Back in February, a federal court ruled that American Express merchant agreements violate antitrust laws, resulting in higher costs for consumers, by forbidding retailers that accept AmEx from encouraging customers to use competing cards like those from Visa, MasterCard, and Discover. Today, the credit card company’s CEO said the company is asking the court to stay this ruling. [More]

merchant agreements

American Express To Fight Court Ruling That Would Let Retailers Encourage Use Of Competing Cards

10 Answers To Credit Card Questions We Get Asked All The Time

Credit cards come with a lot of fine print. But the scene isn’t just complicated for cardholders; it’s complicated for the retailers that accept them, too. What needs signing, and what doesn’t? When can a store ask for ID? Are they allowed to charge different prices for cash and credit? [More]

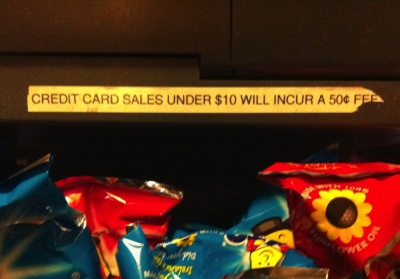

Shop Charges $.50 Fee For Credit Card Purchases Under $10

I spotted a coffee shop charging customer a $.50 for using a credit card on any purchase that is under $10. It doesn’t break any laws, but it does violate their agreement with the credit card companies. [More]

Walmart Said I Needed Wisconsin Driver's License To Buy With Credit Card

Matthew says a Wisconsin Walmart demanded not only an ID with his MasterCard purchase, but a Wisconsin state driver’s license. Because Matthew is from out of state, he was out of luck. Read on to see whether or not Matthew escaped the store with his munchies: [More]

Pizza Hut Won't Let Customer Use Credit Card Without Photo ID

Chuck tells Consumerist that he witnessed a strange transaction at Pizza Hut recently. When another customer went to pay for her purchase with a credit card, the person behind the counter asked to see her ID before allowing her to pay for her pizzas with a credit card. She didn’t have any ID with her, and was forced to leave without her pizzas. [More]

Disney Store Refuses Small Credit Card Purchase Because You Left Your ID In The Car

UPDATE: This complaint has been resolved. Reader Terry is annoyed because the Disney Store refused to sell his family $8.50 worth of stuff unless he went out and got his wife’s ID from the car. [More]

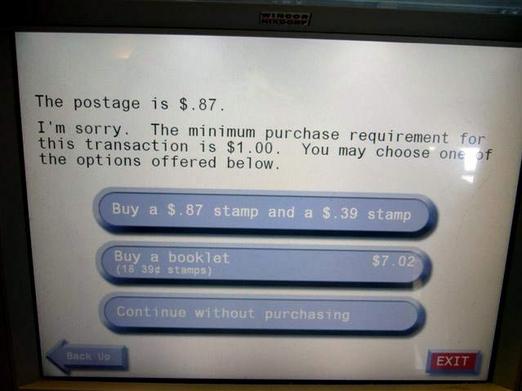

Squash Minimum Purchase Fees With Wallet-Sized Merchant Agreement

Fed up with stores not knowing the rules for credit card purchases, Andy at NonToxicReviews created this handy credit-card-sized PDF of the relevant portions of Visa’s and MasterCard’s merchant agreements.

More On Minimum Purchases, Surcharges, And Other Credit Card Merchant Agreement Violations, From The Companies Themselves

We’ve posted a lot of stories of businesses requiring customers who pay with a credit card to make minimum purchases, or pay a surcharge, or show ID. And as we’ve repeatedly said, the businesses’ merchant agreements with the credit card companies forbids these practices. A reader wrote in to argue that this might not be true, as many businesses contract with third-party credit card processors, and are not bound by the merchant agreement. So we did some investigating.

This McDonald's Charges 25¢ To Use A Credit Or Debit Card, Violates Merchant Agreement

Reader Brandon sent us this picture of a McDonald’s violating its merchant agreement by charging a fee for using a credit or debit card. The text reads, “FEE ASSOCIATED WITH CREDIT/DEBIT CARD OF 25¢ WILL BE APPLIED TO CARD TOTAL.”