An investigative report finds that Massachusetts regulators only acted against 3% of its licensees during the sub-prime peak, the lowest among fellow New England states, while publicly preening that it was being “aggressive.” In fact, as foreclosures rose during ’06-’08, enforcement actually dropped. Forget who watches the watchdogs, who watches? [More]

mortgage brokers

Before I Strategically Default, Can I Get A New House? Pwease?

Old news: homeowners strategically defaulting on their loans. New news: They first want to get financing for a new house. [More]

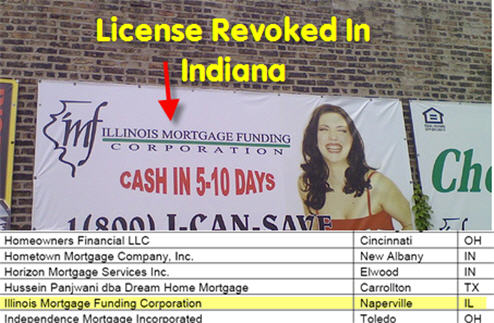

Oh Sh*t! 40% Of Indiana's Mortgage Brokers Lose Their Licenses

40% of Indiana’s mortgage brokers have lost their licenses because they did not comply with a new law aimed at “raising the standards” of the mortgage lending industry. The law requires mortgage brokerages to “name a principal broker with at least three years experience who has passed a state exam and will oversee his company’s business affairs,” says BusinessWeek. Sounds reasonable, doesn’t it?