Freddy was furious. $126 in overdraft fees? Even though his balance is sometimes down to the wire, he is careful to make sure he has enough funds in his account. Ah yes, but this doesn’t account for when they mess up. [More]

overdraft fees

Bar Charges Me Twice For A Drink, I Get $126 In Overdraft Fees

Freddy watches his balances like a hawk, so he was surprised when TD Bank hit him for $126 in overdraft fees. Turns out the bar he had gone to had accidentally charged his debit card twice for one of his drinks, and though he was careful to stay within his low balance, it set the stage for a cascade of fees. [More]

Chase Approves Transaction Anyway After Customer Declines Overdraft Protection

Paul opted not to sign up for Chase’s overdraft fee trap–oh wait, they call it “protection”–but Chase happily ignored this fact and approved a transaction anyway, which led to a $34 overdraft fee that they refuse to reverse. The loophole they’re using to get around Paul’s opt-out is that the vendor was someone he’d authorized in the past, and therefore this new transaction isn’t protected from the bank’s “protection” fee. [More]

North Dakota Court Says Bank Can Rob Customer Of $12K In Overdraft Fees

If you live in North Dakota and find yourself buried in overdraft fees, don’t go crying to the state’s Supreme Court. Judges ruled that a bank was within its rights to stick a hog farmer with $12,000 in overdraft charges. [More]

Bank Of America Patents Method For Denying Refunds

Ah, innovation! Bank of America was just awarded a patent for a process that lets it make sure any teller at any branch will know not to give you a refund on a disputed overdraft fee. According to Techdirt, the idea is to prevent “refund shopping,” where a customer might visit multiple branches hoping to find a sympathetic ear. [More]

Consumerist On Marketplace: Bank Gives You 24 Hours To Fix Overdrafts

I was on Marketplace on public radio this morning, chiming in about Huntington Bank’s new 24-hour grace period they’re giving customers who overdraft. If you deposit the funds you’re lacking within a day, no fee, but if you don’t, you’ll get a $23 charge. This program is automatic, you don’t need to be enrolled in overdraft protection. Sounds nice and innovative, but I’d rather the bank deny the charge and get no fee instead. Here’s the audio: [More]

Chase Just Goes Ahead And Adds Overdraft Protection To Your Account

Lori called up Chase to tell them that she was traveling internationally in the next few weeks. She wanted them to note her account so there wouldn’t be any blocks when charges from far-away countries started appearing. Then the fast-talking rep just sort of added overdraft protection to Lori’s account, just casually worked it in there, like she was doing her a courtesy. [More]

Branch Manager Quits Rather Than Trick Bank Customers Into Signing Up For Overdrafts

The bank branch manager who felt uncomfortable that his bank was making him choose between misleading customers into signing up for overdraft protection and keeping his job has decided to quit. [More]

Wells Fargo Ordered To Pay $203 Million For Processing Transactions High To Low, Maximizing Overdraft Fees

A California judge ordered Wells Fargo to pay California customers $203 after finding that the bank had deliberately manipulated the way it processed transactions in a way that turned one overdraft fee into as many as 10, at $35 a pop. [More]

Banks Told To Target Financially Unsavvy For Overdraft Reup

Consulting firms are telling banks to hone in on the financially precarious to sign back up for costly overdraft protection that will only further erode their bank account. Here are some quotes from their strategies: [More]

Get Customers To Sign Up For Overdraft Fees Or Get Fired

One of our readers is a bank teller branch manager and he feels queasy. His bank is making him trick customers into signing back up for overdraft fees, and if he doesn’t, he’ll get fired. [More]

Banks Must Now Ask You To Opt In To Debit Card Overdraft Plans

If you’re opening a new bank account today, don’t be surprised if you’re asked to enroll in an overdraft plan for debit-card purchases. And don’t be afraid to say no, either. Today’s the first day that banks have to ask your permission to enroll you in such plans; yesterday, they could have just signed you up automatically. If they did, though, you can still back out. Existing bank customers must opt in no later than August 15th if they want to keep their overdraft “protection.” [More]

Banks Luring You Into Signing Back Up For High Overdraft Fees

Banks are mad they can’t just automatically charge you a $35 overdraft anymore if you happen to try to buy a candy bar without enough cash in your account. Newly enacted legislation says they have to get you to opt-in to such overdraft programs. So, what they’re doing is renaming the overdraft programs something else, making them sound awesome, and then blitzing your mailbox and inbox with up-sells. Some banks are even calling people up! [More]

I Have $132 In Overdraft Fees After Bank Cashes Post-Dated Check

A Consumerist reader wrote into us today to tell us how he ended up with $132 in overdraft fees, not because he went on a spending spree and didn’t manage his finances correctly, but because his eager beaver roommate went ahead and deposited his post-dated rent check almost a full week early. [More]

Wells Fargo Pulls $4,000 From Checking Account To Repay Student Loan

When you borrow from a bank where you also keep your day-to-day cash, you might be opening yourself up to problems down the line. Most banks have a right of setoff, which means they can tap other accounts you hold with them to repay themselves money you owe. For a woman in Atlanta, this meant Wells Fargo legally drained her checking account without warning, leaving her and her husband with no cash and $385 in overdraft fees, due to some ongoing confusion over a student loan. [More]

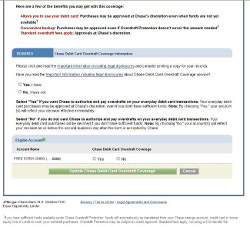

Is Chase's Overdraft Fee "Opt-In" Purposefully Confusing?

Reader Victor, a former WaMu customer who wasn’t exactly pleased to end up with Chase, thinks the bank’s Federal Reserve mandated on-line overdraft fee “opt-in” form is purposefully confusing. He’s sent a screenshot so you can take a look for yourself. [More]

How To Ensure You're Never Stuck With Overdraft Fees

Robb wrote in with a suggestion on how to bank without ever getting stuck with an overdraft fee — make sure as many plastic purchases as possible come from prepaid cards. His method seems like a hassle but may be worth the effort for those who can’t keep tabs on their checking account balances. [More]

I Spent $94 And Was Stuck With Nearly $500 In Overdraft Fees

Max bunched together $94 worth of purchases with his Wells Fargo debit card that somehow racked up $480 in overdraft fees because he was dinged with a fee for each of his purchases. An Executive Email Carpet Bomb resulted in whittling $150 off the balance, but that still leaves a nasty $330 in fees hanging over Max’s head. [More]