Yelp is trying to change the way users visit restaurants — or the way in which they wait for a table with the $40 million purchase of Nowait, a startup that uses technology to streamline the seating process at restaurants around the country. [More]

murders and executions

FCC Chair Ajit Pai Has No Plans To Review AT&T/Time Warner Merger

In recent years, the FCC played a key part in blocking the mergers of AT&T and T-Mobile, and Comcast and Time Warner Cable, while also using its regulatory leverage to place pro-consumer conditions on the mergers it did approve — like getting Charter to agree to not use data caps for seven years. However, the FCC will apparently give AT&T its wish and not even chime in on the pending merger of AT&T and Time Warner. [More]

Verizon And Charter Romance Heats Up; Could Merger Marriage Be On Horizon?

Earlier this month, it was reported that Verizon has a thing for big cable companies that begin with the letter “C,” and that it really wants to make out under the bleachers with either Comcast or Charter. Now comes news that Big V has actually begun the courting process with the latter. [More]

Senators Call On AT&T And Time Warner To Explain How Merger Will Benefit Americans

During the campaign, then-candidate Donald Trump talked openly about putting a halt to the pending merger of AT&T and Time Warner, he has since appointed an FCC Chairman who has historically been pro-merger. That’s why a handful of Senators have called on the two companies to explain how this consolidation will be in the public interest. [More]

Verizon Reportedly Interested In Buying Comcast Or Other Big Cable Company

AT&T has been on a buying spree in the last two years, first snatching up DirecTV and its more than 20 million customers, and now trying to acquire the massive Time Warner media empire. The company’s nemeses at Verizon apparently have acquisition envy, and are mulling over a purchase of a cable biggie like Comcast or Charter. [More]

AT&T Thinks It Might Be Able To Avoid FCC Review Of Time Warner Merger

A merger of the nation’s largest pay-TV provider (and second-largest wireless service provider) and a major multimedia conglomerate with multiple cable channels might seem like a gimme for review by the Federal Communications Commission, but AT&T now thinks it may be able to avoid or minimize scrutiny from the agency in its efforts to acquire Time Warner. [More]

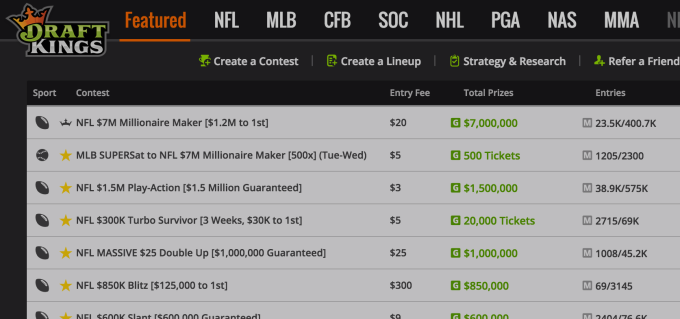

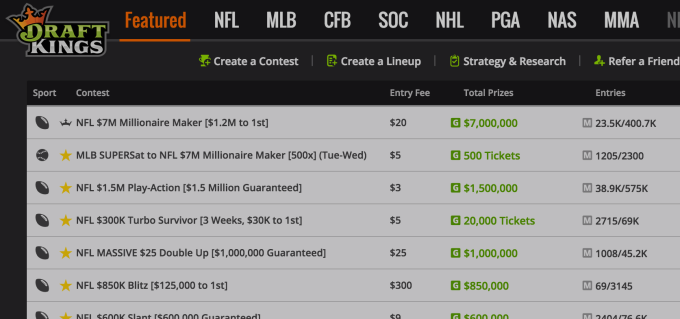

FanDuel & DraftKings To Merge In Daily Fantasy Wedding

After months of speculation and denials about a possible merger, the two biggest names in daily fantasy sports — DraftKings and FanDuel — have finally confirmed that they are indeed getting hitched. [More]

Rumors Of DraftKings & FanDuel Merger Heat Up Again

Nearly four months after DraftKings and FanDuel shot down rumors they were considering a merger, those “people familiar with the situation” are once again whispering about wedding bells between the two largest players in the daily fantasy sports industry. [More]

AT&T, Time Warner Stock Prices Fall Slightly Amid Merger Skepticism

Before the $85 billion merger of AT&T and Time Warner was official, it was already being decried by people in both presidential campaigns, consumer advocates, lawmakers, and former regulators. Amid this backlash to the news, both companies’ values have taken a bit of a ding today. [More]

Why AT&T Is Buying Time Warner, And Why So Many People Aren’t Happy About It

The time from new rumor to signed deal was only about two days, and yet here we are: AT&T is putting the moves on Time Warner, planning to bring the content powerhouse under its roof. This proposal will now, of course, have to grind its way through the gears of government approval. But while this proposal is a giant deal for two giant companies, the name that’s likely to come up more than any other in all the comments back-and-forth is neither Time Warner nor AT&T, but rather a competitor: Comcast. [More]

AT&T Confirms $85 Billion Acquisition Of Time Warner Inc.

After two days of “people close to situation” leaking information about a possible merger between AT&T and Time Warner Inc., the two companies have confirmed the deal which is valued at around $85 billion. [More]

Reports: Possible AT&T/Time Warner Merger Valued At $85 Billion

This morning, the world woke to find out that AT&T and Time Warner were getting cozy and maybe thinking about moving in together. Now comes news that talks have heated up and that a nearly $90 billion deal could be in the offing. [More]

Report: Kroger Entertaining Idea Of Buying Whole Foods

The largest grocery store chain in the country could be getting a bit bigger and a lot more organic, as the rumor mill began churning that Kroger is exploring the idea of buying Whole Foods. [More]

Report: Twitter Looking To Sell Itself — Maybe To Google

Twitter might be a hugely popular social media platform, but for all its influence and reach, the company is not exactly minting money. So it may not come as a surprise that Twitter is once again the subject of merger rumors. [More]

Unilever Buys Seventh Generation. What About Honest Co.?

Days after Unilever was rumored to be discussing a deal to purchase The Honest Company — the line of household and personal care products co-founded by actress Jessica Alba — the company behind everything from Ben & Jerry’s to Vaseline added a different high-profile independent brand to its portfolio: The eco-friendly cleaning supply folks at Seventh Generation. [More]

Could AB InBev Try To Buy Coca-Cola To Create Beer & Soda Voltron?

After you’ve spent more than $100 billion to acquire your biggest competitor, what’s left? Sure, you can buy up that smaller business here and sell off this subsidiary there, but how does a company regain the adrenaline rush of pulling off a transaction so big people need to stop and count the zeros? [More]