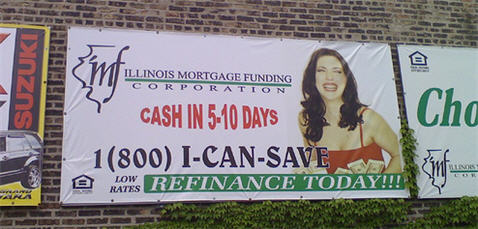

Did you know that gas price gouging almost never occurs as prices rise? Rather, it’s most often when dealers keep prices artificially high even as their costs fall. As gas costs were near $5 a gallon until falling and oil companies earn around $100 billion each year, it’s a good time to question what really goes into the price of gas. The numbers on the gas station sign hide a complex set of transactions. Before gas can power your car, it must be discovered as crude oil, traverse three markets, and be refined from crude into gas. Inside, we’ll explain the three markets, walk you through the role of refineries, and show how oil companies use creative tactics to manipulate gas prices…

markets

../../../..//2008/10/06/the-stock-market-is-not/

The stock market is not doing well. The Dow Jones industrial average fell below 10,000 for the first time since 2004, and is currently down 440 points. [NYT]

Nobody Panic: Government Seizes Freddie Mac, Fannie Mae

Oh dear, all that talk about Freddie and Fannie being “adequately capitalized” was utter bullshit and the government has now announced plans to place the failed government sponsored enterprises into conservatorship. That means the fate of the housing market and the global economy rest squarely on the shoulders of U.S. taxpayers.

../../../..//2008/06/18/is-a-commodity-bubble-the/

Is a commodity bubble the new housing bubble? [NPR]

JP Morgan, Fed To Bail Out Bear Sterns

Bear Stearns, facing a grave liquidity crisis, reached out to JPMorgan on Friday for a short-term financial lifeline and now faces the prospect of the end of its 85-year run as an independent investment bank.

It's Bigger Than The U.S. Stock Market, It's Unregulated, And You've Never Heard Of It

Credit default swaps form a large but obscure market that will be put to its first big test as a looming economic downturn strains companies’ finances. Like a homeowner’s policy that insures against a flood or fire, these instruments are intended to cover losses to banks and bondholders when companies fail to pay their debts.

The Subprime Meltdown Is The Tip Of The Credit Iceberg

The ongoing subprime meltdown is merely the first destructive wave of credit catastrophe to wash over Wall Street, according to Slate’s resident explainer. Americans drunkenly bandy credit around in several forms: mortgages are the most prevalent loans turning sour, but credit card debt, student loans, and auto loans are silently conspiring to threaten our macroeconomic well-being.

10 Best And 10 Worst Housing Markets

Forbes has put together a list of the best and worst housing markets in the U.S. Think every market is dropping? Apparently not. Salt Lake City, you’re doing just fine. So far. Overall, the picture isn’t as rosy:

California Police Seize 375 Pounds Of Bathtub Cheese

Meet Floribel Hernandez Cuenca and Manuel Martin. California police arrested the pair on “felony cheese making charges” after they tried to sell 375 pounds of bathtub cheese at an open-air market in San Bernardino. Bathtub cheese, otherwise known as “illegal soft cheese,” can cause a range of maladies including listeria, salmonella, and everybody’s favorite gut goblin, E. coli.

The 375 pounds of seized illegal cheese included panela, queso fresco and queso oxaca varieties, the [California Department of Food and Agriculture] says. It was a significant find, the department says.

Pending Home Sales Plummet 12% In July

“The housing market is bad and is going to stay bad for some time,” said Zach Pandl, an economist at Lehman Brothers Holdings Inc. in New York, who predicted a 3 percent drop. “This number does not look good for existing home sales for August.”

Subprime Meltdown Spreads To "Jumbo" Mortgages

The New York Times has an interesting article that explains the affect the subprime lending meltdown is having on so-called “jumbo” loans.

Why Is Gas So Freakin' Expensive?

Did you know that gas price gouging almost never occurs as prices rise? Rather, it’s most often when dealers keep prices artificially high even as their costs fall.