The state of Illinois has filed a lawsuit against payday lender Check Into Cash, but not for its short-term lending practices. Instead, the company is accused of exploiting its low-wage employees by forcing them to sign non-compete agreements that restrict their ability to find jobs elsewhere. [More]

payday lending

Operator Of Payday Lending Venture Found Guilty Of Racketeering, Other Charges

Nearly two years after federal authorities arrested the man behind the company responsible for one of the scammiest payday loans Consumerist has ever seen, the man and his lawyer were convicted of racketeering related to running a $3.6 million online payday lending operation that exploited more than 4.5 million people. [More]

Financial Protection Bureau Finalizes New Rules To Curb Predatory Lending, But Will Congress Let It Happen?

In an effort to rein in short-term, high-cost loans that often take advantage of Americans who need the most help with their finances, the Consumer Financial Protection Bureau has finalized its new rule intended to make these heavily criticized financing operations to be more responsible about the loans they offer. But will bank-backed lawmakers in Congress use their authority to once again try to shut down a pro-consumer regulation? [More]

Payday Lenders Go To Court In Attempt To Keep Working With Banks

The payday lending industry claims that recent regulatory efforts to rein in short-term, high-interest loans have severely restricted their access to traditional banks. Now a trade organization representing the controversial lenders has asked for a federal court to intervene. [More]

Payday Lending Trade Group Promises To Clean Up Misleading Online Ads

Google dealt a big blow to the payday lending industry, when it recently decided to ban the short-term/high-cost lenders’ ads from search results. At the same time, federal regulators are pushing for stricter regulations on these controversial financial products. Now a payday lending trade group is hoping to do some damage control by creating a program to identify companies making misleading claims in online ads. [More]

DNC Chair Walks Back Her Opposition To Payday Lending Reform

Only three months ago, Florida Congresswoman and chair of the Democratic National Committee Debbie Wasserman-Schultz was actively lobbying her fellow lawmakers in opposition to pending reforms for the payday loan industry, finding nothing wrong with lenders who charge interest rates in the range of 300% to people in dire need of cash. Now that the actual rules have been announced, the legislator has had a sudden change of heart. [More]

Consumers, Payday Lending Employees Face Off On Proposed Short-Term Lending Rules

Consumer advocates, regulators, and representatives of the small-dollar lending industry descended upon Kansas City on Thursday to discuss the Consumer Financial Protection Bureau’s long-awaited proposed rules intended to rein in predatory lending. [More]

Google Invests In Payday Lender While Banning Ads For Payday Loans

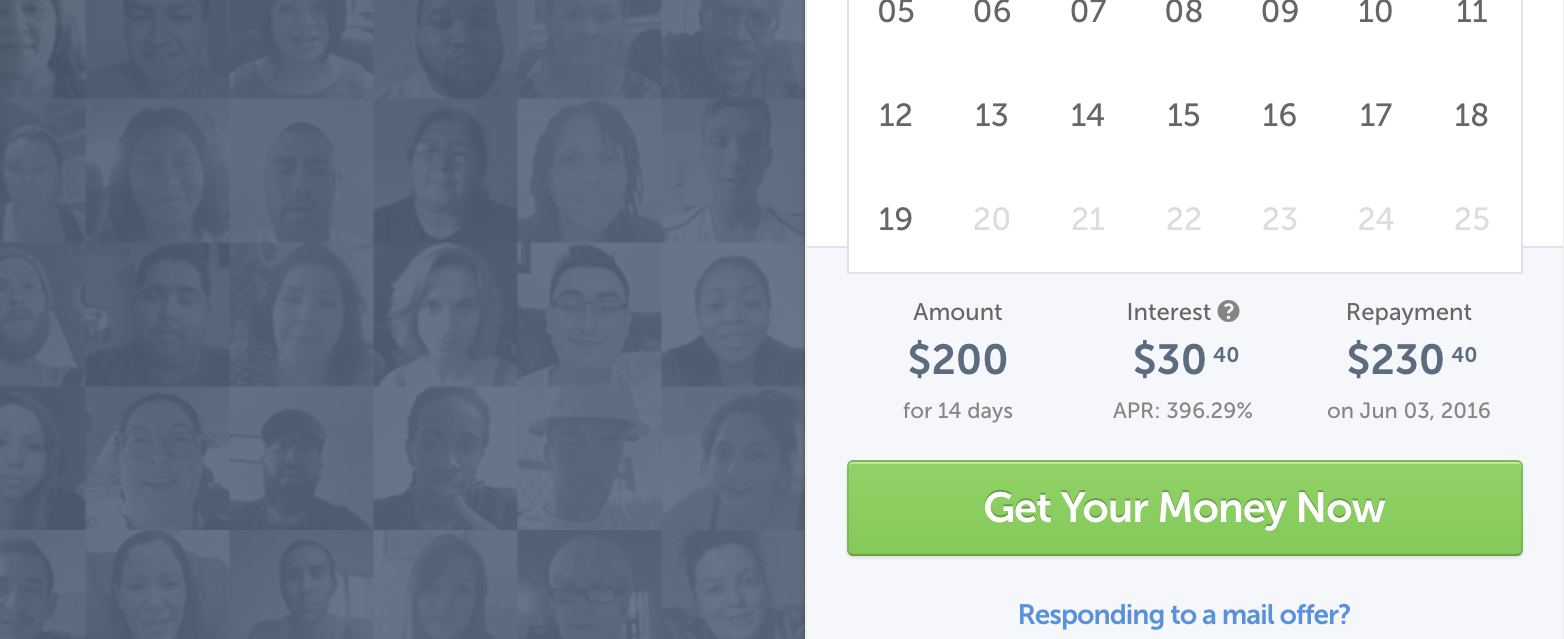

Last week, Google announced it would no longer include ads for payday lenders — financial services, outlawed in many states, that offer short-term, small-dollar loans, often with triple-digit interest rates — to protect “users from deceptive or harmful financial products.” All the while, Google’s parent company is investing in a startup that offers loans with annual percentage rates as high as 600%. [More]

Online Payday Lenders Could Be Worse Than Traditional Payday Lenders

The typical outsider’s view of payday lending involves seedy looking storefront shops in strip malls near pawn shops and bail bonds, so the idea of going to a short-term lender with a cleanly designed, professional website might seem more appealing (not to mention convenient). However, a new report finds that online payday loans may wreak more financial havoc than their bricks-and-mortar counterparts. [More]

Religious Groups Call On DNC Chair To Denounce Pro-Payday Loan Bill

Faith-based community organizations are among the loudest voices in the battle against predatory lending practices like payday loans. And while most of their efforts are on education and local reforms, a coalition of these groups is thinking nationally, calling on Congress, including the chair of the Democratic National Party, to rethink their support a pro-payday loan piece of legislation. [More]

DNC Chair Backs Pro-Payday Loan Bill; Thinks 300% Interest Is A Consumer Protection

You currently can’t get Republican and Democratic lawmakers to agree on a lunch order, let alone jointly support legislation. But one controversial piece of legislation is not only garnering support from both sides of the aisle, it’s also got the Chair of the Democratic National Committee pushing for legislation that would undermine the Consumer Financial Protection Bureau’s ability to regulate predatory lending. [More]

Bank-Backed Lawmakers Accuse CFPB Of Hurting Consumers By Trying To Regulate Payday Loans

It’s never a good sign for the Consumer Financial Protection Bureau when it’s called to testify at a Congressional subcommittee hearing subtitled “The CFPB’s Assault on Access to Credit and Trampling of State and Tribal Sovereignty.” And so it should come as little surprise that bank-backed members of the House Financial Services Committee is trying to paint the agency’s efforts to rein in predatory lending as an attack on the very people the CFPB is trying to protect. [More]

Two Payday Lenders Agree To Pay $4.4M In Fines, Release Borrowers From $68M In Loans, Fees

Federal regulators continued an ongoing crackdown on deceptive payday loan players by reaching a multimillion-dollar agreement with two lenders to settle accusations they illegally charged consumers with undisclosed and inflated fees. [More]

Connecticut Tribes Join State Leaders In Fighting Unlicensed Payday Lending By Oklahoma Tribe

The fight against payday lenders operating through affiliation with Native American tribes to skirt Connecticut law escalated this week as leaders of the state’s federally recognized Indian tribes joined forces with state officials to denounce the often financially devastating credit practice. [More]

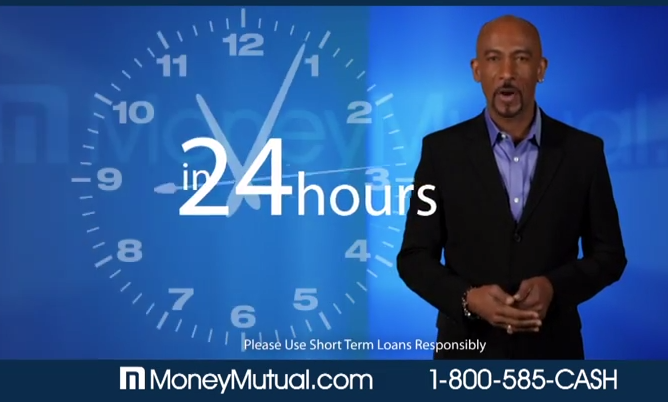

Montel Williams-Endorsed MoneyMutual To Pay $2.1M Penalty

For years, TV personality Montel Williams has been the daytime TV face of payday loan lead generation service MoneyMutual, even as it faced investigations from federal and state agencies. Just a few days ago, Montel got into a Twitter spat with a woman who questioned why he was acting as a spokesperson the company, and showed that maybe he needed a refresher course on annual percentage rates. But as part of a deal with regulators in New York state, Montel will no longer market payday loans in the state and MoneyMutual will pay a $2.1 million penalty to settle allegations that it illegally marketed payday loans to New York residents. [More]

Faith V. Greed: The Battle Between Faith-Based Organizations And The Payday Loan Industry

“The Bible condemns gaining wealth through usury; and the writers of Scripture warn about gaining wealth through exploiting the poor… [but] The State of Alabama allows Payday lenders to charge an annual interest rate of 456%.” [More]

Are The Comments Opposing Payday Loan Rules Legitimate?

Last summer, the Consumer Financial Protection Bureau released proposed rules intended to prevent borrowers from falling into the costly revolving debt trap that can leave people worse off than if they hadn’t borrowed money in the first place. Since then, those in the payday lending industry have ramped up their efforts to ensure the proposal isn’t finalized. [More]