manage to fly under the radar by operating online or hiding their loans as part of another business. In an effort to crackdown on loans that violate state laws, New York has created a database for banks to use to help identify sketchy lenders, and Bank of America — no stranger to the issue of questionable loans — is the first to sign on. [More]

CFPB Report Confirms Payday Lenders And Debt Collectors Are The Worst

For decades, payday lenders and debt collectors did their work while being largely ignored by federal financial regulators. And a new report from the Consumer Financial Protection Bureau, which recently gained oversight authority over the largest of these businesses, calls out many of the sketchy, sometimes illegal, practices some in these industries have been getting away with for far too long. [More]

Payday Lenders Can’t Use Tribal Affiliation To Garnish Wages Without Court Order

For years, a handful of sketchy payday lenders have been using purported affiliations with tribal lands to try to skirt federal and state laws. But courts and regulators have recently been cracking down on these operations, saying that a tribal connection does not shield a business from prosecution. One operation facing charges from the Federal Trade Commission has now agreed to pay nearly $1 million in penalties over charges that it illegally garnished borrowers’ wages and wrongfully sued them in tribal courts. [More]

Believe It Or Not, Outlawing Payday Loans Will Not Lead To Looting & Pillaging

Critics of payday lending say the practice traps many borrowers in a debt spiral, forcing them to take out additional loans to pay back the first. Yet these short-term loans do have proponents (many of them profiting from the industry) who claim that without this pricey option for quick cash, desperate consumers will turn to more unsavory means, leading to increased crime rates and other doom and gloom predictions. But does that really happen? [More]

CFPB In “Late Stages” Of Working On Rules To Stop Predatory Payday Lending

Lisa took out a payday loan to help pay her rent. When she couldn’t repay the loan after 14 days she rolled it over, bringing her total debt to $800. After repaying more than $1,400, she remains stuck in the revolving door of debt associated with payday lending. It’s stories like these that the Consumer Financial Protection Bureau aims to stop with new rules to regulate the payday loan industry. But those in the payday industry say Lisa should have simply known better. [More]

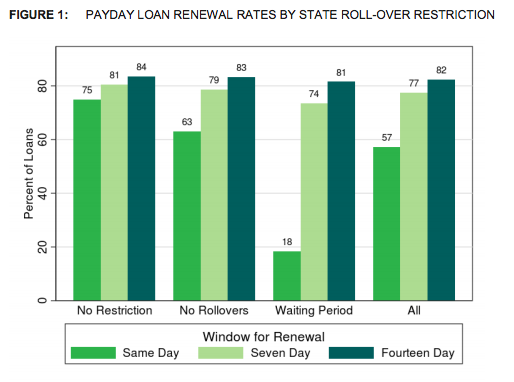

4 Out Of 5 Payday Loans Are Made To Consumers Caught In Debt Trap

The revolving door that is the payday lending debt trap is real. The high-interest, short-term loans may even be more damaging to consumers that previously thought. Four out of five payday loans are rolled over or renewed every 14 days by borrowers who end up paying more in fees than the amount of their original loan, a new Consumer Financial Protection Bureau report finds. [More]

Banks Ditched Payday Lending-Like Programs, But What’s Next?

Bank may have exited the payday lending business this month, but that doesn’t mean their next foray into small dollar loans will be any less predatory. That’s why the National Consumer Law Center is urging banks to show leadership in developing affordable credit options for consumers. [More]

And Then There Was One: Wells Fargo, U.S. Bank Discontinue Payday Loan Products

The small victories are adding up in the battle against predatory loans this week. Wells Fargo and U.S. Bank announced they will discontinue high-risk payday lending programs. [More]

Arizona Becomes 16th State To Punch Payday Lenders In The Face

Arizona is about to say goodbye to predatory payday lenders who issue loans with annual interests exceeding 460%. On Thursday a decade-old law will expire, capping interest rates at 36%. The predatory lenders begged to keep the law in force, but voters and the legislature just sat back and gave the industry a big, slow, deserved punch right in the face. [More]

Lose Your Job? Don't Worry, Our Exorbitant Payday Loan Fees Are On Us

Do you need cash right now, but are worried that you might lose your job in the next two weeks? Guarantees for customers who lose their jobs have worked for Hyundai, Ford, GM, and Sears, so now the practice has expanded to the payday loan industry.

House Preparing To Legalize Payday Loans With 391% APRs

A House subcommittee wants to legalize payday loans with interest rates of up to 391%. Lobbyists from the payday industry bought Congress’ support by showering influential members, including Chairman Luiz Gutierrez, with campaign cash. The Congressman is now playing good cop, bad cop with the payday industry, which is pretending to oppose his generous gift of a bill.

Ohio Payday Lenders Lie, Bribe The Homeless In Attempt To Overturn Usury Limits

Ohio payday lenders, still smarting from their punch in the face, are turning to lies and deceit to qualify a ballot initiative that would overturn the state’s recently approved usury limits. The industry’s petition gatherers are telling people that the initiative would “lower interest rates,” even though it would raise the maximum allowable APR from 28% to an astounding 391%. They’re also giving dollars to illiterate homeless people who sign the petition.