Crapple writes: [More]

mutual funds

../..//2008/01/10/if-youre-looking-to-invest/

If you’re looking to invest in mutual funds and avoid capital gains tax, Vanguard Tax Managed International Fund (VTMGX) and Third Avenue Value Fund (TAVFX) are recommended as funds to look into, along with index funds and ETFs (exchange traded funds) in general. [WSJ]

../..//2007/11/28/thinking-of-selling-a-mutual/

Thinking of selling a mutual fund soon? You might get tax savings if you do it before the year-end distributions. [Kiplinger]

How To Tell A Good Stock Picking Strategy From A Faulty One

Okay, so Jack Hough’s column in SmartMoney this week is really just an extended ad for his new book. But in this case, the content of the book is something valuable that we think a lot of Consumerist readers will want to know about: how to identify reliable stock picking strategies.

Is Wall Street Killing America?

Wall Street’s relentless drive for short-term profit is ruining corporate America and the consumer experience, according to John Bogle, founder of the Vanguard Group. The overseer of one of the world’s largest mutual funds appeared on Bill Moyers Journal to discuss a New York Times investigation that revealed substandard care at nursing homes owned by investment firms. According to Bogle, the trend is not contained, and has dire long-term consequences:

The financial sector of our economy is the largest profit-making sector in America. Our financial services companies make more money than our energy companies — no mean profitable business in this day and age. Plus, our healthcare companies. They make almost twice as much as our technology companies, twice as much as our manufacturing companies. We’ve become a financial economy which has overwhelmed the productive economy to the detriment of investors and the detriment ultimately of our society.

Investors Don't Like Mutual Funds Anymore?

USAToday is reporting that US stock funds, once the darling of investors, aren’t drawing dollars like they used to.

Example Of Multiple Buy Low Sell Highs

As far as our novice eyes can tell, this transaction chart, found at thewallstreetbully, demonstrates the concept we posted last week of buying low and selling high within a single investment over time.

Thinking Differently About "Buy Low, Sell High"

We’ve been reading this weekend’s New York Times mutual funds report sitting on our kitchen table a little bit at a time for breakfast and something we saw in, “Don’t Pay Tax Twice On Your Fund Gains” changed how we thought about the old adage of “Buy Low, Sell High.”

"Now, Everyone Wants A Dishwasher."

We were discussing expanding our mutual fund portfolio (not hard, as it only contains ONE fund right now) with our step-father and mentioned adding in some international and European funds.

What Are "12b-1 Fees?"

Another factor to consider when choosing a mutual fund are its 12b-1 fees, which are basically money the fund managers take out to pay for running and marketing the fund.

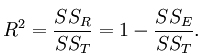

What Is R-Squared?

We’re trying to learn more about mutual funds, which we find quite frightening, so let’s start by breaking down some terms, like R-squared, a measure of volatility. Here’s what Vanguard says:

What Are "Expense Ratios?"

For the new investor considering mutual funds, one important comparison basis is their expense ratio.

Comparing Index ETFs and Mutual Funds

We understand that investing in index exchange trade funds (ETF) can be a good option for beginning investors, but what if you’re also looking at mutual funds, and you want to compare purchase costs between the two?

Financial Advisors Often Give Poor, Expensive Investing Advice

Want to get some investment advice that is expensive and doesn’t perform any better than other, less costly options? If so, ask your broker or financial advisor for investing advice. They’re much more likely to point you toward an investment with a “load” — a fee that ranges in price but generally runs 3% to 5% of your investment’s value — simply for them “recommending” it (some would say “selling” it is more accurate.)