A recent study found that student enrollment agreements at virtually all of the nation’s biggest for-profit colleges have forced arbitration clauses that strip students of their rights to file a lawsuit against the school, and in most cases bar students from joining their similar or identical disputes together. Under pressure from lawmakers and consumer advocates who questioned how these schools could continue to take billions in federal aid while trying to avoid accountability in the courtroom, the nation’s biggest for-profit educator has decided to stop using the controversial arbitration clauses. [More]

mandatory binding arbitration

The 3 Myths Banks Are Using To Defend Their “Get Out Of Jail Free” Cards

Earlier this month, the Consumer Financial Protection Bureau proposed rules intended to restore some of those constitutionally granted rights that the Supreme Court has stripped away in recent decades. Faced with the possibility of having to be held responsible for their bad actions, some industry groups are coming out in force against the rules, presenting the same laughably thin argument that consumers ultimately benefit by not being able to sue the companies they do business with. [More]

Proposed Rules Would Take Away Banks’ “Get Out Of Jail Free” Card

Many bank accounts, and almost all credit cards, wireless services, private student loans, and payday loans contain clauses in their contracts that strip consumers of their right to sue these companies, and their right to join others in a class action, effectively allowing businesses to sidestep the legal system. While lawmakers in Congress debate the issue, and the U.S. Supreme Court has repeatedly given its approval to these practices, the Consumer Financial Protection Bureau is making good on its pledge to restore consumers’ constitutional right to having their day in court. [More]

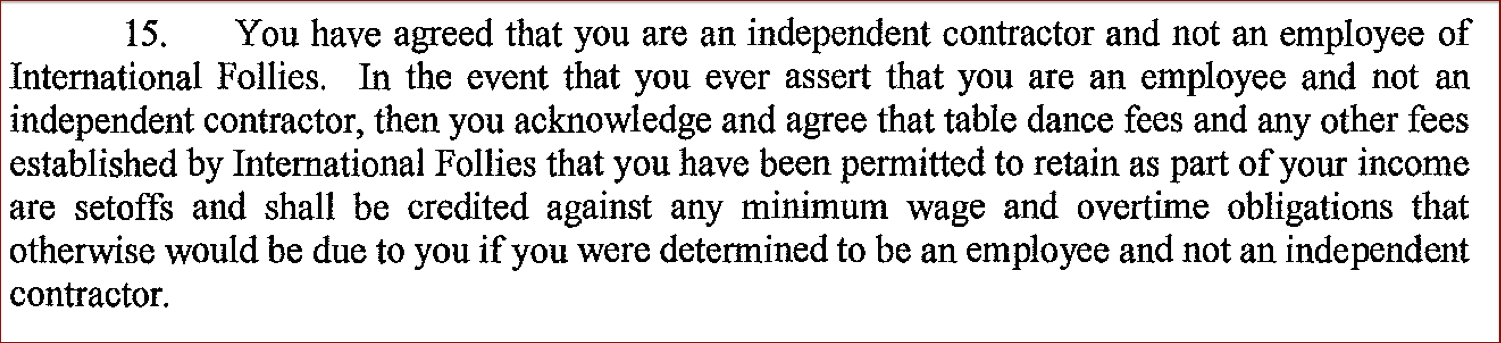

Screwed Over By A For-Profit College? You Probably Signed Away Your Right To Sue

When Corinthian Colleges Inc. collapsed, leaving thousands of students in the lurch with student loan debt and credits that they didn’t know would be usable at other schools, they were generally unable to sue the failed for-profit educator because the students had unwittingly signed away their right to a jury trial or class action. CCI wasn’t the only for-profit operator with this anti-consumer practice, and a new report tries to get a grasp on the scope of the problem. [More]

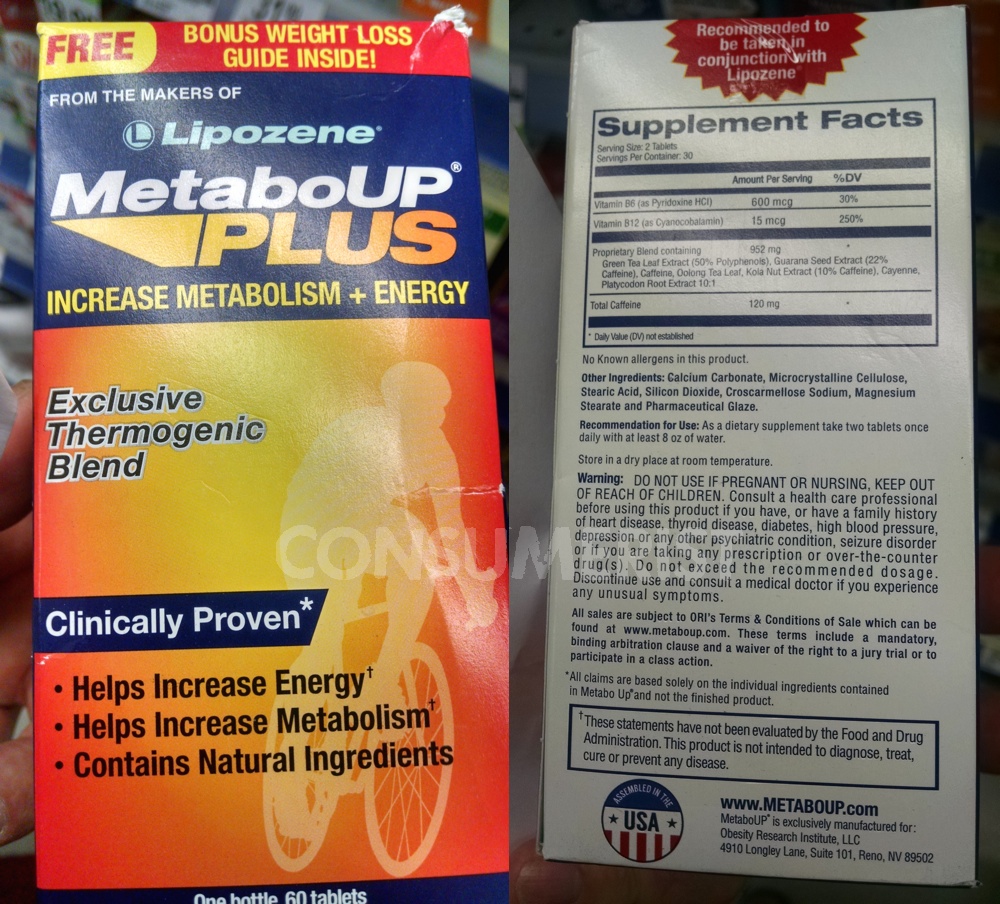

Take This Weight-Loss Supplement And Give Up Your Right To A Jury Trial

If you wanted to get an idea on the ridiculous overuse of forced arbitration, here’s one of the more absurd examples we’ve seen — a weight-loss supplement with the added non-benefit of stripping users of their right to sue the company that made the pills. [More]

New Bill Could Stop Cable & Phone Companies From Taking Away Customers’ Right To Sue

Five years ago today, the U.S. Supreme Court sided with AT&T, ruling that companies could use a couple paragraphs of legalese buried deep in unchangeable user agreements to strip customers of their right to file a lawsuit. An upcoming piece of legislation seeks to restore that right for telecom customers. [More]

Reminder: You Should Opt Out Of Starbucks Card Mandatory Arbitration Now. Here’s How

This week, the new terms and conditions for Starbucks cards — the gift and stored-value cards that you can use to rack up rewards in their newly revamped reward program — went into effect. That means existing users have until May 12 to opt out of the chain’s normal requirement that card users waive their right to sue the company. [More]

You Can Now Opt Out Of Snapchat’s Arbitration Clause — Here’s How

Popular messaging service Snapchat has had a binding arbitration clause — which takes away a user’s right to sue the company — in its user agreement since 2014. Yesterday, Snapchat updated its terms to give users 30 days to opt out of this anti-consumer restriction on their legal rights. [More]

Court Reminds Us All: You Have No Right To Sue Your Phone Company

If you don’t like your wireless company’s service, or your current rate plan, you’re free to change providers. But if you think your wireless provider is breaking the law, you can’t sue the company; and it doesn’t matter which of the four major carriers you have, because they all strip their customers’ of their legal rights. [More]

GrubHub/Seamless Hates Its Customers, Strips Them Of Legal Right To Sue

If you have a legal dispute with online food delivery portal GrubHub (or its Seamless subsidiary), you will soon lose the ability to resolve that matter in a court of law. And if there are others out there with the same problem as you, you’ll each have to fight GrubHub on your own because the company has decided to view its all of its customers as potential litigants. [More]

You Will No Longer Need To Go To Seattle To Resolve A Starbucks Card Dispute

As things stand now, if you have a legal dispute with Starbucks about your Starbucks Card, the coffee company could force you to travel to Seattle to resolve the matter — not in court, but through the shadowy, unfair process of binding arbitration. However, Starbucks is about to adopt new policies to be more flexible about the location, and give you 30 days to opt out of signing your rights away. [More]

Bill Aims To Restore Consumers’ Legal Rights Stripped Away By Supreme Court Rulings

In recent years, a narrow majority of the U.S. Supreme Court has repeatedly sided against consumers’ access to the justice system, concluding that a 90-year-old law gives companies the authority to effectively skirt the legal system by preempting customers’ lawsuits. That’s why some legislators have decided it’s time to change that law. [More]

Debt Collectors Can Sue You, But Court Might Not Let You Sue Debt Collector Back

A new report claims that a growing number of debt collectors are trying to exploit a legal loophole that allows them to bring potentially frivolous lawsuits against alleged debtors, but bars those defendants from bringing their own legal action against the debt collector. [More]

Supreme Court Once Again Shows Its Disdain For Consumer Rights

For the third time in five years, the U.S. Supreme Court had a chance to reverse a terrifying trend in consumer rights by doing something, anything, to rein in “forced arbitration” clauses that strip consumers of their legal rights and effectively give companies a license to steal. And for the third time in five years, the SCOTUS majority showed its interests lie in protecting the coffers of big business rather than Americans’ access to the legal system. [More]

Groups Call On AmEx, Chase, Citi, Toyota, Others To Stop Forcing Customers To Sign Away Their Legal Rights

Once upon a time, if a company wronged a customer — not just by screwing up an order or having poor customer service, but by actually breaking the law — that customer could file a lawsuit and try to hold the company accountable. And if the company wronged lots of customers in the same way, they could join together in a class action. Now, thanks to the U.S. Supreme Court, companies can get away with breaking the law by simply including a few handy lines of text in their customer agreements and contracts. But just because the company can use this “get out of jail free” card, doesn’t mean it should. [More]

Banks Urge Congress To Continue Renewing Their “Get Out Of Jail Free” Cards

Nestled deep in the text of the lengthy contracts for most credit cards and bank accounts are little clauses that not only prohibit harmed customers from suing their bank or card issuer, but also prevents them from banding together with similarly injured consumers to argue their dispute as a group. In October, the Consumer Financial Protection Bureau announced it would consider limits on these clauses, but now the banking industry is trying to use its leverage with D.C. lawmakers to shut down that process. [More]

12 Things We Learned From The New York Times’ Investigative Report On Arbitration

Consumerist’s first post on the subject of arbitration, back in 2007, described a dispute that was ultimately resolved in the consumer’s favor. Since then, we’ve been against the practice, pointing out when popular companies change their terms of service to add arbitration clauses. It doesn’t matter, though, because arbitration can save companies so much money that they don’t especially care what we think. Sometimes. [More]