One might assume that banks marketing to U.S. military servicemembers would not be out to nickel and dime these men and women with unnecessarily high fees on their accounts. But among those financial institutions levying the highest level of fees on its account-holders are several that not only market to the military but also have branches on military bases. [More]

overdraft fees

BOfA Stops Overdraft-Friendly Practice Of Re-Ordering Transactions From High To Low

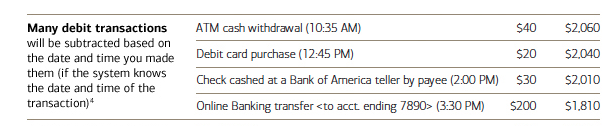

As we’ve noted multiple times over the years, some banks love to lump all transactions made by a customer during a day or weekend together and then process them not in the order they were received, but from largest to smallest. For customers on the brink of overdrafting, this can result in numerous fees that may have been avoided if the charges had been processed chronologically. In a rare bit of positive Bank of America news, the bank has decided to stop this high-to-low transaction processing (for many debit purchases). [More]

CFPB: Bank Customers Leaking $225 In Overdraft Fees Per Year On Average

Why is your bank account leaking so much money ever year? Where does it all go? Checking account customers are bleeding funds to the tune of about $225 per year on average, the Consumer Financial Protection Bureau says in a new study. That means that despite regulations aimed at lessening the effects of overdraft fees and clear up the whole process. [More]

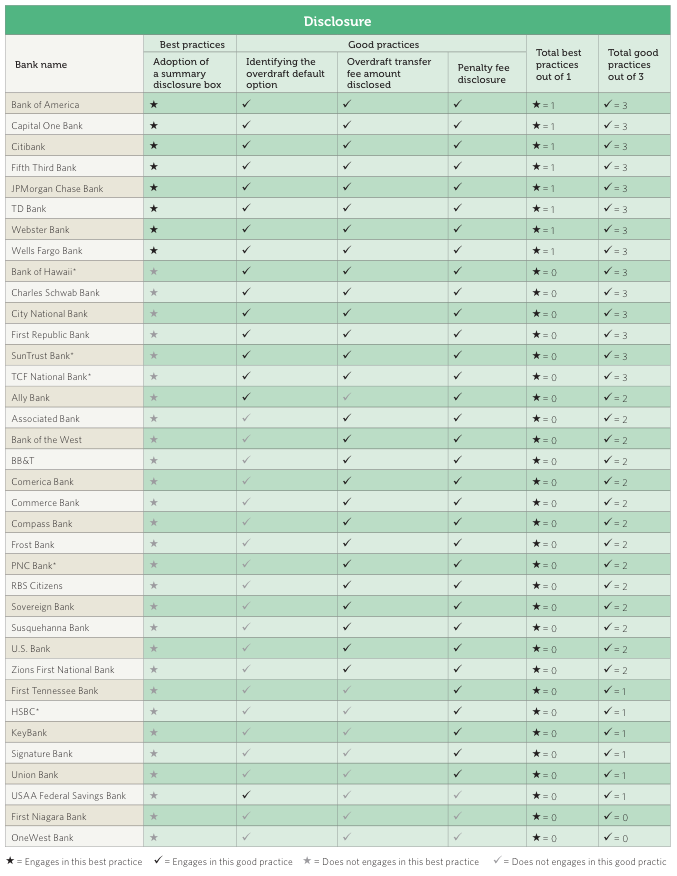

Consumer-Friendly Checking Account Practices Vary Wildly From Bank To Bank

Unless you’ve been hiding under a bed for the last six years, you probably know that the banking industry isn’t exactly beloved by many American consumers. As a reaction to public sentiment (and threats of regulation), a number of banks have begun phasing in some more consumer-friendly practices, but a new study shows these changes are not industry-wide and that several banks are still years behind. [More]

Banks Raking In Billions In Profits From Overdraft Fees

The notion behind an overdraft fee — in which a bank customer is charged a penalty for overdrafting his account — is twofold: To incentivize consumers to pay attention to how much money is in their accounts, and to allow the bank to recoup any money it lost by covering the overage. But a new report claims that these fees have become such a profit center for banks that it’s now in their interest to push account-holders with low-balance bank accounts toward overdrafting. [More]

Here’s Where Your Money Is Going: Consumers Paid $32 Billion In Overdraft Fees Last Year

Making the case for new overdraft legislation is a pretty big bit of evidence that shows just how hard those fees hit our wallets: Last year consumers paid a whopping $32 billion in overdraft fees, a $400 million jump from 2011. This, despite regulations that seek to protect consumers from such hefty charges. [More]

New Legislation Seeks To Rein In Overdraft Fees

Bank overdraft fees can pile up rapidly, making it increasingly more difficult for a consumer to get back to zero, which is why Congresswoman Carolyn Maloney of New York recently introduced legislation aimed at limiting how much and how frequently banks can ding account holders for these fees. [More]

Court: Wells Fargo Misled Customers About Debit Card Transactions But Doesn’t Have To Pay Back $203 Million (Yet)

It was a good news/bad news day at the Ninth U.S. Circuit Court of Appeals yesterday, as the court set aside a $203 million judgement against Wells Fargo for the way it processed debit card transactions, but kept the door open to hope that consumers might see some of that money. [More]

CFPB To Take A Closer Look At Overdraft Fees

Expensive and complicated overdraft fees are pretty high on, if not at the top of, many bank customers’ complaint lists. So it only makes sense that the newly formed Consumer Financial Protection Bureau has decided to look into whether or not these fees are a fair way to keep people from overdrafting, or just a profit center for banks. [More]

BofA Scraps Plan To Let Customers Opt In To Overdraft Fees

As it paid out $410 million to settle a class-action suit over reordering transactions to maximize overdraft fees and backed down after initiating a $5 monthly fee for debit card users, Bank of America has done some soul-searching. The bank says it’s decided not to go ahead with a plan to let customers opt in to a $35 overdraft fee on debit purchases made with insufficient funds. [More]

Judge Approves BofA's $410M Overdraft Settlement

To settle a class-action suit over reordering transactions to maximize overdraft fees, Bank of America agreed to pay out $410 million months ago. A judge has now approved the settlement, and the bank has coughed up the money into an escrow account from which it will be distributed to customers who were part of the suit. Those who had a Bank of America debit card between January 2001 and May 24, 2011 will automatically receive a payment of at least 9 percent of the fees they paid. [More]

Bank Of America Paying Out $410 Million For Reordering Your Transactions To Maximize Overdraft Fees

What makes this Bank of America $410 million class action settlement special is that it’s over a basic consumer banking business practice. For years, banks have been processing your daily transactions in order from highest to lowest, rather than real-time. They say they’re doing us a favor so that if we have a check bounce, it’s the one for the babysitter and not the mortgage payment. But this class action suit claims that Bank of America did this to unjustly enrich itself. It’s one of over 60 lawsuits against various banks for similar practices, and it could reshape the entire industry. [More]

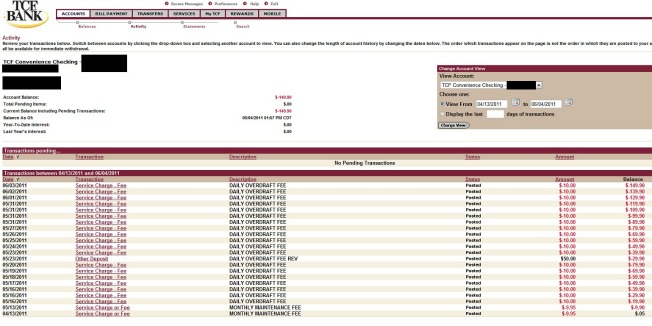

TCF Bank Won't Close $.05 Account, Prefers To Charge $149 In Fees

Reader DFCL says that he asked TCF Bank to close his account back in April as it only had a $.05 balance. Now it’s June, his account is still open, and he’s in collections for $149 in fees. Some very exciting things happened between those two points, including him offering to donate $500 to charity if they waived his fees. They declined his offer. [More]

Most Who Opted In To Overdraft Protection Were Wrong About How It Worked

One of the results of the regulatory overhaul was that banks couldn’t automatically enroll people in “overdraft protection.” This kicked off a mammoth effort by banks to try to convince customers it was in their best interest to sign up for a program that would let them get charged $35 for overdrafting a $1 candy bar rather than go through the pain and humiliating of having a card declined. But a new survey by the Center for Responsible Lending found that most of the people who did opt in either had a misconception about how the overdraft protection, or simply wanted the ceaseless onslaught of pitches from their bank about it to stop. [More]

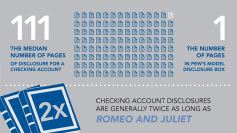

Checking Account Disclosure Documents Are Longer Than Romeo & Juliet, Contain Less Teen Sex

We recently wrote about the PIRG study showing how fewer than 40% of banks were willing to clearly disclose checking account fee schedules. Now a new report from the Pew Charitable Trust demonstrates just how far banks are willing to go to make it difficult for consumers to know what they are getting with their checking accounts. [More]

Wachovia's Lame Attempt To Get You To Sign Up For Overdraft Fees

Wachovia sent out an eblast trying to get people to sign back up for overdraft protection, and the fees that “service” entails. [More]

Chicago Restaurant Owes $118K In Overdraft Fees, May Have To Close

If you’ve felt the burn of a $35 overdraft charge, just be thankful you’re not Chicago’s Heartland Cafe, which has had to shell out $118,000 in cascading overdraft charges. [More]