Three years ago, the Consumer Financial Protection Bureau warned consumers that some credit card companies weren’t clearly disclosing the risks of promotions, including deferred-interest offers that promise not to charge interest on purchases as long as the balance is paid off by a certain date. However, if that doesn’t happen customers can find their bill nearly doubled thanks to retroactive interest charges. Now the agency is setting its sights on retailers, urging them consider more transparent promotions for store-branded credit cards. [More]

lines of credit

Surprise Charges: Feds Advise Retailers To Make “No Interest” Store Credit Offers More Transparent

Nearly 26 Million American Adults Have No Credit History

While a recent survey found that nearly 35% of consumers have never pulled their credit report, a new report from the Consumer Financial Protection Bureau points out that some of those consumer might not have anything on their reports anyway. [More]

Don't Mistake Credit For An Emergency Fund

If you’re struggling to make ends meet, it’s understandable to half-joke that your credit cards act as your emergency fund. But if you can save and choose not to, content that credit will rescue you from any trouble that arises, you’re only tempting fate. [More]

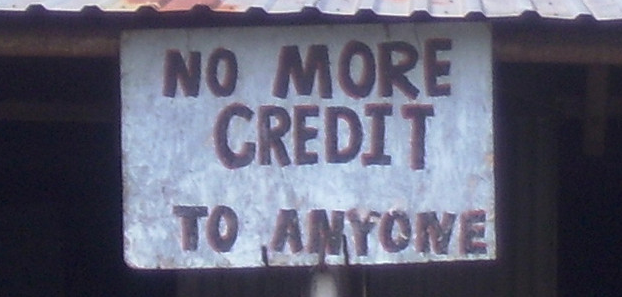

BoA: No Credit, Even For Rocket Scientists

If you have any lines of credit and you use them to manage your financial flow, you should evaluate your personal money matrix so you’re ready in case all of them get cut. They’re cutting lines of credit even for rocket scientists like reader Rocky. That’s right, he’s an engineer in the aerospace industry, has never overdrawn, never been late, never incurred NSF charges, and has 3 Masters and 2 MBAs. Overnight, they cut his four lines of credit. Apparently his only crime was simply having them. He called multiple times and got nowhere, only to be told to talk to a credit counselor. A credit counselor? Bank of America, he doesn’t have bad credit, he has no lines of credit because you just cut them all. His story, inside…