If you have a mortgage but fail to keep current on your homeowners’ insurance, the bank will just go out and get a “forced-place” policy for you. Problem is, you’ll often pay top dollar for insurance that provides minimal coverage while the bank makes money on commissions from the insurer and fees charged to the homeowner. Now the Federal Housing Finance Agency is looking to make forced-place policies slightly less lucrative for lenders. [More]

less is mortgage

Wells Fargo Settles With Freddie Mac For $869 Million

Because a few days can’t go by without one of the few remaining big banks agreeing to pay out hundreds of millions of dollars (without ever admitting any wrongdoing), Wells Fargo has agreed to settle with Freddie Mac for $869 million over — you guessed it — toxic mortgages from the Bubble Era. [More]

Government Shutdown Could Completely Screw Up Your FHA Mortgage Application

As the real estate market still continues to creep up out of the sinkhole that opened beneath our feet five years ago, home buyers have still been able to rely on loans backed by the Federal Housing Administration. But if lawmakers in Washington can’t figure out a way to keep spending money in the very near future, the federal government would effectively shut down, putting pending FHA mortgages at risk of falling through. [More]

Wells Fargo Fails At Getting Federal Mortgage Lawsuit Dismissed

The same day that trial began in the Justice Dept.’s lawsuit against Bank of America, the DOJ had another victory in a similar suit filed last year against Wells Fargo, as the bank failed this morning in its attempt to have the suit dismissed. [More]

Clearer Mortgage Rules, No-Fee Refinances Key To President’s Plan For Middle-Class Housing Market

On Tuesday, President Obama will visit Arizona, one of the states that took the biggest butt-whooping from the housing boot, and one of five states (along with Nevada, Florida, Michigan, and Georgia) that still account for a full 1/3 of the negative equity in the U.S. In a speech in Phoenix, the President will outline what his administration believes are steps that will help give more middle-class Americans a chance at securing a foothold in the housing market. [More]

Banks Received $814 Million In Federal Incentives For Mortgages That Ended Up In Redefault

According to the latest report from the Special Inspector General for the Troubled Asset Relief Program (or the much-cooler SIGTARP), the nation’s mortgage servicers have received more than $800 million in incentives for making modifications on mortgages that have ultimately resulted in the homeowner redefaulting on the loan. [More]

Drop In Number Of First-Time Home Buyers Is Cause For Concern

The notion of buying your first home, building equity, and eventually moving up the property ladder is still something many young Americans aspire to, but between more stringent underwriting procedures, lingering student loan debt, competition from real estate speculators and higher interest rates, first-time buyers are being squeezed out of the market. [More]

Bank Of America Attempts To Discredit Statements Of Former Employees

Last month, it was revealed that six former Bank of America employees and one ex-contractor for the bank, had given sworn statements in a lawsuit filed against BofA, and that these statements painted a picture of a system that deliberately lost mortgage modification paperwork and rewarded staffers for pushing employees into foreclosure. Now BofA has issued a detailed rebuttal of those allegations and why it believes that these statements misrepresent the truth. [More]

Homeowners Accuse Bank Of America Of Racketeering In Lawsuit Over Mortgage Modifications

Following the recent revelations from former Bank of America employees that the nation’s most-hated financial institution allegedly engaged in deliberate schemes to delay and deny mortgage modifications, a group of three homeowners have sued BofA, alleging violations of federal anti-racketeering laws. [More]

Losing Your House To Foreclosure Doesn’t Necessarily Mean You No Longer Owe Money To The Bank

There’s a commonly held notion that losing one’s home to foreclosure is the final act in a sad drama, that the homeowner has hit bottom and has nowhere to go but up. But thousands of foreclosed-upon homeowners are finding out, years after turning their keys over to the bank, that they may still be on the hook — sometimes for hundreds of thousands of dollars. [More]

Former Staffers: Bank Of America Rewarded Us For Lying To Homeowners, Losing Paperwork, Denying Modifications

In sworn statements provided for a lawsuit by homeowners against Bank of America, a half-dozen people who reviewed loan modification applications for BofA say the company encouraged staffers to lose applicants paperwork so that it could later be denied, putting homeowners at further risk of losing their homes. And if these people are to be believed, some folks out there may have lost their homes so that a BofA employee could get a Target gift card. [More]

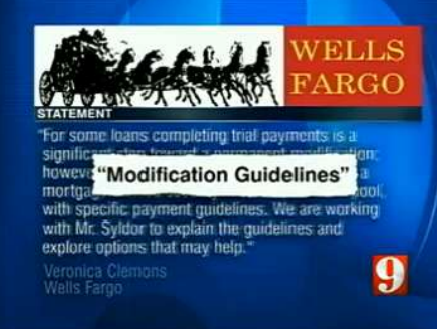

Wells Fargo Forecloses On Homeowner Who Made Payments Too Early

A homeowner in Orlando is confused, and with good reason. He says he not only made his mortgage payments on time to Wells Fargo, but that he sometimes paid early and sometimes paid more than he was supposed to. And yet, the bank decided to foreclose on his home. [More]

Mortgages Slightly Easier To Get For Prime Borrowers, Still Tough For Subprime Applicants

Ten years ago, a potential home buyer could walk into a Countrywide office and get pre-approved for a half-million dollar home loan based on a bank statement written in crayon on a restaurant place mat and a pinky swear that the loan could be paid back. We all know too well the results of those lax standards, which is why regulators and banks ramped up restrictions on lending to the point where applying for a home loan is like auditioning for American Idol, without the washed-up celebrity appearances. But a new survey says that lenders are easing up… a bit. [More]

Should You Pay Off Your Mortgage Before You Retire?

Considering that the average retirement age is approaching 282 and a large number of people have taken out second mortgages or equity lines of credit in recent years, not everyone who is nearing retirement has the option or ability to get rid of that home loan early. But for those that do, there are some things to consider. [More]

Foreclosed-Upon Homeowner On The Hook For Squatters Because BofA Won’t Assume Title To House

Homeowner Tries To Get Mortgage Adjustment, Ends Up Owing $14,500 More On Her House

When a retired Michigan homeowner applied for a mortgage adjustment back in 2009, little did she know that it would result in years of ongoing legal wranglings, a sizable increase in the amount of her mortgage and possible eviction. [More]

Fannie & Freddie To Let Some Underwater Homeowners Walk Away From Their Mortgages

Since bailed-out mortgage servicers began dealing with the toxic loans made during the housing bubble, the focus has been on people who couldn’t pay their mortgages. Now Fannie Mae and Freddie Mac have an out for people who have continued to pay while their houses have lost value. [More]

CFPB Rules Aim To Protect Homeowners From Inept & Foreclosure-Happy Mortgage Servicers

One week after it announced a new set of rules that require mortgage lenders to prove that borrowers will actually be able to pay back their loans, the Consumer Financial Protection Bureau is unveiling a slew of new rules for mortgage servicers intended to curb some questionable practices and provide more safeguards for all borrowers. [More]