After an earlier report that it would do so, JPMorgan Chase says it’ll be reissuing debit cards for all its customers, replacing the old magnetic strip cards with those containing microchips for increased security. [More]

jpmorgan chase

JPMorgan Chase, Bank Of America Agree To Wipe Debt Cleared By Bankruptcy From Credit Reports

Two of the country’s largest banks are finally getting around to removing the debt consumers eliminated during bankruptcy proceedings from their credit reports, a move that puts Bank of America and JPMorgan Chase in line with federal law. [More]

Executives & Loan Officers Must Pay $600K For Being Part Of Illegal Mortgage Kickback Scheme

Nearly five months after Wells Fargo and JPMorgan Chase agreed to pay more than $35 million – including $11.1 million in redress to affected consumers – for their part in an illegal mortgage kickback scheme, the purported masterminds behind the “pay-to-play” arrangement are finally facing action from federal regulators for their shady dealings. [More]

Chase Hit With $50 Million Settlement Over Robosigned Mortgage Documents

The nation’s biggest banks have already been hit with billions of dollars in settlements over robosigning — the illegal process of signing and filing important mortgage documents without reviewing them for accuracy — so what’s a few million more? Today, the Justice Dept. announced a settlement with JPMorgan Chase that will require the bank to pay more than $50 million in cash, mortgage credits, and loan forgiveness, to over 25,000 currently and recently bankrupt homeowners. [More]

Marching Band Delivers Petition To Citi Asking Banks To “Revoke License To Steal”

In a handful of recent decisions, the U.S. Supreme Court has affirmed the right of businesses to effectively break the law by putting a few carefully worded sentences into their contracts and user agreements. But just because you can add these clauses doesn’t mean you have to do so, which is why pro-consumer advocacy groups gathered more than 100,000 signatures on a petition that was delivered, with a little bit of music, to Citigroup HQ in Manhattan this morning. [More]

Wells Fargo, Chase To Pay $35.7M For Allowing Illegal Mortgage Kickbacks

Federal law prohibits giving or receiving kickbacks in exchange for a referral of business related to a real-estate-settlement service, but for four years a now-defunct title company in Maryland provide cash, marketing materials and consumer information in exchange for referrals. And now the banks have agreed to pay more than $35 million — including $11.1 million in redress to affected consumers — for their sins. [More]

Petition Demands Big Banks Give Consumers Back Our Right To Sue

Since 2011, when the U.S. Supreme Court affirmed that it was perfectly okay for companies to take away a consumer’s right to sue — and their ability to join other wronged consumers in a class action — by inserting a paragraph or two of text deep in lengthy, unchangeable contracts, the rush has been on for almost every major retailer, wireless provider, cable company, and financial institution to slap these mandatory binding arbitration clauses into their customer agreements. Now one petition is gathering signatures, calling on the nation’s largest banks to put an end to the practice. [More]

Report: Fidelity Investments Likely Victim Of Same Hackers Responsible For JPMorgan Breach

Just a week after JPMorgan Chase said that 76 million households and 7 million businesses were affected by a late August data breach, another large mutual fund company admits it was likely targeted by the same hackers. But unlike JPMorgan, Fidelity Investments says there’s no indication any customer data was stolen. [More]

Chase Data Breach Hit 76M Households, 7M Businesses; Account Info Not Stolen

Remember that coordinated hack attack against JPMorgan Chase and other banks from August? Chase now says information — but apparently no payment data — on some 76 million households and 7 million small businesses was compromised. [More]

Chase Proactively Replacing Some Debit, Credit Cards Involved In Home Depot Breach

Home Depot has yet to confirm the estimated number of customer credit and debit card accounts that were compromised during the data breach that affected thousands of stores for five months, and it’s not known whether much of the stolen card info will ever be sold by the hackers now that everyone knows about the massive theft. Regardless, JPMorgan Chase has already begun the process of replacing some cards for customers who may have been affected. [More]

JPMorgan Chase, At Least Four Other Banks Hit By Hackers In Coordinated Attacks

No one is too big to get hacked — and that includes JPMorgan Chase and at least four other banks that were hit by hackers earlier this month. The FBI is investigating the blitzes, which seem to be sophisticated, coordinated cyberattacks that grabbed gigagbytes of data. [More]

Ohio Woman Sues Chase For Alleged Mortgage Law Violation

When you don’t follow the rules, you’re likely to get into a bit of trouble. In this case, JPMorgan Chase found itself party to a lawsuit alleging the company violated a law aimed to protect homeowners. [More]

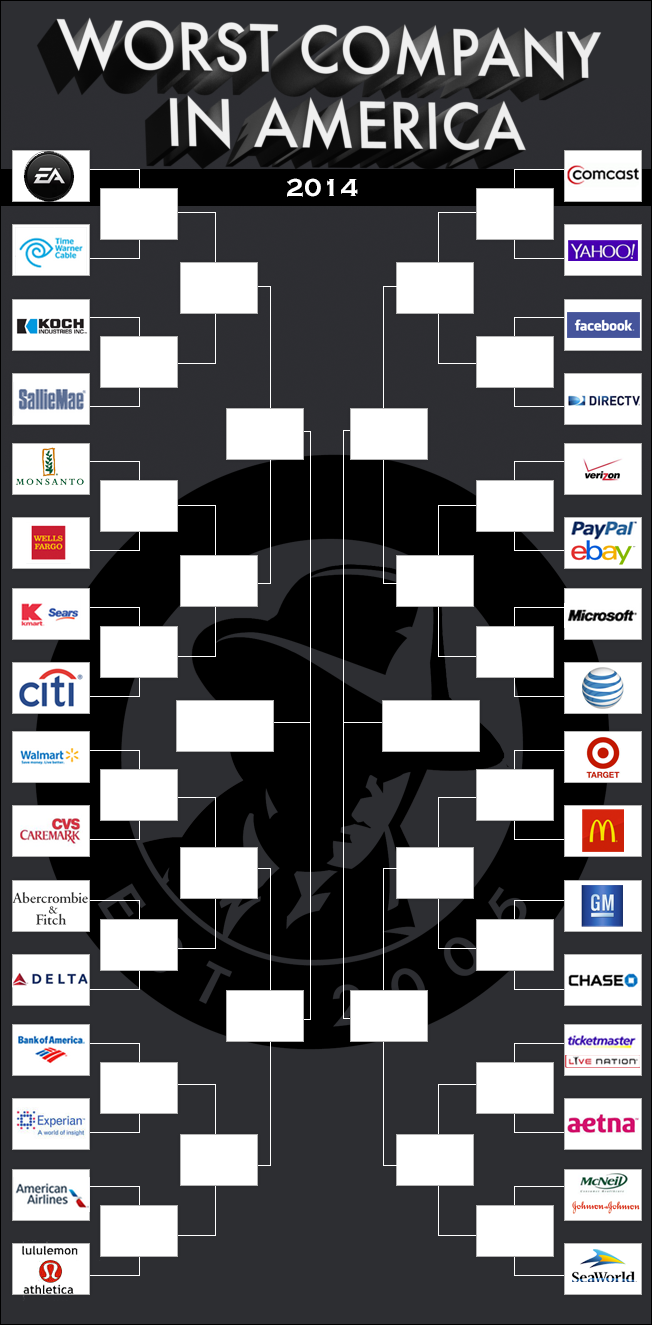

Time Warner Cable Ekes Out Another Win, To Face Monsanto In Worst Company Quarterfinals!

Two weeks ago, 32 bad businesses entered the Worst Company in America velodrome. But since they didn’t all bring their racing bikes with them, they just began beating the holy snot out of each other for our readers’ amusement. Giants fell, upstarts pulled upsets, and battle-hardened vets relived their glory days when they could more easily lay claim to the Golden Poo. Now, after two rounds of out-and-out, completely organized mayhem, eight contenders still stand, but to quote the greatest movie ever made in the history of films with the word “highlander” in the title: There can be only one. [More]

Latest Worst Company Voting Results Confirm: People Hate Banks

After a brief breather, it was back to pummeling the living heck out each other for the remaining contenders in this year’s Worst Company In America tournament. And even though the nation’s largest airline and biggest fast food chain looked like they might have had what it takes to challenge for the Golden Poo, one has to always remember an ages-old truth: People just plain hate banks. [More]

Facebook Gets The Thumbs-Up From Haters, Takes Final Spot In Worst Company Not-So-Sweet 16

After more than a week of bloodshed, half of the contenders that dared to dip their toes into the Worst Company wading pool (stocked with laser-equipped piranha and some ill-tempered guppies) have been carried out in Consumerist-branded body bags. The 16 fighters that remain are bruised, but not broken, and one of them will soon be crowned with the coveted Golden Poo. [More]

Comcast, Abercrombie, Chase Victorious In First Day Of Worst Company Competition!

The 2014 Worst Company In America competition got off to a big start today with readers turning out in droves to vote on the tournament’s first three match-ups that saw a former Golden Poo champ flexing its muscle, a tournament mainstay making its case for the WCIA title, and the year’s first upset. [More]

Have Fun Breaking Down This Year’s Worst Company In America Bracket

The above bracket will be updated at the end of each day of WCIA competition to reflect that day’s results.

——————

After going through all of your nominations, then having y’all rank the contenders and eliminate the chaff from the wheat, we’re proud to present the first round match-ups for this year’s Worst Company in America tournament! [More]

Here Are Your Worst Company Contenders For 2014 — Help Us Seed The Brackets!

After sorting through a mountain of nomination e-mails, we’ve whittled down the field of competitors for this year’s Worst Company In America tournament to 40 bad businesses. Here’s your chance to have your say on how these players will square off in the bracket, and which bubble teams will get left out in the cold. [More]