Perkstreet wasn’t a bank. It partnered with online banks and gave users a debit card that provided rewards just as rewarding as those from the best credit card rewards programs, but without the temptation to get into debt. Seems ideal, and also seems too good to be true. It was. Perkstreet executives have explained the problem very bluntly: they’re out of money and can’t pay out everyone’s accrued award balances. [More]

out of business

Pool Manufacturer Shuts Down, Leaving Homeowners With Empty Pits And Liens On Their Homes

The Aqua Pool & Spa company in California had been building pools for over 20 years and had built up a good reputation, but after a bank went under and called in a $3 million loan, the company abruptly laid off everyone last week and shut its doors. Now everyone who was in the process of getting a pool built is stuck with torn up yards and half-finished pools. What’s worse, subcontractors are now dunning those customers for payment for services or supplies, even when the homeowners already paid (through Aqua Pool & Spa) months earlier. [More]

Need A New Car? Consider A Saturn

The Washington Post notes that although Saturn dealerships have until this time next year to close, many will be saying goodbye sooner due to low inventory, and that’s partly why now is a good time to buy a Saturn. That is, if you don’t plan on reselling it in a couple of years.

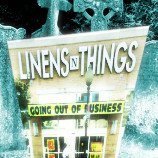

Linens 'N Things Resurrected (In Canada)

In today’s marketplace, going out of business doesn’t mean you go away forever. Your storefronts may disappear, but you’ll just pop up again online—like CompUSA and Circuit City—or you’ll come back on someone else’s shelves as a brand, like Linens ‘N Things.

../..//2009/07/06/hershey-is-closing-its-online/

Hershey is closing its online store (www.hersheygifts.com) at the end of the month, saying they can’t keep it running in this economy. If you like their “chocolate” products, everything on the site is on sale for 25% off. [LA Times] (Thanks to Robert!)

Alan Thicke Can't Save Tahiti Village Timeshare Company From Going Under

Even the hearty television presence of Alan Thicke couldn’t help Consolidated Resorts, Inc., a company owned by Goldman Sachs that sold timeshares, from going belly up. An anonymous tipster emailed us yesterday to say that they “just laid off most of their staff, including all collections, customers service, marketing, information technology departments.” And according to this insider, this is good news for consumers.

Store Goes Out Of Business Before Delivering Crib

Christopher and his wife bought a crib through a local store, and two and half months later they still haven’t received it. Now the store is going out of business, and Christopher isn’t sure what he can do to get his money back.

../..//2009/03/26/if-you-use-filefront-finish/

If you use Filefront, finish up your business with them and say goodbye before March 30th, because they’re shutting down. [filefront] (Thanks to RT!)

If We Buy This And Give It Back To You, Will You Read It, Circuit City Execs?

After seeing our photo evidence of the sorry state of the St. Peters, MO, Circuit City yesterday, Eric decided to check out the final days of the Circuit City in Poughkeepsie, NY. He writes, “On one clearance table, among the overpriced cables, I saw this. I’m not sure what this was doing there, but it’s probably something the Circuit City executives should have read a few years ago, huh?” Yes, but it’s never too late! Those executives are going to end up working somewhere after all. By the way, do CC execs get a liquidation discount?

Peanut Corp Has Gone Out Of Business

It was bound to happen, and it looks like it just did: Peanut Corporation of America has filed for Chapter 7 bankruptcy, and will liquidate its assets to pay off creditors.

Fortunoff Files For Bankruptcy (Again)

Regional jeweler Fortunoff has thrown in the towel and filed for bankruptcy today. The retailer cited terrible holiday sales, a “severe liquidity crisis” in January, and the cost of expanding its jewelry line into Lord & Taylor stores as reasons. Fortunoff was brought out of an earlier bankruptcy about a year ago by a private equity firm, but it didn’t take.

"Why Circuit City Failed"

Now that Circuit City has finally sputtered out, it’s fun to talk about what did them in—see their firing-your-best-employees stunt a few years back, for example. But what do former Circuit City employees think? This guy worked with them from 1997 to 2002, and he says for one thing, they should have never stopped carrying appliances.