Earlier this year, legislators introduced a bill that would require consumers to fix any outstanding safety recall on their vehicle before a registration renewal would be granted. While that measure has gone nowhere since March, a newly introduced highway reauthorization bill includes a provision that would create a pilot program for a similar plan. [More]

legislation

Bill Would Create Program To Notify Drivers Of Safety Recalls When Applying For Registration

Senate Committee Votes Down Several Auto Safety Reforms

Since automakers began recalling vehicles in force last year – punctuated by the millions of models covered by General Motors’ massive ignition switch defect and Takata’s explosive airbags – lawmakers have been trying to push through reforms that would make it more difficult to keep potentially deadly automobiles on the roadways. But proposed laws such as those that would impose fines on owners of vehicles who don’t follow-through with recall repairs or barring used car dealers from selling vehicles with unrepaired recalls likely won’t see the light of day after being voted down by a Senate committee last week. [More]

Lawmakers Introduce Legislation That Would Give Legal Marijuana Businesses Access To Banking Services

One of the biggest challenges facing the new legal marijuana industry comes down to money: now that businesses in certain states have gotten the go ahead to sell weed, many of them are stuck in a tough spot when it comes to actually dealing payments for their products, since the drug is still illegal under federal law. A group of senators is seeking to change that, introducing a bill that would take the heat off legal marijuana operations and give them access to banking services. [More]

Legislation Would Allow Some Rental Car Companies To Rent Vehicles Under Recall If They Give Notice

In 2014, auto manufacturers recalled nearly 60 million vehicles, including millions that are handed from one customer to another by rental companies. While the major rental car companies promised back in 2012 that they would stop renting and leasing recalled vehicles, new legislation would allow some to send potentially dangerous cars back on the road. [More]

House, Senate Introduce Legislation To Cover The Cost Of Community College

Back in January, the White House proposed a plan to help offset the increasing cost of higher education for millions of prospective students: Offer free community college. Yesterday, companion bills introduced in the House and Senate take that idea and make it a reality. [More]

Senators Introduce Legislation To Close Federal Funding Loophole Exploited By For-Profit Colleges… Again

Legislators continued their crusade to rein in the abuses of predatory for-profit college institutions by introducing a measure today that would close a funding loophole that often led the schools to target certain consumers in order to pad their bottom line. [More]

Congress Takes Another Stab At Undercutting Gainful Employment Rules Two Weeks Before Implementation

The Department of Education’s long-awaited gainful employment rules – aimed at reining in the for-profit college industry – go into effect on July 1. But just because there are only 14 days before implementation, doesn’t mean those opposed to the regulations are giving up their fight. [More]

Tesla Won’t Be Selling Cars Directly In Texas For At Least Another Two Years

Tesla won’t be conquering the Lone Star state anytime soon, as bills in front of the Texas legislature that would allow direct-to-consumer sales by the electric car maker likely won’t see the light of day until 2017, when the next regular legislative session begins. [More]

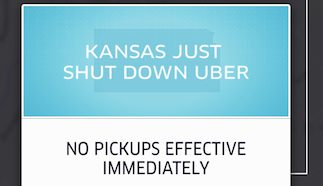

Uber Halts Operations In Kansas After Legislature Votes To Mandate Background Checks, Insurance Coverage

It seems like every few months a new city or state announces it will no longer allow Uber to operate in its jurisdiction. But in a slight change of pace, the ride-sharing company is actually taking itself out of the equation in Kansas. [More]

PRO Students Act Aims To Protect Students From For-Profit Colleges’ Bad Behavior

It’s difficult to go a month or even just a few weeks without hearing of another for-profit college being under investigation for unscrupulous practices, such as inflated job placement rates and pushing students into costly student loans. New legislation announced today aims to curtail the number of investigations we hear about by protecting students from predatory, deceptive, and fraudulent practices in the for-profit college sector, before they even enroll. [More]

Legislation Would End Forced Arbitration In Student Enrollment Agreements

When Education Credit Management Corporation announced late last year that it would buy 56 of for-profit education chain Corinthian College Inc.’s Everest University and WyoTech campuses, consumer advocates expressed great concern that the new company – which would operate under the name Zenith – would continue the unfair practice of requiring students to sign away their right to seek any legal action against the company if they’re wronged. While ECMC ultimately said it would do away with the practice, new legislation aims to strengthen students’ legal rights when it comes to forced arbitration. [More]

Digital Privacy And Parental Rights Act Would Put Restrictions On The Use Of Student Data Online

Students are more dependent than ever on technology and the Internet for their education, but those same apps and online learning tools that help educate them could be putting their personal information at risk if shared improperly. Nearly a month after it was first expected, a pair of U.S. representatives have introduced a bill aiming to restrict third-party use of students’ sensitive personal data. [More]

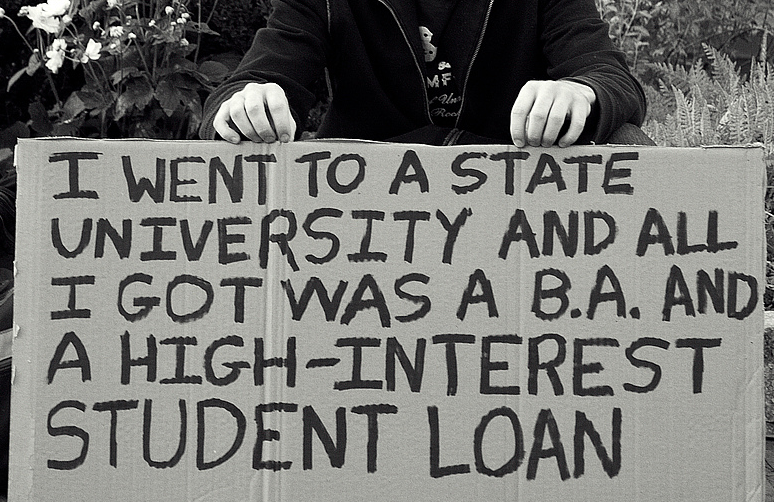

Student Loan Borrower’s Bill Of Rights Would Reform Disclosure And Servicing Standards

In recent weeks, legislators have introduced a range of bills aimed at addressing student loans and revamping the laws governing those debts. Today, that push continued with the reintroduction of a bill that would ensure student borrowers are treated fairly and understand the range of options at their disposal. [More]

Legislation Would Limit How Education Companies Use Students’ Online Data

With the use of technology now tightly tied to education, consumer advocates and parent groups have increasingly voiced concern about how student data is used. New legislation aims to alleviate worries over the exploitation of students’ personal information by placing restrictions on how that data can be used by third-party technology companies. [More]

Bill Would Ban Marketing, Sale Of Electronic Cigarettes To Minors; Create Regulations On Packages & Labeling

Earlier this month a new study found that it was increasingly easy for teens to purchase e-cigarettes despite a plethora of laws prohibiting the sale of such products to minors. Today, a group of Senators are taking action to make it more difficult for minors to purchase the products by creating restrictions on sales and marketing of e-cigarettes. [More]

Legislators Once Again Introduce Bill That Would Allow Student Loan Refinancing

If at first you don’t succeed try again… and again, and again. That appears to be the approach members of Congress are taking when it comes to a bill that would allow student loan borrowers to refinance their private and federal student loans. [More]

Tesla Faces One Last Hurdle In New Jersey After Senate Passes Bill Allowing Direct-To-Consumer Sales

A little more than a year after the New Jersey Motor Vehicle Commission unanimously voted to block the sale of Tesla vehicles directly to consumers, the state’s Legislature passed a bill allowing the car company to bypass auto dealerships and continue its unique model of car sales. [More]