Following a string of high-profile data breaches last year, Visa and MasterCard handed down a requirement that all merchants transition to the more secure chip-enabled credit card payment system by October of this year. While several major retailers have already made or are in the process of making the switch, a new report finds that many small business owners don’t even know about the deadline – or the potentially costly consequence of not meeting it. [More]

mastercard

Appeals Court Breathes New Life Into ATM Fee Price-Fixing Suit

More than two years after a federal court dismissed price-fixing lawsuits against Visa, MasterCard, Bank of America, JPMorgan Chase, and Wells Fargo, a federal appeals court has revived the cases that involve allegations that these banks and payment networks illegally and anticompetitively established fee levels for out-of-network ATM use. [More]

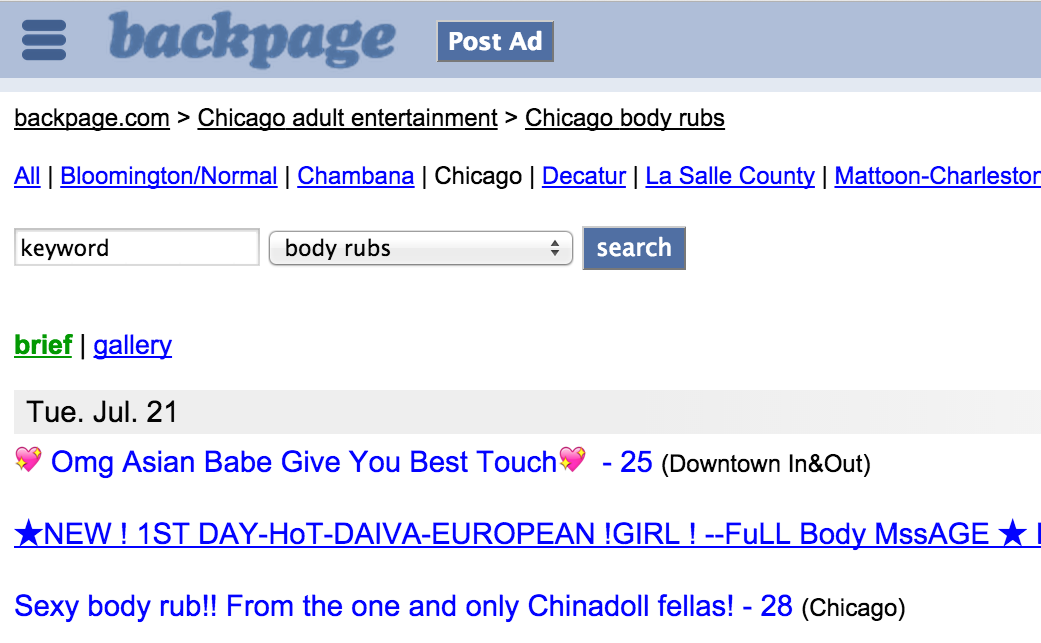

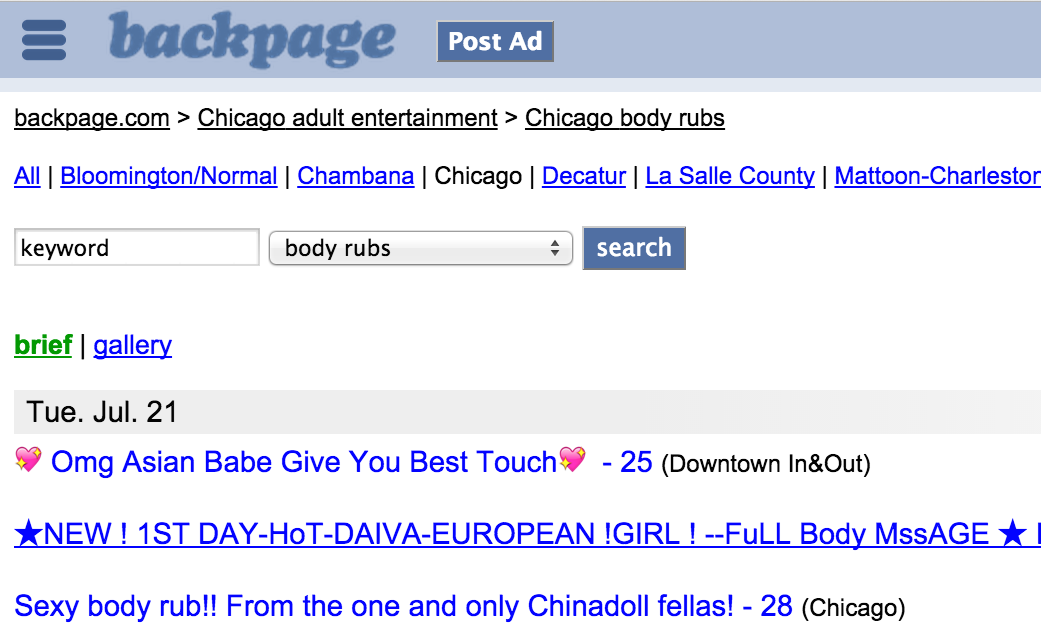

Court Says Sheriff Crossed Line By Convincing Visa, MasterCard To Sever Ties With Backpage.com

First, an Illinois sheriff convinced Visa and MasterCard to stop doing business with online classifieds site Backpage.com, claiming the site was a storefront for sex traffickers. Then Backpage sued the sheriff, alleging his actions were tantamount to government censorship. Now a judge in the case has told the sheriff to back off of Backpage. [More]

Backpage.com Sues Sheriff For Persuading Visa, MasterCard To Stop Serving Site

Earlier this month, the sheriff of Cook County, IL, persuaded both Visa and MasterCard to end their relationships with online classifieds site Backpage.com, alleging the site is known to “promote prostitution and facilitate online sex trafficking.” Today, the website fired back with a lawsuit against the sheriff. [More]

Survey Says: You’d Rather Have Your Nude Pics Leaked Than Your Financial Information

MasterCard wants to know how you feel, so they asked a bunch of people: Do you feel safe? Do you feel secure? Do you feel like you need a cookie and a nice cup of cocoa? Wait, scratch that last one. MasterCard’s survey only covered feelings about how safe and secure you feel your financial information is. The answer? Not very secure at all. [More]

Could You Soon Be Making Purchases By Scanning Your Face? That’s The Plan At MasterCard

Who has time to memorize the special code or password when you could just scan your face to approve an online purchase? While using facial recognition as confirmation you’re, well, you, might seem a little far-fetched, it could be a reality this fall according to MasterCard. [More]

Visa, MasterCard Cut Ties With Backpage.com After Pressure From Law Enforcement

After pressure from law enforcement, both Visa and MasterCard have announced they will no longer process payments for classified ads on Backpage.com. The site has often been criticized for its “Adult” section, which some say makes it easy for pimps and sex traffickers to solicit customers for sex. [More]

Target Wants To Perfect Chip-and-PIN Before Venturing Into Digital Payment Methods

Consumers and businesses alike are always seeking out ways to streamline the checkout experience, most recently with mobile payment systems like Apple Pay and Android Pay. But there’s one major retailer that won’t be jumping into new payment options just yet. [More]

Visa Unveils Plan To Breakdown Airline Fees Separately On Statements

With all the extra fees tacked on by airlines – bag fees, WiFi fees, seat upgrade fees – it can be hard to remember exactly what you paid for each of these add-on charges. Visa customers won’t have to worry about keeping things straight anymore, as the credit card company now plans to breakdown airline charges on monthly statement. [More]

Walmart Executive: Chip-And-Signature Credit Cards Not Enough To Protect Consumers

The long-awaited move from traditional magnetic stripe credit cards to cards equipped with computer chips has been touted as a safer, more secure method of payment for consumers. But a top executives at the country’s largest retailers says all the hype surrounding the new cards will likely be a security letdown without the use of PIN requirements. [More]

American Express To Fight Court Ruling That Would Let Retailers Encourage Use Of Competing Cards

Back in February, a federal court ruled that American Express merchant agreements violate antitrust laws, resulting in higher costs for consumers, by forbidding retailers that accept AmEx from encouraging customers to use competing cards like those from Visa, MasterCard, and Discover. Today, the credit card company’s CEO said the company is asking the court to stay this ruling. [More]

American Express Loses Antitrust Lawsuit Over Merchant Rules

After nearly five years of legal battles, a federal court has ruled that American Express’s merchant agreements violate antitrust laws and has resulted in higher costs for consumers. [More]

New Visa Feature Uses Smartphone Location Tracker To Prevent Fraud By Knowing Where You Are At All Times

Forgetting to tell your bank that you’ll be traveling far outside of your normal spending zone can often lead to frustrations like having transactions rejected out of concern that your card is being used fraudulently. In an attempt to make the lives of frequent travelers easier – and prevent fraud – Visa plans to launch a new service this spring that automatically informs banks where you are. [More]

Costco Says Dumping American Express Was About “Saving Money For Customers”

Yesterday, American Express announced the impending end of its monogamous relationship with Costco, meaning that not only will AmEx cards no longer be accepted at the popular warehouse store but that co-branded AmEx/Costco credit cards will be useless after March 31, 2016. Now Costco is breaking its silence on the split, saying it was all done in the best interest of Costco shoppers. [More]

Visa, MasterCard Working On Security Improvements To Make Data Breaches Suck Less

The data breaches, major and minor, that we’ve seen over the past few years aren’t going anywhere. Payment system and database hacks are, for now, basically inevitable. And that’s why Visa and MasterCard have both announced plans to expand their security features for online shopping. [More]

3 Things Costco Shoppers Need To Know About Split From American Express

Yesterday, American Express confirmed rumors that it would be ending its exclusive partnership with Costco at the end of March 2016. While that is more than a year away, Costco members and AmEx cardholders already have some important questions. [More]

Costco To Stop Accepting American Express In 2016

It’s been rumored for months that Costco and American Express would eventually end their exclusive relationship, allowing members of the warehouse club to use other cards. Now AmEx has confirmed that the deal will indeed come to an end in early 2016. [More]