It’s been a long time since we’ve heard from former Bank of America CEO Ken Lewis, the acquisition-happy buffoon who thought it would be a grand idea to buy Countrywide without doing any due diligence on all those worthless loans written by the failing company. And it will be another few years before he’s allowed to climb back to the top of the corporate ladder, as he’s agreed to a 3-year ban from serving as an officer or director of any public company. [More]

ken lewis

On 5-Year Anniversary Of Mortgage Meltdown, Those Responsible Are Doing Just Fine

On Sept. 15, 2008, Lehman Brothers became the largest bankruptcy filing in the history of this country. It was the first domino of many to fall, followed by the likes of Bear Stearns, Merrill Lynch, Countrywide, Wachovia, Washington Mutual, and many other banks and investment firms that had bet too much money on the subprime mortgage market, only to have it collapse when people realized many of those bad loans would never be repaid. These events ripped apart the American economy and left people out of work for extended periods of time. But not most of the bankers responsible for the mess. [More]

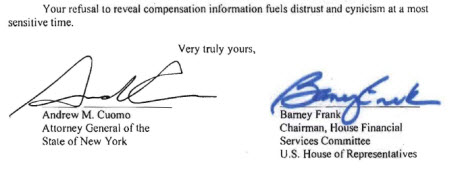

Oh Snap: NY AG Sues EX-Bank Of America CEO For Fraud

Andrew Cuomo has announced a lawsuit against Bank of America’s former CEO Kenneth D. Lewis, its former CFO Joseph L. Price, and the company itself, for “duping shareholders and the federal government in order to complete a merger with Merrill Lynch.” Uh oh! [More]

Salary Czar To Ex-BoA CEO: No Pay For You!

Departing Bank of America CEO Ken Lewis will get no 2009 pay or bonus. But won’t this serve as a disincentive to future executives who are thinking about totally cocking up their company and bringing down the US economy? [WSJ] (Thanks to Snarkysnake!)

Bank Of America Posts $1 Billion Loss In Third Quarter

Do you hate Bank of America? Well take today’s earnings report and wallow around in it like Ann-Margret in beans, becuse the bank has posted a loss of $1 billion before dividends to preferred shareholders—”When those dividend payments are included, the loss was $2.24 billion,” reports the New York Times.

Union: Don't Let BofA CEO Keep Ginormous Pension

Outgoing Bank of America CEO Ken Lewis looked like he had a pretty sweet deal, with the $53 million pension he’s due to get when he walks. Hold on, says one union, in a letter to White House “pay czar” Kenneth Feinberg: “The American people are counting on you to reform the reckless culture of Wall Street that allows bank executives to drive our economy into the ground and walk away with millions.”

Soon-To-Be-Ex Bank Of America CEO Has $53 Million Pension

Ken Lewis is probably a little bummed out that he will no longer be the CEO of Bank of America — but how sad can he be with a $53 million pension?

BoA CEO Resigns

Bank of America CEO Ken Lewis resigned yesterday after becoming a lightning rod for criticism after his controversial takeover of Merril Lynch. Even though BoA has appeared in our Worst Company in America contests each year, it’s kind of sad because his office had a good record of solving our reader’s problems they sent in to the executive office. Too bad that ethos couldn’t have flowed downhill more.

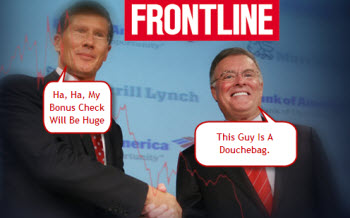

Frontline Examines The Bank Of America/ Merrill Lynch Merger

The merger between Merrill Lynch and Bank of America was sold to us as a marriage made in heaven that would save the financial system. It wasn’t, and it didn’t. Now Frontline takes a closer look at the now-infamous debacle that cost tax payers billions — and CEO Ken Lewis his chairmanship.

Bank Of America CEO: We Had To Acquire Merrill Lynch To Save The Economy

Are you a Bank of America shareholder who is angry at CEO, (and former chairman of the board) Ken Lewis for going ahead with the Merrill Lynch deal? Well, you’re just mean. It wasn’t his fault. At least, that’s what he’s just testified before the House Committee on Oversight and Government Reform.

Does Anyone Have $34 Billion For Bank Of America?

Kenneth Lewis is probably having a pretty crappy day. The government just told him that he needs to find $33.9 billion in order to “withstand any worsening of the economic downturn.” Anybody got any spare change?

Bank Of America CEO Fired As Chairman

Bank of America CEO Ken Lewis has been sh*tcanned from the chairman position, but will remain CEO, says the NYT. Calls for Lewis to resign in shame and go cry alone with his money have been getting louder over the past few months.

Bank Of America CEO: The Bush Administration Made Me Do It!

New York Attorney General Andrew Cuomo’s office is at it again. They’ve been investigating the circumstances that led to the merger of Bank of America and Merrill Lynch and the subsequent bonus payments to executives. In a letter to Senator Chris Dodd (D-CT), chairman of the Senate Banking Committee, Cuomo quotes Bank of America CEO Ken Lewis as saying that former Treasury Secretary Hank Paulson threatened him with removal from his position and mass firing of the board and senior management if he didn’t allow the merger to go through.

Merrill Lynch Bonus Recipients May Be Revealed Next Week

Well, it looks like the whole Merrill Lynch bonus scandal may have a Scooby Doo ending — with a judge unmasking the executives by the end of next week.

Is Bank of America About To Become THE Bank of America?

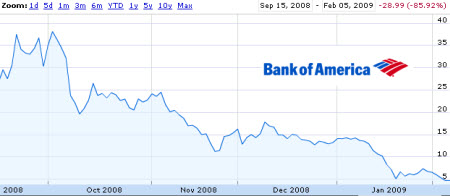

Bank of America‘s stock slid to a 20 year low today as investors became increasingly convinced that the bank would be nationalized. Share tumbled 18% early today, before climbing back up in the afternoon, says CNNMoney.