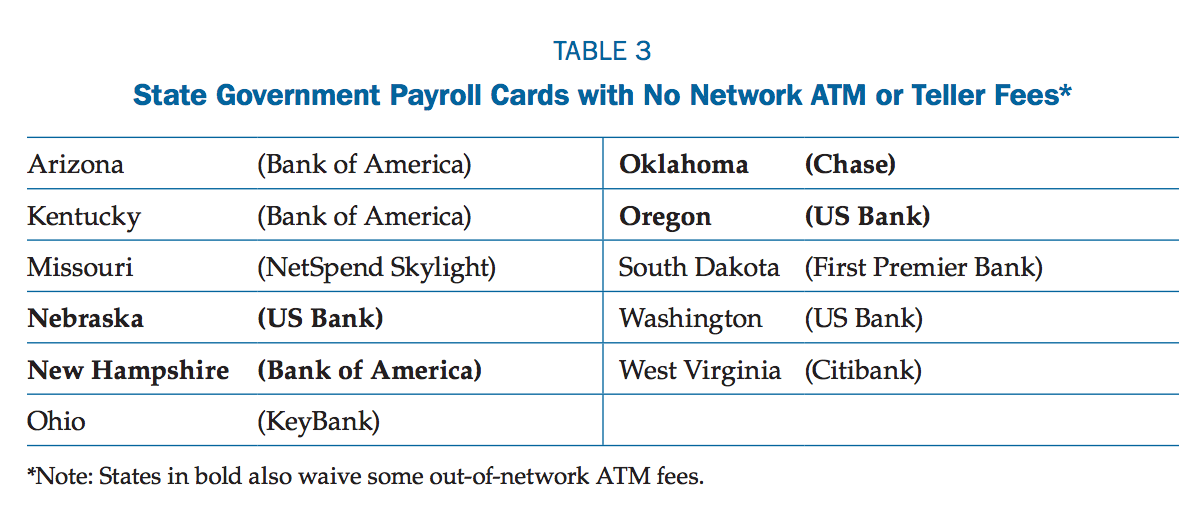

Using payroll cards to pay employees is an increasingly popular replacement for traditional checks. In fact, 19 states now use these cards to pay state workers who don’t use direct deposit. And while some of these cards provide employees with easy and affordable access to their funds, most are merely adequate, and some exorbitant fees that can eat into users’ finances. [More]

nclc

Undercover Investigation Finds Serious Problems With Paid Tax Preparers

With the deadline for filing your annual tax return coming quickly, millions of Americans are putting their 1040s and other forms in the hands of largely unregulated paid tax preparers. But a new undercover report from the National Consumer Law Center finds that many of these preparers either don’t know what they’re doing or are allowing taxpayers to file false information. [More]

60,000 Consumers Call On FCC To Not Allow Robocalls To Cellphones

Earlier this year, we told you how the American Bankers Association was seeking exemptions from the FCC that would allow banks to get around a law that forbids businesses from robocalling cellphones without prior approval. Today, 60,000 consumers are telling the FCC to just say now to the banks’ request. [More]

Is It Time For Regulators To Stab Zombie Debt Through The Brain?

What a lot of people don’t know — and what debt collectors rarely mention — is that most unpaid debt has an expiration date after which you can’t be sued for repayment. And even fewer consumers are aware that this dead debt can be sparked back to life by making a payment after it’s already passed on to the debt afterlife. A new report calls on federal regulators to make sure that debt doesn’t rise from the dead in zombie form. [More]

Beware Of Unprepared, Unscrupulous Tax Preparers

While one might assume that it requires a modicum of tax expertise and perhaps some sort of certification to be a paid tax preparer, the sad fact is that most states have little to no standards for selling tax preparation services, meaning that once again millions of Americans are being put at risk when seeking help with their tax returns. [More]

No Surprise Here: Credit Reports Created With Your Online Information Are Mostly Inaccurate

More than 64 million Americans are cut off from access to traditional banking because they lack credit history. To better serve these unbanked consumers financial institutions are relying on the promises of big data brokers to accurately determine the creditworthiness of consumers. But is the new method a reliable way to provide affordable access to credit? Not really, a new report by the National Consumer Law Center points out. [More]

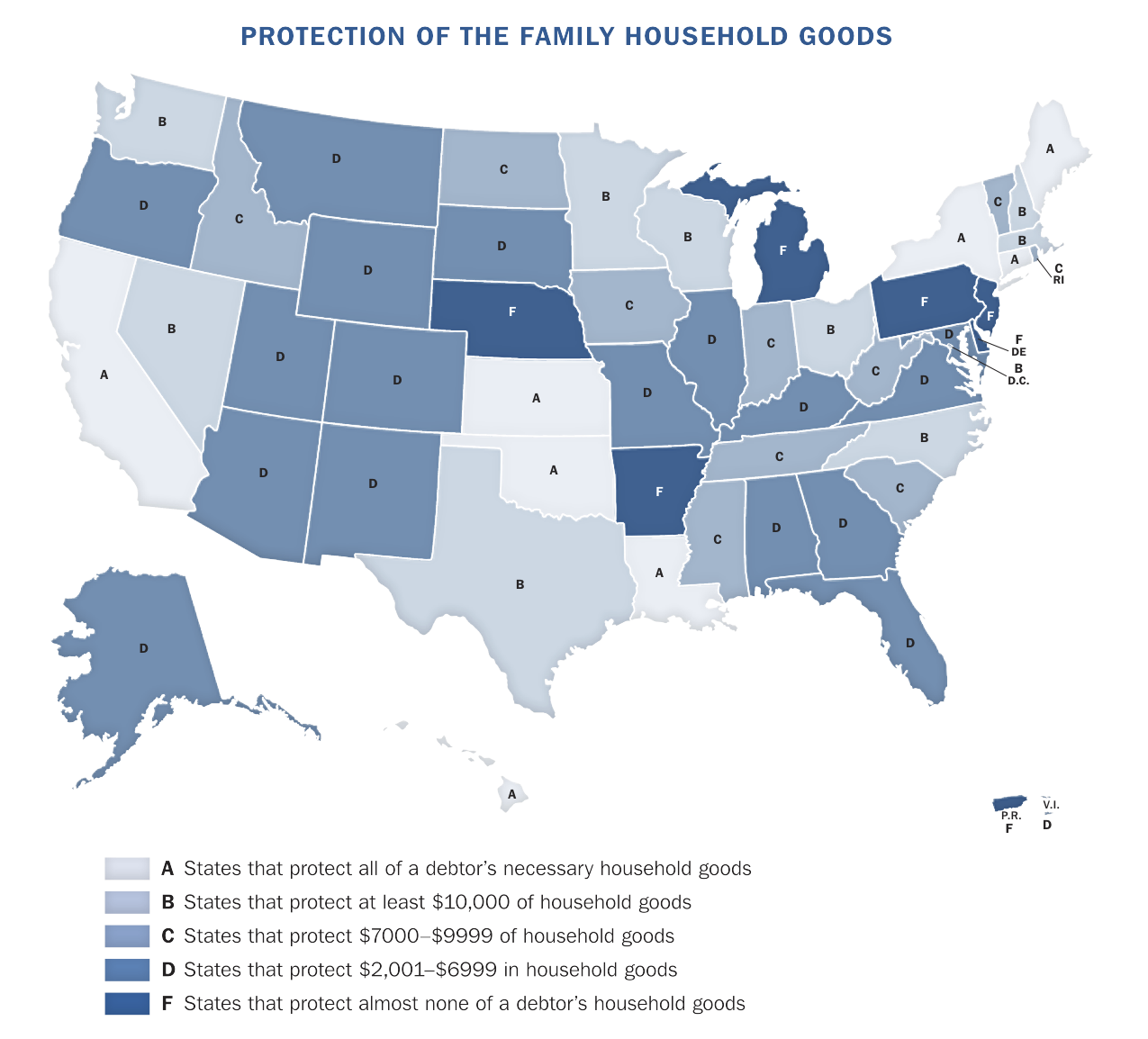

In Vermont, Debt Collectors Can’t Seize Your Goats Or Bees, But Your Car May Be Up For Grabs

Every state has some level of protection for debtors so that they are able to continue living and working while repaying their debts. But the level of protection covers the spectrum from protecting reasonably priced homes, vehicles, and necessary goods, to protections so minimal that the debtors will likely remain in the red, unable to ever climb out of debt. [More]

Banks Raking In Billions In Profits From Overdraft Fees

The notion behind an overdraft fee — in which a bank customer is charged a penalty for overdrafting his account — is twofold: To incentivize consumers to pay attention to how much money is in their accounts, and to allow the bank to recoup any money it lost by covering the overage. But a new report claims that these fees have become such a profit center for banks that it’s now in their interest to push account-holders with low-balance bank accounts toward overdrafting. [More]