The smaller versions of Madoff are still out there, convincing people to hand over their savings for foolproof investments that don’t actually exist, but every once in a while the authorities nab another one. This week it’s Philip G. Barry, a Brooklyn-based guy who operated out of my own neighborhood and happened to run a pornography business.

investments

Why You Should Pay Off That Mortgage Before You Retire

If you planned on retiring soon you’ve probably had to readjust your expectations. But even if you’re still on target to take it easy soon, you should reconsider until you’ve paid off your mortgage.

WSJ: Jackson Collectibles Are A Poor Investment

First, let me say that I am furious that I ate my Cheetos from my collectible Cheeto experiment a while back, because Chuck Jaffe at the Wall Street Journal says one with an MJ likeness just sold for $35 on eBay. What that really underscores, though, is the only surefire way to make any money on Jackson memorabilia is to be the one selling the crap to unwise shoppers.

Be Your Own Financial Regulator

Any sort of federal agency to protect consumers from abuse from the financial industry is months, or possibly years, away, notes Linda Stern of Reuters. That’s why you shouldn’t depend on such an agency to protect you in the meantime. In fact, you can take her advice and use it no matter what happens at the federal level.

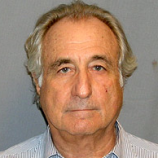

Madoff Asks Judge For 12-Year Sentence

“Mr. Madoff is currently 71 years old and has an approximate life expectancy of 13 years,” wrote Sorkin, whose letter was released on Tuesday. “A prison term of 12 years – just short of an effective life sentence – will sufficiently address the goals of deterrence, protecting the public and promoting respect for the law.”

../../../..//2009/06/20/here-are-5-personal-finance/

Here are 5 personal finance podcasts to subscribe to, download, and argue with during your commute or workout. [Automatic Finances] (Photo: uhuru1701)

Should I Reduce My 401k And Put The Money Toward Credit Card Debt?

Given the state of the economy today, is it better for me to reduce my 401k to a minimum and use the extra funds to pay off my credit card debt? This is a good time to put money into the markets, based on my admittedly limited understanding, but with interest rates going through the roof (my personal Chase card went from 12.99 to 23.99), I would like to kick down my cc debt (now at around $6,000) faster. I’m currently only putting 6% in my 401k, and I’m fairly young (35). Have you advice for me?

WSJ Asks, "Is Your Home A Good Investment?"

Brett Arends at The Wall Street Journal has compared Case-Shiller house price data to annual inflation rates, and speculates that owning a home may not be a very good investment. “You can often do better on long-term inflation protected government bonds,” he writes.

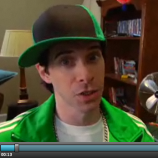

Seth Green Gives Sound Financial Advice In Special Cribs Clip

Seth Green takes you on a tour of his crib in this clip from Un-Broke, a financial program airing next Friday on ABC. “BOOM! That’s math all over your face!”

Since When Is Dropping $1600 On A Purse An Investment?

How do you turn the purchase of a purse with a four-figure price tag into a sound financial decision in a recession? That’s the task luxury brand marketers and fashion magazines have right now, and their solution is to spin luxury purchases as an “investment.” But is it a good investment? Not really.

How Does The Chrysler Bankruptcy Impact Your Mutual Fund?

What impact does the Chrysler bankruptcy have on regular investors who hold bond funds? Most likely little to none, it turns out. Consumer Reports points out that most mutual funds have been avoiding Chrylser, GM, and Ford debt for years now—and if your fund does include Chrysler, it’s probably a tiny portion of your overall investment.

Banks Seeking To Value Assets Higher Than Market Value

Banks are pushing for a change to banking rules that would allow them to ignore mark to market accounting for assets in markets that they deem “inactive.” In other words, if a bank is loaded with worthless assets but decides that the market for those assets is frozen, they can value those assets higher than the market would. Or to simplify it even more, they can create value out of toxic assets. And it looks like now the Financial Accounting Standards Board, which so far has been against this rule change, is caving in.

Single Men Trade Stocks Too Much

Nick Kapur at The Motley Fool says that men trade stocks more frequently than women. This is not a good thing; the result of all this hyperactivity and overconfidence is lower earnings on your investment. He writes, “Worse still (for unmarried guys like me) is that single men trade a whopping 67% more than single women, earning them annual net returns of 2.3% less! The authors cite increased trading costs, taxes, and a greater tendency to speculate as reasons for this underperformance.”

Blockbuster's Stock Nosedives On News It Is Investigating Bankruptcy

Blockbuster’s stock just dropped 79% this afternoon after Bloomberg published a story that said the company hired the firm Kirkland & Ellis “to evaluate restructuring options, including a possible pre-packaged bankruptcy.” Blockbuster says they’ve only hired the firm for “refinancing and capital raising initiatives,” and that they do not intend to file for bankruptcy.

Oprah & Orman Give Out Free Book: "2009 Action Plan"

“Suze Orman’s 2009 Action Plan” is free to download from Oprah.com for the next week. Unlike last year’s “Women & Money,” this book is intended for pretty much everyone. We haven’t read it, so here’s a line from the Amazon editorial review: “There are safeguards to put in place, actions to take, costly mistakes to avoid, and even opportunities to be had, so that you are protected during the bad times and prepared to prosper when things take a turn for the better.”

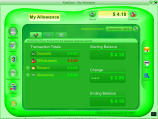

KidsSave Software Helps Your Child Track Investments

KidsSave is a kid-centric application (Windows XP only, with an OS X version coming out next year) that lets your child track allowances and other types of “income” and teaches the benefits of saving.

Here's A Cartoon Explaining The Types Of Bonds

Slate’s “The Big Money” has decided it’s time to start educating readers on some core financial principles, and they’re starting with the very basics, presented in a “Schoolhouse Rocks!” style. Their first cartoon explains the four types of bonds. Visually, it’s a perfect match to the style of the original cartoons, but we hope they work on a catchier jingle for their next installment.